The benefits of multi-asset funds

Discover the reasons why investors are choosing multi-asset funds

Investing can seem like a daunting task - but it doesn’t have to be. You can invest your money in a diverse portfolio of assets in a single fund.

What is a multi-asset fund?

When you invest in a fund, the team managing that fund usually splits your money across a bundle of investments where all (or most) of them belong to a single type of asset.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

For example, most retail funds are equity funds, meaning they hold a selection of shares in a range of different companies. Similarly, a bond fund will put almost all your money into corporate and/or government bonds.

A fund has to obey its mandate in terms of what it can invest in, or “hold”. The fund’s mandate will usually state how much of the holding should be within a certain region, the margin of discretion the fund manager has, the amount of cash held at any one time, and so on.

A multi-asset fund, such as those offered by Charles Stanley’s Personal Portfolio Service, is a little bit different. It allows a fund manager to hold several different types of assets within the fund. For example, a fund might be split between shares, corporate bonds, and UK government bonds or “gilts”.

What are their benefits?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Some people claim that the asset mix in your investment portfolio is the greatest determining factor in the returns that you make. But deciding how to balance your investments between shares and bonds - or any other type of asset can be extremely difficult.

With multi-asset funds, that responsibility is taken out of your hands and put in those of professionals, who will manage the asset balance of your fund to meet a specific risk target, or manage several funds with different balances and different levels of risk. A multi-asset fund could provide you with all the diversification you require from an investment portfolio.

How can they mitigate risk?

One of the core principles in building an investment portfolio is diversification. To use an extreme example, if you put all your money into a single company and it goes bust, or its share price takes a dive, you are totally exposed to that downturn.

If you hold different companies that are all in the same business, such as oil production, or property development, your portfolio will be slightly more diversified, but you still have a huge amount of exposure to market risk, and the risk that the market the companies operate in could collapse or decline.

So, you should ideally try to hold many different shares across many companies, sectors and geographical regions. However, sifting through and picking a number of shares in unfamiliar markets takes a huge amount of work. You might decide instead to invest in a professionally managed fund, where a team of researchers led by a fund manager do the legwork for you, and let you invest in the companies they find, for a fee.

But even then, if you are invested 100% in shares, that still exposes you to fluctuations in the stock market. To diversify even further, you might want to hold several different types of assets: shares, corporate bonds, gilts, property, and possibly some cash to round things out. A multi-asset fund seeks to diversify away volatility by investing in several different types of asset class.

What tax-efficient savings can multi-asset funds make?

The great thing about putting money into a stocks and shares Isa, is the potential to make money without having to pay taxes on it. You won’t have to pay any capital gains tax when you sell shares that are inside an Isa, and you won’t have to pay tax on any of the dividend income you make from shares, or coupon payments on bonds, or interest rates on cash - or any other source of investment income.

That means that instead of paying tax on income, you can take the money you would have handed to the government, and invest it right back into your pot. This adds a significant potential boost to your returns. Indeed, the combination of compound interest and reinvesting dividends is one of the most powerful forces in growing an investment pot. So if you want to put money into a stocks and shares Isa but aren’t sure how to invest it, a multi-asset fund could be an easy and efficient way to get the job done.

Find out more at Charles-stanley.co.uk/personal-portfolio-service

The value of investments can go down as well as up and investors may not get back the amount they originally invested. Charles Stanley & Co. Limited is authorised and regulated by the Financial Conduct Authority and a member of the London Stock Exchange. Registered in England No. 1903304, Registered office: 55 Bishopsgate, London EC2N 3AS.

-

‘Incredibly terrible’: Russia’s plans for nuclear weapons in space

‘Incredibly terrible’: Russia’s plans for nuclear weapons in spaceIn The Spotlight Moscow’s ‘alarming ambitions’ could cause a ‘Cuban Missile crisis in space’

-

Bone broth: stock drinking ‘phenomenon’ has ‘skyrocketed’ online

Bone broth: stock drinking ‘phenomenon’ has ‘skyrocketed’ onlineThe Week Recommends The wellness trend could hold millennia-old secrets for skin and gut health

-

6 sleek homes for minimalists

6 sleek homes for minimalistsFeature Featuring a Nordic-style condo in Montana and brand-new modern dwelling in Northern California

-

3 tips for buyers ahead of a home inspection

3 tips for buyers ahead of a home inspectionThe Explainer As a potential home buyer, you need to be as informed as possible

