The benefits of a professional risk assessment

Investing can be tricky – but a professional risk assessment can help ensure your money ends up in the portfolio best suited to your needs

Why get professional advice?

Many first-time investors opt for online DIY or “execution-only” services when setting up their investments. The marketing for these services can be persuasive, encouraging you to take responsibility for your financial future while avoiding the costs associated with professional financial advice.

But these services have their limits. When it comes to something as important as building your investment pot - whether for your retirement, to pay your children’s university costs, or simply for a rainy day - getting help from a professional can make a significant difference.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

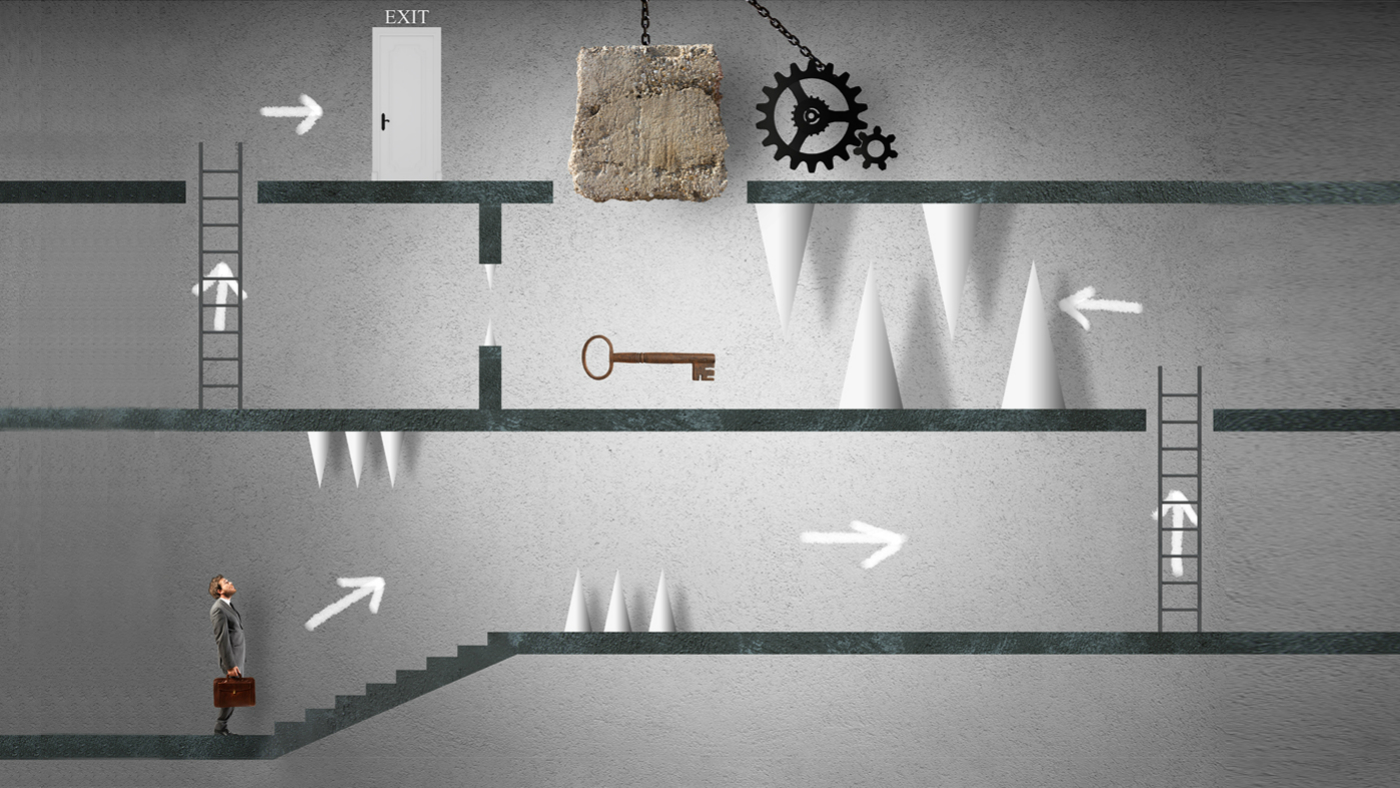

One key way in which a professional adviser can provide better value than a DIY service is by assessing your risk profile. If your money is in a portfolio that is more risky than you are comfortable with, you could end up sweating as its value swings. Worse yet, you could wind up not meeting your investment objectives, because you either took on too much or too little risk.

For example, if you were asked where on a scale of one to five you sat in terms of how much investment risk you are comfortable taking on, chances are you would put yourself at a three. This is because most people, especially those with little experience in investing, tend to lack a clear conception of what constitutes a risky investment. Most tend to think of themselves as moderate risk-takers.

Almost nobody will put themselves at either extreme on the risk scale, even if a professional might recognise that they were very risk-averse, or risk-tolerant. Execution-only services can initially appear to be cheaper. But paying a professional adviser from Charles Stanley to manage your portfolio can save you money in the long term, by helping you keep costs down and avoid hidden fees and unnecessary risks.

How can risk assessment help?

Clearly, it is extremely difficult for an individual with little or no experience in investing to correctly assess how much risk they are comfortable taking and what that means in terms of how and where they should invest their money.

A professional risk assessment, usually delivered via a risk profiling tool and/or a qualified investment adviser, will help you decide whether you can afford to take on more risk, to target higher returns, or should consider dialling down your risk level in order to make a more defensive portfolio.

A professional risk management service such as that employed by Charles Stanley’s Personal Portfolio Service will pinpoint precisely how much risk you should be taking. It will consider both practical and emotional factors: how much could you afford to lose before your quality of life would be affected? How comfortable are you about your investments potentially fluctuating in value by 10% in a single year, or 15%, or more? Once you’ve answered their questions, a professional investment manager, or relationship manager, will invest your money in a fund, model portfolio or bespoke portfolio that is best suited to your objectives, timelines and of course, attitude to risk.

Among other things, your attitude to risk will be reflected in the asset composition of your investment portfolio. Different assets carry different amounts of risk. For example, shares have typically been seen as the riskiest type of asset, while government bonds have generally been perceived as less risky. Of course, it’s impossible to take all the risk out of investing, but professionals can manage the make-up of their clients’ investments - be it in one of a set of risk-rated funds, or an entirely custom-built portfolio - in order to reduce the chance of unpleasant surprises.

Looking to the future

When you invest your money with Charles Stanley’s Personal Portfolio Service, your attitude to risk is reassessed every year to ensure that the way your money is invested is still right for you as your life circumstances and priorities change. Life’s changing priorities and ups and downs make an ongoing assessment of your attitude to risk a sensible choice for anyone investing over time. No more fiddling or worrying: you can just relax, secure in the knowledge that your money is in the best possible hands – those of an actual human being whose job is to analyse and manage risk.

Find out more at Charles-stanley.co.uk/personal-portfolio-service

The value of investments can go down as well as up and investors may not get back the amount they originally invested.

Charles Stanley & Co. Limited is authorised and regulated by the Financial Conduct Authority and a member of the London Stock Exchange. Registered in England No. 1903304, Registered office: 55 Bishopsgate, London EC2N 3AS.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

What’s a good credit card APR?

What’s a good credit card APR?The Explainer They have gotten even steeper in recent years

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money