Big hit for investors: BTS label valued at £3.2bn in IPO

Demand soaring for shares in the K-pop group’s management company

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

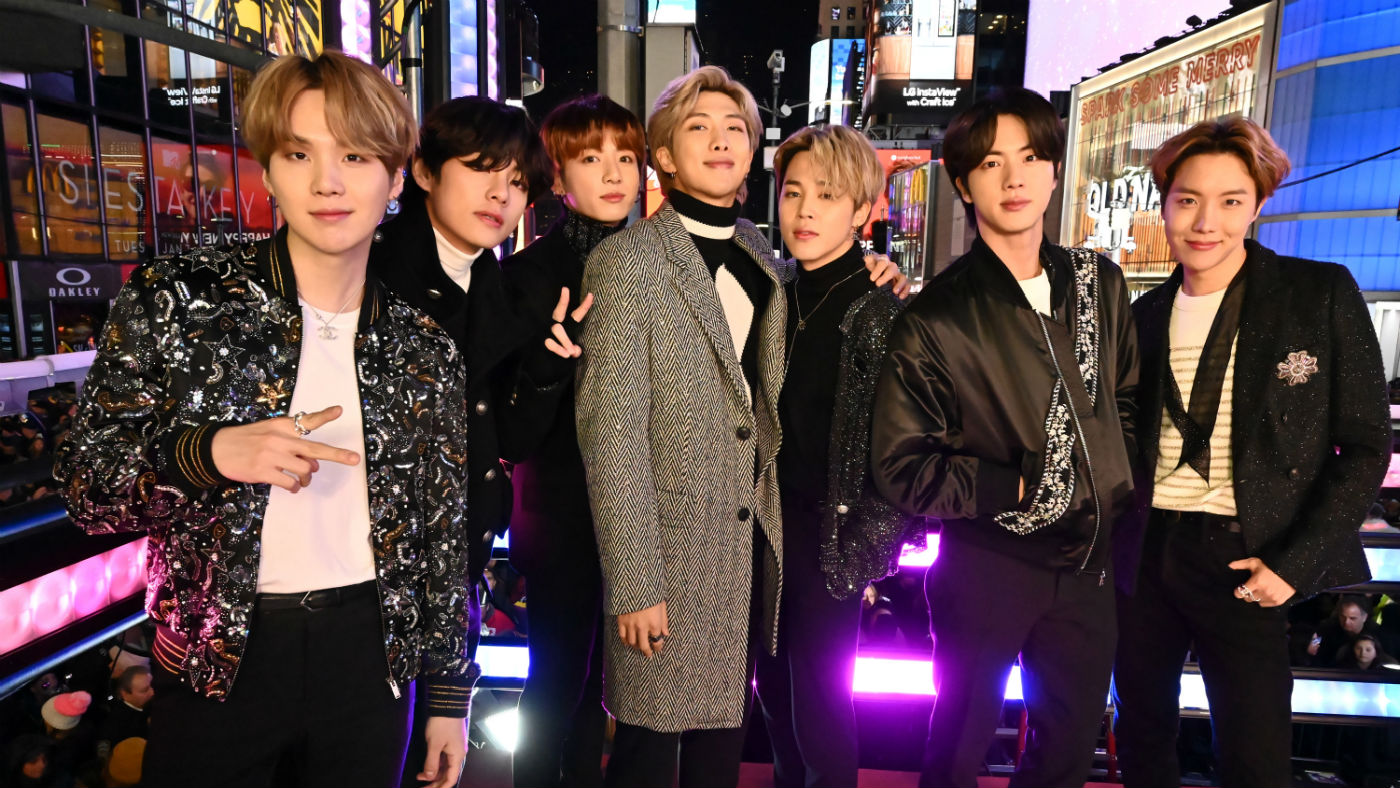

BTS have been trailblazers in the rise of K-pop music across the globe - and now the South Korean superstars are making a noise in the business world too.

The seven-member group made history last month when their first English-language song, Dynamite, topped the US Billboard Hot 100. And the music video for the single smashed records with more than 100 million views on YouTube in just 24 hours.

It’s not just music fans who are keen on BTS either: the K-pop sensations’ management label, Big Hit Entertainment, has been valued at £3.2bn ahead of an initial public offering (IPO) next month.

Article continues belowThe Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“The offer saw demand 1,000 times higher than the number of shares available - in what is South Korea’s biggest IPO in three years,” Sky News reports.

Millionaires and billionaires

A regulatory filing shows that shares in the label have been priced at 135,000 won (£90) each, with a total of 7.13 million new shares up for grabs. These new shares will start trading on 15 October and will raise a total of 963 billion won (£638m), with Big Hit as a whole valued at 4.8 trillion won (£3.2bn).

The BTS boys have also seen their personal wealth boosted by the stock market listing.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

All seven band members - who go by the nicknames Jung Kook, Jin, Jimin, Suga, V, J-Hope and RM - are now multimillionaires thanks to what CBS News describes as the “chart-topping” IPO.

Big Hit CEO Bang Si-Hyuk gave each of them 68,385 shares in August and these holdings are now worth the equivalent of more than £6.1m at the issue price.

Music producer Bang, who is credited with creating BTS, owns about 43% of the label and the IPO has made him a billionaire.

Music and retail

In August, Big Hit reported a £33m profit for the first half of 2020, “as online concert and merchandise sales more than offset the impact of event cancellations in the US, Europe and Asia during the pandemic”, says Sky News.

And another big earner is in the pipeline, with the label this week announcing that BTS will release their second album of the year, BE, on 20 November.

As CNN notes, “BTS is one of the few K-Pop bands to break into Western markets”, with the group’s global success compared to that of The Beatles.

And now the Big Hit IPO is giving “retail investors a chance to get in on the action” surrounding the BTS phenomenon, the broadcaster adds.

Mike Starling is the former digital features editor at The Week. He started his career in 2001 in Gloucestershire as a sports reporter and sub-editor and has held various roles as a writer and editor at news, travel and B2B publications. He has spoken at a number of sports business conferences and also worked as a consultant creating sports travel content for tourism boards. International experience includes spells living and working in Dubai, UAE; Brisbane, Australia; and Beirut, Lebanon.