How does the UK’s energy bill bailout plan compare with rest of Europe’s?

Questions remain about how Liz Truss’s £150bn support package will be funded

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Liz Truss today announced plans to control energy price rises, with a new “energy price guarantee” that will ensure the typical household pays no more than £2,500 a year for their gas and electricity over the next two years.

The new PM said the move “will lower inflation by 5 percentage points from what it otherwise would have been” but did not say how much it would cost. She said that Chancellor Kwasi Kwarteng would “give details of the costs when he makes a fiscal statement later this month”.

Truss also pledged to increase supplies of domestic oil and gas by reversing a ban on fracking put in place by Boris Johnson.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, questions have been raised about how she will fund her plan, which The Times estimated would cost £150bn in total. In response to the price freeze, Labour leader Keir Starmer welcomed the news but said: “Every pound the government refuses to raise in windfall taxes… is a pound of extra borrowing. It’s that simple.”

Truss continues to oppose a windfall tax on energy companies, a measure used by some European countries to help pay for their own bailouts and support packages.

What are other European nations doing?

Germany has announced a €65bn (£56.1bn) package to help households and companies manage soaring prices. Unlike in the UK, this package includes a windfall tax on electricity producers. The chancellor, Olaf Scholz, said he would use income from windfall taxes on companies he accused of making “excessive” profits to reduce consumer prices for gas, coal and oil, reported The Guardian.

The French government has “frozen gas prices at October 2021 levels and capped electricity price increases at 4% until at least the end of 2022”, said the paper. It has also handed €100 to “low- and middle-income households” to help them cover their bills, a lesser sum than the £400 the UK government has given to households.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Meanwhile, in Spain, the government has promised to cut VAT on gas to 5% from 21% from October until the end of the year, and is promoting energy savings. Its approach is more in line with the plan Truss outlined during her leadership campaign than the one she is announcing today.

Meanwhile, Finland plans to offer up to €10bn of liquidity guarantees to the energy sector “to help stave off a financial crisis”, said Reuters. In Greece, subsidies will absorb up to 94% of the rise in monthly power bills for households and 89% of the rise for small and medium-sized firms.

The Polish PM, Mateusz Morawiecki, has taken a broader, multi-faceted approach, including tax cuts on energy, petrol and basic food items, as well as cash handouts for households.

In an approach similar to the UK’s, the coalition government in Romania has implemented a “scheme capping gas and electricity bills for households and other users up to certain monthly consumption levels, compensating energy giants for the difference”, reported Reuters.

Similarly, in Norway, the government has set a maximum price that households should pay for their energy – “anything over that and the government will pay 80% of the bill”, said the BBC. The Oslo government is spending around €2bn (£1.7bn) on the measures.

What do the papers say?

The UK’ move today “is a huge moment for the country and a huge move from Liz Truss, one which will define her early premiership”, wrote Ben Riley-Smith, The Telegraph’s political editor.

The prime minister “has not just stolen Labour’s proposal for an energy bill freeze until next spring, she has multiplied it over and over again”, said Riley-Smith.

Truss’s plan appears to be the most costly in Europe. Her package, which will last until 2024, when the next election is likely, will cost at least £150bn, according to The Times. In a tweet, ITV’s Paul Brand described the timeframe as “interesting” in election terms, and said that Truss “has to hope cost is reduced by energy prices hopefully falling again if current crisis eases”.

What next?

Questions remain over how Truss will fund the measures, particularly if she rejects the European consensus of a windfall tax.

Keir Starmer criticised Truss for her opposition to a windfall tax during this week’s Prime Minister’s Questions, according to The Guardian. “The real choice, the political choice, is who is going to pay,” said the Labour leader.

Sky News’s deputy political editor, Sam Coates, wrote that the broadcaster had said the cost could be in excess of £150bn. But “that assumed that the duration of the protection would be much shorter than the two years promised today”, he said.

The government “will very shortly have to instruct the Debt Management Office how much extra to borrow to fund this, but unsurprisingly they can’t tell us what that will amount to either”, Coates added.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

How are Democrats turning DOJ lemons into partisan lemonade?

