Everything you need to know about your P45

The document from HMRC is vital when changing jobs

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Fewer people may be switching jobs as the number of job vacancies in the UK has slumped, but there is an important document they will all need if they do find a new position: the P45.

There were 781,000 jobs on offer in the first three months of the year, according to the Office for National Statistics (ONS), down 3.2% on the previous quarter.

If you do leave your job and move to a new role, "it makes life a lot easier" if you know how to go about securing your P45, said Unbiased.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What is a P45?

A P45 is a crucial document that employees should receive when they leave a job.

While a P60 summarises an employee's tax information at the end of each tax year, said Starling Bank, a P45 is used "when employees change jobs".

The document is essential for passing on tax and payroll information from the old employer to the new one.

What does a P45 look like?

The P45 does not have a "standard format", said Unbiased, and each may be "slightly different", but it is always divided into four parts.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Part one is sent to HMRC, and part 1A is kept by the worker for their records, while parts two and three are given to the new employer.

What information is on a P45?

A P45 contains numerous details. This includes details of your former employer, National Insurance number, tax code, gross pay and the amount of tax paid for the year.

You need your P45, added the financial advice firm, to make sure you are assigned "the right tax code in your new job" or you could end up paying too much tax.

The document won't show National Insurance deductions or pension contributions, "so it may be useful for the employee to keep their last payslip, in case they need to trace these when they reach retirement", said Starling Bank.

When do you get a P45?

You should get your P45 on your last working day or shortly afterwards. If you haven't received the document within a few weeks of leaving, you "may need to follow up with your employer", said The ANNA Money blog.

But "don't delay". A failure to chase a P45 could mean you end up overpaying income tax.

It is also important to keep hold of your P45 so you "have your own record of your tax code and tax paid to date for the year".

What happens if you lose your P45?

HMRC doesn't provide replacement P45s, said TaxScouts, but if you do misplace yours, "don't panic".

When starting a new job, your new company will give you a starter checklist form that will "calculate what tax code you should be on".

The checklist can be filled in online, but workers will need important information to hand such as their address and postcode, National Insurance number and any relevant student loan plans.

Marc Shoffman is an NCTJ-qualified award-winning freelance journalist, specialising in business, property and personal finance. He has a BA in multimedia journalism from Bournemouth University and a master’s in financial journalism from City University, London. His career began at FT Business trade publication Financial Adviser, during the 2008 banking crash. In 2013, he moved to MailOnline’s personal finance section This is Money, where he covered topics ranging from mortgages and pensions to investments and even a bit of Bitcoin. Since going freelance in 2016, his work has appeared in MoneyWeek, The Times, The Mail on Sunday and on the i news site.

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

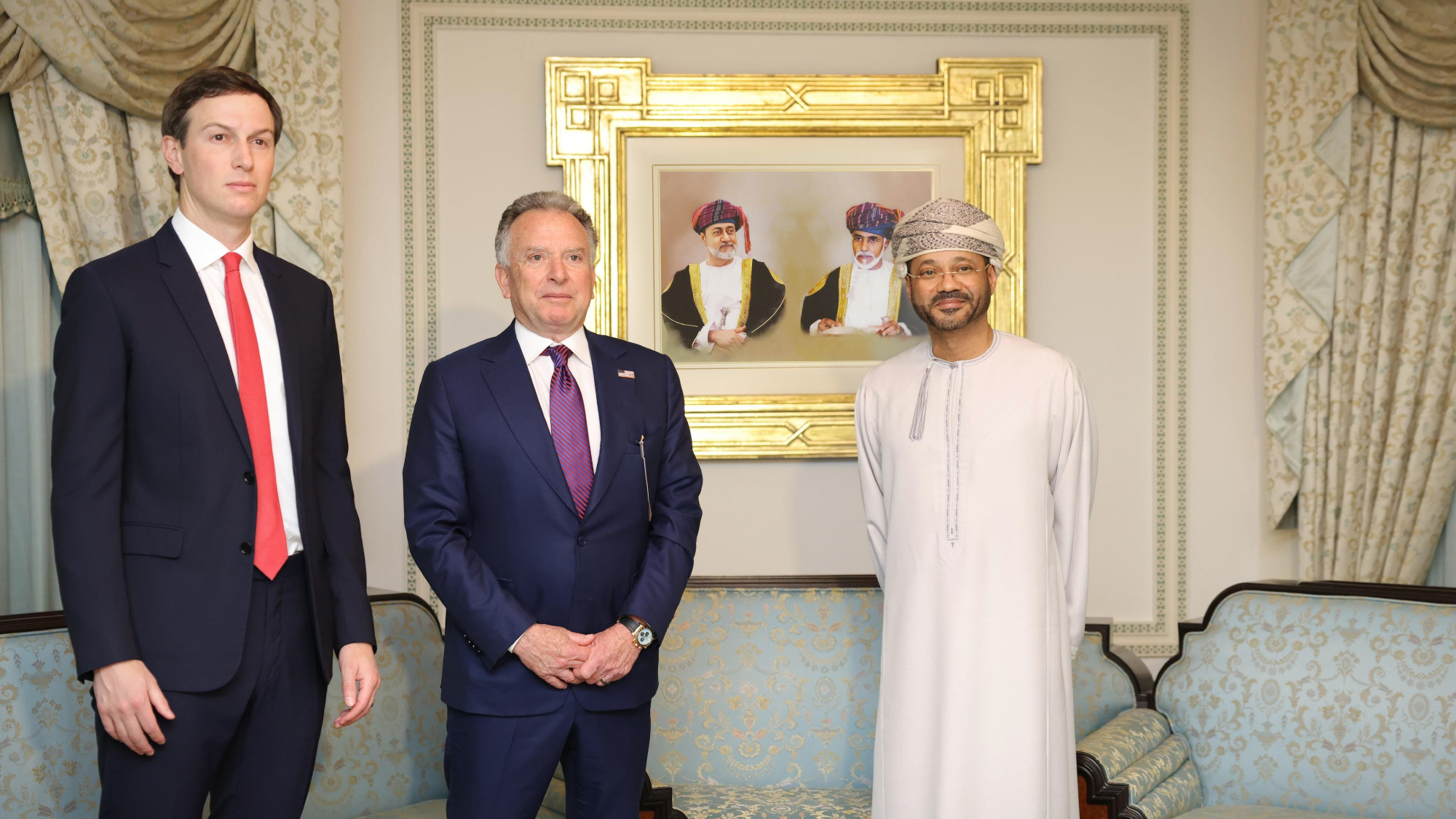

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

5 side hustle ideas to supplement your budget

5 side hustle ideas to supplement your budgetthe explainer Almost two-thirds of Americans are looking to get a second job in the next year

-

The FIRE movement catches on as people want to retire early

The FIRE movement catches on as people want to retire earlyIn the spotlight Many are taking steps to leave the workforce sooner than usual

-

The downsides of a 'forgotten' 401(k) and how to find it

The downsides of a 'forgotten' 401(k) and how to find itthe explainer Don't leave your old retirement plan behind

-

What are your retirement savings account options?

What are your retirement savings account options?The explainer The two main types of accounts are 401(k) plans and individual retirement accounts (IRAs)

-

Considering quitting your job? Here's what to do first.

Considering quitting your job? Here's what to do first.The Explainer Your job likely comes with a number of financial strings attached

-

Financial steps to take if you are laid off

Financial steps to take if you are laid offThe explainer Four moves to minimize your losses

-

5 tax deductions to know if you are self-employed

5 tax deductions to know if you are self-employedThe explainer You may be able to claim home office, health insurance and other tax deductions