No, the stock market is not at all-time highs

BEN HOSKINS/Getty Images

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

At the Guardian, Ha-Joon Chang writes about the U.S. stock market:

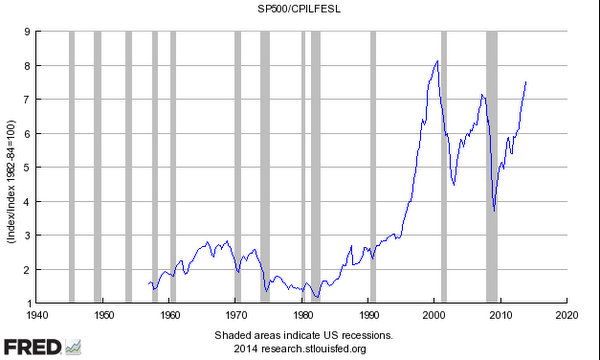

The situation is even more worrying in the U.S. In March 2013, the Standard & Poor's 500 stock market index reached the highest ever level, surpassing the 2007 peak (which was higher than the peak during the dotcom boom), despite the fact that the country's per capita income had not yet recovered to its 2007 level. Since then, the index has risen about 20 percent, although the U.S. per capita income has not increased even by 2 percent during the same period. This is definitely the biggest stock market bubble in modern history.

Biggest bubble in modern history, really? Nope. Always remember folks, when we're talking stock market values, you have to adjust for inflation. Dig a chart of the S&P 500 so adjusted (courtesy of @squarelyrooted):

Is that a bubble? Well, could be. I'd say Chang is right in the end — the priority should continue to be to revive the real economy regardless of what the stock market is doing. But before we get too worked up about bubbles, we ought make sure we're looking at the right chart.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.