How are Democrats turning DOJ lemons into partisan lemonade?TODAY’S BIG QUESTION As the Trump administration continues to try — and fail — at indicting its political enemies, Democratic lawmakers have begun seizing the moment for themselves

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

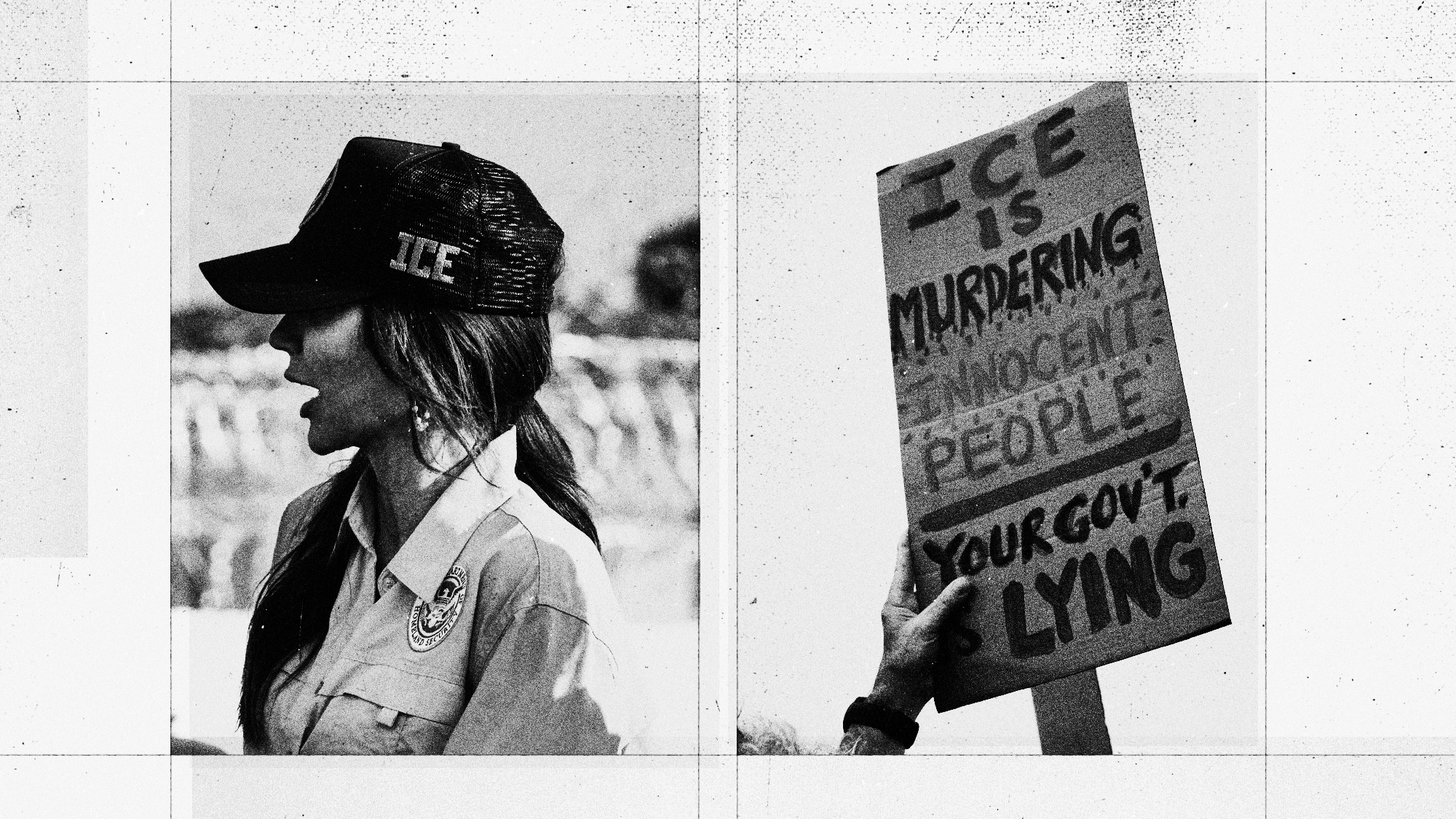

How did ‘wine moms’ become the face of anti-ICE protests?

How did ‘wine moms’ become the face of anti-ICE protests?Today’s Big Question Women lead the resistance to Trump’s deportations

-

How are Democrats trying to reform ICE?

