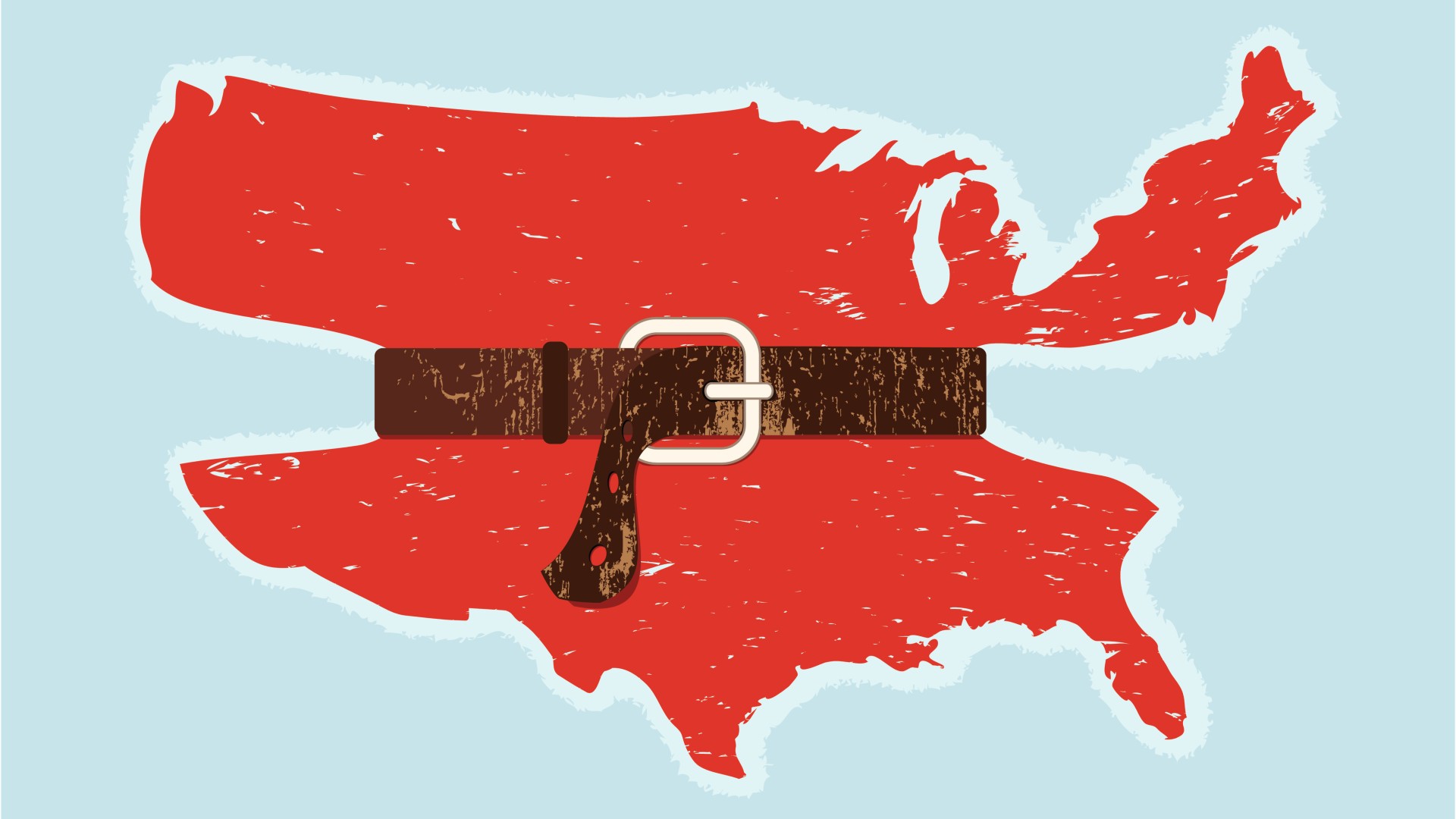

2023: the year of corporate belt-tightening

Numerous companies looked for ways to cut costs this year

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Cost-cutting has always been a major part of business, and the tightening of corporate belts is a common way that companies slash costs while staying competitive. These reductions in spending often come via layoffs and restructurings but can also be seen in the form of product price increases and other adjustments that make consumers scoff.

