Time to panic about the debt ceiling?

The sharpest opinions on the debate from around the web

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The federal government hit the $31.4 trillion debt ceiling this week, forcing the Treasury Department to resort to what Treasury Secretary Janet Yellen said were "extraordinary measures" necessary for the government to continue paying its bills. But the measures, which include suspending investments for some government accounts, will only buy about five months. As early as June, the Treasury Department will run out of ways to cover some of the government's obligations to bondholders, Social Security recipients, and other spending already approved by Congress, unless sharply divided lawmakers come together to raise the ceiling and let the government borrow more.

But that won't be easy. The new Republican House majority opposes raising the debt ceiling without deep spending cuts, while Democrats, who control the Senate, say they won't let the GOP use the deadline as leverage to slash federal programs. "We will not be doing any negotiation," White House Press Secretary Karine Jean-Pierre said. The government has faced the threat of a catastrophic debt default before, and the two sides always came together in time. Can Republicans and Democrats work this out before the government runs short of money, or could this be the year the worst happens?

This showdown is scary

"The debt limit has become a ticking time bomb that comes close to exploding roughly every two years," says Grace Segers in The New Republic. Congress set the current ceiling "after a bracing fight in the fall of 2021," raising it by $2.5 trillion to keep the bills paid into 2023. But there are "some new complications" this time around that have created a real danger that this could be the year the time bomb explodes.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

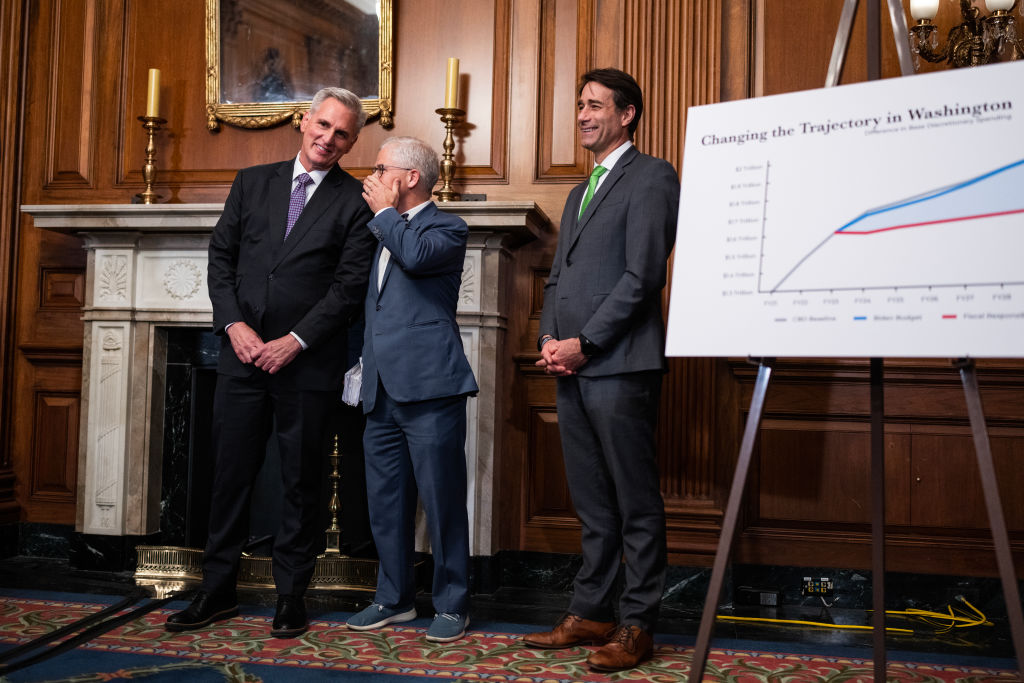

The Democrats controlling the Senate and the new Republican majority in the House are miles apart. And the "turbulent House Republican conference" includes a "faction of conservative lawmakers" who blocked Rep. Kevin McCarthy (R-Calif.) until they forced him to promise "massive spending cuts to balance the federal budget." A weakened McCarthy might not be able to hold together his five-seat GOP majority "on key priorities such as funding the government or, say, raising the debt ceiling."

Compromise is essential

"Republicans are right to want to stop the reckless spending trends of the last four years," says The Wall Street Journal in an editorial, but the debt limit must be raised. The GOP has to unite, pick its spending targets carefully, and show it's negotiating for the good of all, because "nobody sane in Washington wants to be blamed for triggering a default."

Republicans can't cut spending unilaterally in this divided Congress, and they see the debt ceiling as their "best bargaining chip," says the Santa Rosa, California, Press Democrat in an editorial. But while Democrats like to suggest Republicans are "holding the economy hostage," they are culpable, too, unless they negotiate.

Don't panic just yet

It "sounds ominous," says Josh Boak at The Associated Press, when Treasury Secretary Janet Yellen says "extraordinary measures" are necessary to prevent the government from defaulting on its debt. And it's true, defaulting "could cause millions of job losses, a deep recession that would reverberate globally and, ironically, higher interest rates that would make it harder to manage the federal debt."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"But — take a breath," Boak adds. The measures in question are little more than "a bunch of accounting workarounds." It's like handing out IOUs, and paying everything back once politicians make a deal and raise the debt ceiling. What's more worrying is "what happens if they are exhausted this summer without a deal in place."

This standoff will do lasting damage no matter what

Indeed, the real deadline isn't until June, says Bill Dudley in Bloomberg, and "I expect disaster to be averted at the last minute, as it has been in the past." But even if Congress raises the debt limit "before the Treasury runs out of cash, financial markets will suffer." Previous standoffs like the one in 2011 "led to significant outflows from Treasury money-market mutual funds into commercial banks, and to distortions in markets where people trade and borrow against Treasury securities." And the closer we get to the brink, "the more it will undermine confidence in the U.S. dollar" and increase the government's borrowing costs.

Getting through this showdown and raising the debt limit is just a Band-Aid, Dudley says. Really, the debt limit should be abolished. because it "encourages political grandstanding" rather than fostering fiscal discipline.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

Musk: What did he achieve in Washington?

Musk: What did he achieve in Washington?Feature Elon Musk leaves his government job but not after bruising his image, slashing aid and firing thousands

-

National debt: Why Congress no longer cares

National debt: Why Congress no longer caresFeature Rising interest rates, tariffs and Trump's 'big, beautiful' bill could sent the national debt soaring

-

House GOP pushes ahead on deficit-boosting tax bill

House GOP pushes ahead on deficit-boosting tax billFeature Republicans push a bill that will lock in Trump's tax cuts, cut Medicaid and add trillions to the national debt

-

Will Harris or Trump fix the national debt?

Will Harris or Trump fix the national debt?Today's Big Question Both candidates have big spending plans

-

Fiscal headroom: can the UK afford more tax cuts?

Fiscal headroom: can the UK afford more tax cuts?Today's Big Question Lower borrowing costs could give the Chancellor more room for manoeuvre in upcoming Budget

-

Supreme Court rejects Biden's student loan forgiveness plan

Supreme Court rejects Biden's student loan forgiveness planSpeed Read

-

Senate approves debt ceiling suspension, averting default

Senate approves debt ceiling suspension, averting defaultSpeed Read

-

House gives broad bipartisan approval to bill raising debt limit, sending it to Senate

House gives broad bipartisan approval to bill raising debt limit, sending it to SenateSpeed Read