How are Democrats trying to reform ICE?Today’s Big Question Democratic leadership has put forth several demands for the agency

-

‘The West needs people’

‘The West needs people’Instant Opinion Opinion, comment and editorials of the day

-

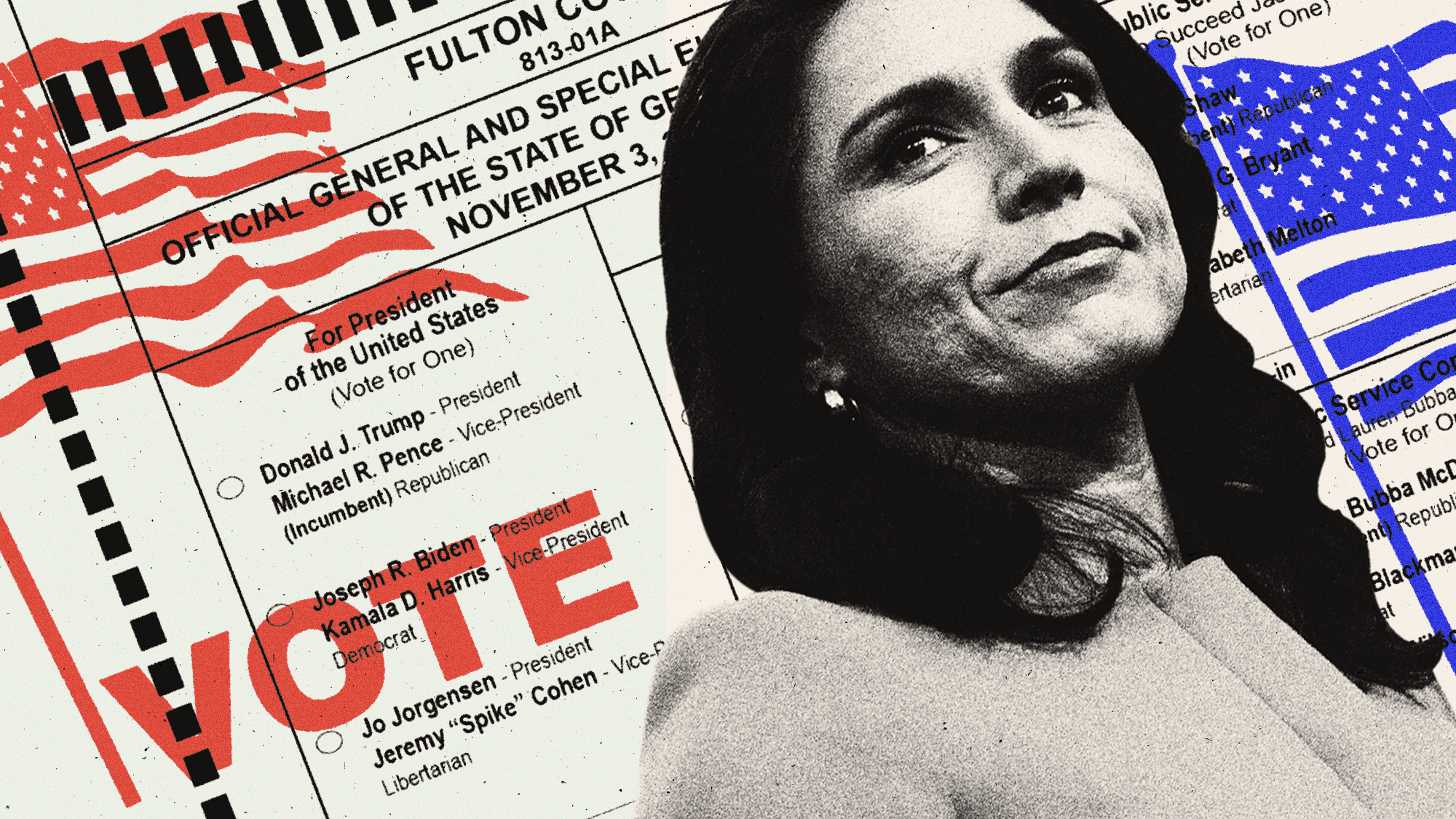

Why is Tulsi Gabbard trying to relitigate the 2020 election now?

Why is Tulsi Gabbard trying to relitigate the 2020 election now?Today's Big Question Trump has never conceded his loss that year

-

Will Democrats impeach Kristi Noem?

Will Democrats impeach Kristi Noem?Today’s Big Question Centrists, lefty activists also debate abolishing ICE

-

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK