Fiscal headroom: can the UK afford more tax cuts?

Lower borrowing costs could give the Chancellor more room for manoeuvre in upcoming Budget

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Chancellor Jeremy Hunt's scope to deliver a pre-election giveaway in his March budget has been given a boost but economists are divided on whether the country can really afford more tax cuts.

Data from the Office for National Statistics (ONS) showed that increased VAT and income-tax receipts, coupled with reduced spending, led to a deficit of £7.8 billion in December 2023, marking "the lowest for the month since the pre-pandemic year of 2019", said The Guardian.

With lower debt-interest payments also contributing to the improvement in the government's financial position, analysts told the paper the prospects for a multi-million-pound giveaway package "had brightened".

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Hunt could use the windfall in a number of ways, including tax cuts, increased public spending, or debt reduction – or "a combination of all three", noted The Guardian – but it was tax cuts that he hinted at during last week's World Economic Forum in Davos.

What the papers said

The Chancellor may be plotting fresh tax cuts, but the Office for Budget Responsibility (OBR), fired a "warning shot" yesterday when it said that Hunt has left himself a "tiny" margin of error against the government's own debt-reduction rules, said the Financial Times (FT).

In November, the watchdog forecast £13 billion of budget headroom, but OBR chair Richard Hughes has issued a warning over the forecast's vulnerability to interest rate assumptions and data revisions.

And the independent public finance watchdog has not yet provided its forecast for the government's headroom in the upcoming budget, a figure that will be a "crucial determinant of the chancellor's scope to cut taxes or increase spending", said the FT.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In simple terms, "fiscal headroom" refers to rules set by chancellors to control government borrowing, said Sky News's economics editor Ed Conway. One of the rules Hunt has set as himself as chancellor concerns the UK's national debt: he has to show that he is bringing down Britain's net debt as a percentage of gross domestic product (GDP) within five years.

But this rule is less "strict" than it sounds, said Conway, akin to the "fiscal equivalent of St Augustine's prayer: 'Lord, make me good. But not yet.'" It allows for an increase in national debt, as long as it appears to decline within five years.

According to last November's autumn statement, the government aims to meet its fiscal rules, with its preferred measure of national debt rising from 90.2% of GDP in 2023/24 to 95% by 2026/27.

It then declines to 94.9% of GDP in 2027/28 and further to 94.4% of GDP in 2028/29. The crucial "fiscal headroom" is derived from the difference between the last two figures: 94.9% of GDP and 94.4% of GDP, amounting to approximately £13 billion in potential spending for the Treasury.

But it is important to remember that this rule is not an "immutable law of economics" but a self-imposed regulation, added Conway. Despite seeming like a monolithic number, it constantly changes, influenced by fluctuations in the size of the economy and tax receipts, leading to a tendency to "yo-yo around from one year to the next".

What next?

The wisdom of pinning the future of the economy "not on the question of the smartest long-term policy but on the difference between a few decimal places on a spreadsheet" is up for debate, said Conway.

But the ONS's current assessment suggests that, due to higher-than-expected tax receipts and favourable economic conditions, Hunt is likely to meet his fiscal rules with £20 billion to spare.

And there are several ways he could use this cash, "some more likely than others" said The Times's economics correspondent Jack Barnett.

He will almost "certainly" extend the freeze on fuel duty at a cost of about £6 billion, said Barnett. But with a general election on the horizon, the Conservatives will be keen to begin "accruing favour with voters", with many in the party "convinced that tax cuts are the means to seize this political capital".

How effective a round of tax cuts will prove in boosting the Conservatives' electoral chances is questionable; current polling also suggests a round of tax cuts "would make little inroads" in luring voters away from Labour, with just 22% of the public wanting tax cuts if it means lowering spending on public services.

Sorcha Bradley is a writer at The Week and a regular on “The Week Unwrapped” podcast. She worked at The Week magazine for a year and a half before taking up her current role with the digital team, where she mostly covers UK current affairs and politics. Before joining The Week, Sorcha worked at slow-news start-up Tortoise Media. She has also written for Sky News, The Sunday Times, the London Evening Standard and Grazia magazine, among other publications. She has a master’s in newspaper journalism from City, University of London, where she specialised in political journalism.

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Anthropic: AI triggers the ‘SaaSpocalypse’

Anthropic: AI triggers the ‘SaaSpocalypse’Feature A grim reaper for software services?

-

NIH director Bhattacharya tapped as acting CDC head

NIH director Bhattacharya tapped as acting CDC headSpeed Read Jay Bhattacharya, a critic of the CDC’s Covid-19 response, will now lead the Centers for Disease Control and Prevention

-

How are Democrats turning DOJ lemons into partisan lemonade?

How are Democrats turning DOJ lemons into partisan lemonade?TODAY’S BIG QUESTION As the Trump administration continues to try — and fail — at indicting its political enemies, Democratic lawmakers have begun seizing the moment for themselves

-

How did ‘wine moms’ become the face of anti-ICE protests?

How did ‘wine moms’ become the face of anti-ICE protests?Today’s Big Question Women lead the resistance to Trump’s deportations

-

How are Democrats trying to reform ICE?