-

Secured credit cards: what they are and how they can jumpstart your credit

Secured credit cards: what they are and how they can jumpstart your creditspeed read They are easier to qualify for and more accessible to people with poor or no credit

-

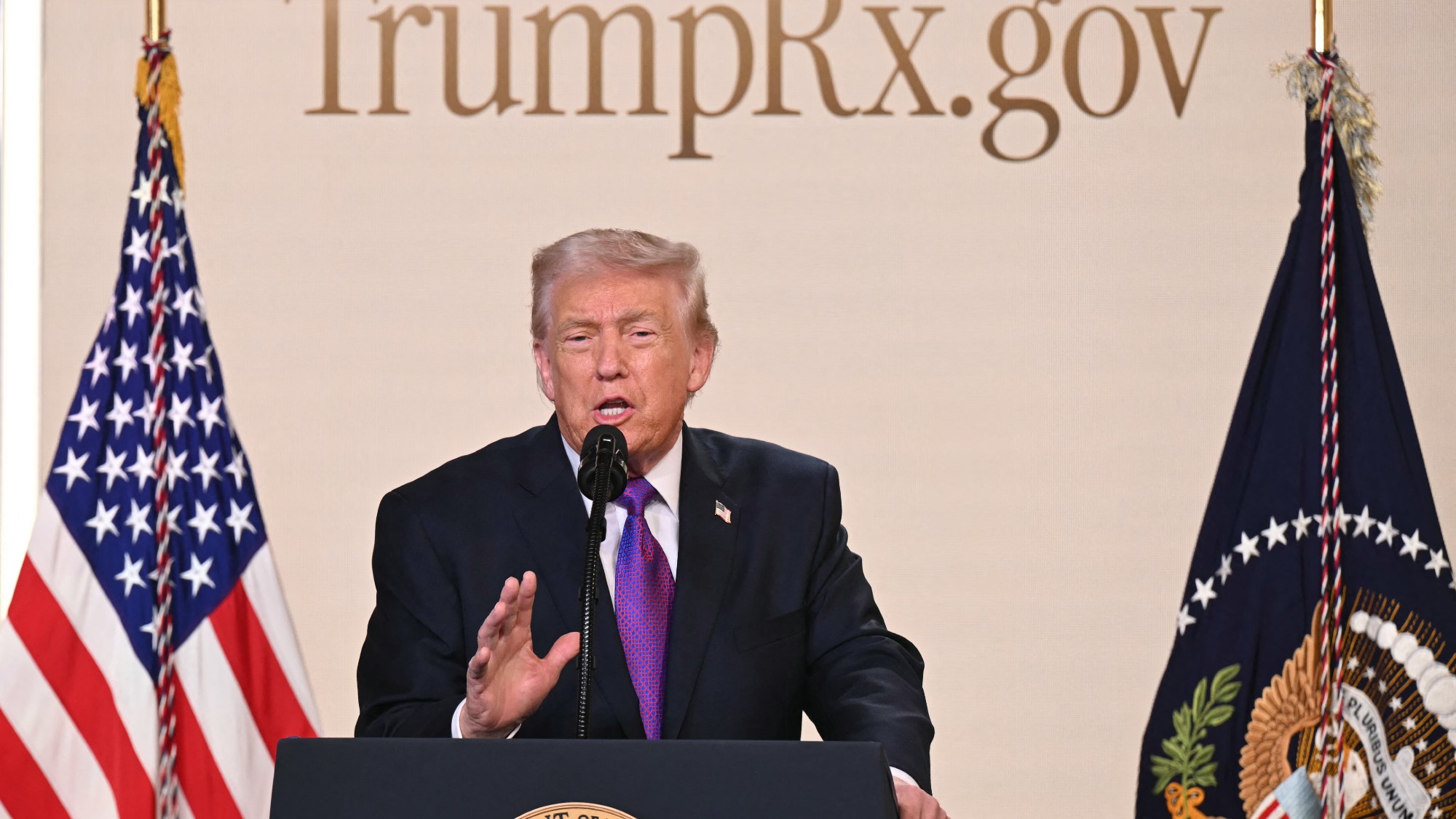

What’s TrumpRx and who is it for?

What’s TrumpRx and who is it for?The Explainer The new drug-pricing site is designed to help uninsured Americans

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What’s a good credit card APR?

What’s a good credit card APR?The Explainer They have gotten even steeper in recent years