How are Democrats trying to reform ICE?Today’s Big Question Democratic leadership has put forth several demands for the agency

-

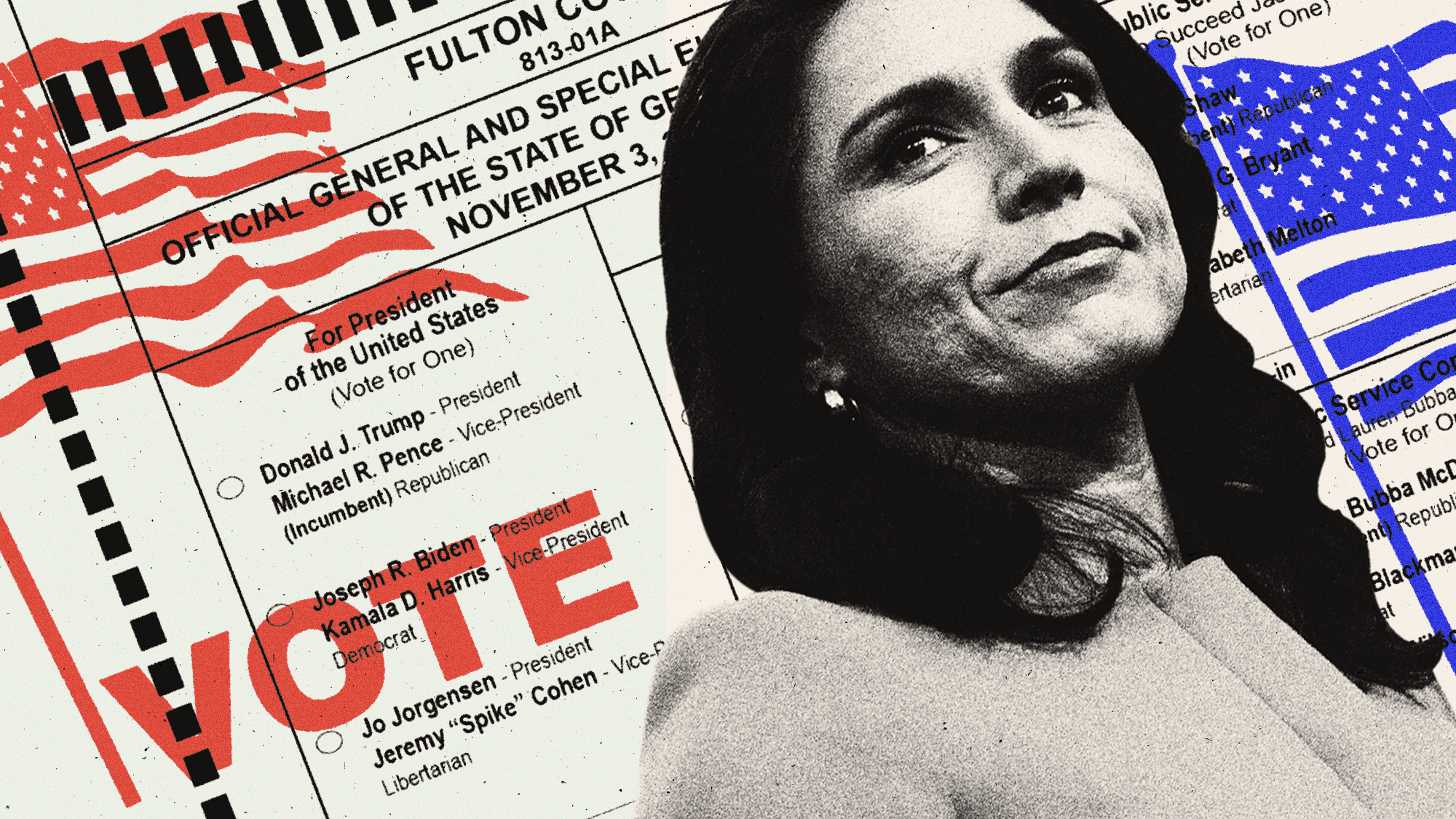

Why is Tulsi Gabbard trying to relitigate the 2020 election now?

Why is Tulsi Gabbard trying to relitigate the 2020 election now?Today's Big Question Trump has never conceded his loss that year

-

‘Implementing strengthened provisions help advance aviation safety’

‘Implementing strengthened provisions help advance aviation safety’Instant Opinion Opinion, comment and editorials of the day

-

Will Democrats impeach Kristi Noem?

Will Democrats impeach Kristi Noem?Today’s Big Question Centrists, lefty activists also debate abolishing ICE

-

‘The surest way to shorten our lives even more is to scare us about sleep’

‘The surest way to shorten our lives even more is to scare us about sleep’Instant Opinion Opinion, comment and editorials of the day

-

Unrest in Iran: how the latest protests spread like wildfire

Unrest in Iran: how the latest protests spread like wildfireIn the Spotlight Deep-rooted discontent at the country’s ‘entire regime’ and economic concerns have sparked widespread protest far beyond Tehran