The trend ramped up last year, and many companies went through major bouts of belt-tightening in 2023. Here are just a few instances:

Tech layoffs

Many tech companies made waves in 2023 by laying off large amounts of their employees. Nowhere was this more evident than at Spotify, where the market leader in music streaming has parted ways with hundreds of workers in an effort to reduce costs.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The company laid off more than 500 employees this January, following the pattern of other tech brands that saw similar cuts. This was followed in June by the laying off of an additional 200 employees. Sahar Elhabashi, a vice president at Spotify, said those layoffs would coincide with "a strategic realignment of our group and [reduction of] our global podcast vertical and other functions." The latest culling happened on Dec. 4, when Spotify laid off another 1,500 employees, or 17% of its staff.

In a letter to employees, Spotify CEO Daniel Ek wrote that layoffs were needed because "capital has become more expensive." This is a result of Spotify taking on large amounts of debt "when interest rates are low and money's cheap," Marketplace reported.

Numerous other tech companies saw wide swaths of layoffs this year, including Google, Salesforce, Microsoft, Zoom, Meta and others. This is due to an overall decline in product sales and overzealous hiring by tech companies, among other factors.

Dividends

One shift that wasn't relegated to only one brand in 2023 was the slashing or otherwise complete pause of dividend payouts. One way to stop hemorrhaging money is to stop paying shareholders, and many companies got in on the action.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

By February 2023, "as many as 17 companies in the Dow Jones U.S. Total Stock Market Index cut their dividends," Bloomberg reported. The most notable of these was likely Intel, which saw its dividend payouts fall to the lowest level in 16 years, according to the outlet. V.F. Corp, which owns apparel brands like Vans, Timberlands, The North Face and Supreme, reduced its dividend to just 30 cents, and many other companies followed suit.

These cuts come as C-suite executives "have been forced to carefully manage both costs and debt to maintain free cash flow," Fortune reported. It was also noted that companies have to be careful with reducing dividends as these types of moves "can scare off investors and dent companies' share prices," Fortune added.

Marketing

Another area that underwent a metamorphosis in 2023 was the marketing strategies of corporations. Many companies looked to slice their marketing budgets as a way to reduce spending, but some experts have cautioned that this is not in a brand's best interest.

"It can be a mistake to target marketing for cost cuts," according to the consulting firm McKinsey & Company. Companies often "[follow] an unwritten rule: If they're strapped for cash, they'll stop investing in areas — such as marketing — that don’t generate an obvious direct return on investment," McKinsey added. But a massive cut in marketing "may backfire and have serious long-term consequences." Many companies may look to trim marketing budgets because there is "an assumption that consumers don't want to spend in tough or uncertain times," the firm said, but "research shows that despite the current macroeconomic uncertainty, consumer resiliency is still strong."

"The need for visibility, trust-building, customer retention and long-term growth doesn't cease during economic downturns," Forbes reported, noting that "if anything, it becomes more pronounced." Rather, the outlet recommended companies ramp up marketing in order to "survive a recession and thrive in its aftermath."

Despite this, numerous companies still saw major cuts in their marketing budgets this year. This was unsurprisingly seen at a high level in the tech industry, as "several large advertising companies reported a sharp cutback in spending from U.S. tech and telecom companies," Bloomberg reported. Companies like Apple, Meta and Amazon "are now showing a drop off in bigger ad spending," the outlet added.

Justin Klawans has worked as a staff writer at The Week since 2022. He began his career covering local news before joining Newsweek as a breaking news reporter, where he wrote about politics, national and global affairs, business, crime, sports, film, television and other news. Justin has also freelanced for outlets including Collider and United Press International.

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Companies are increasingly AI washing

Companies are increasingly AI washingThe explainer Imaginary technology is taking jobs

-

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?Today’s Big Question Investors navigate a suddenly uncertain global economy

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Why is pizza in decline?

Why is pizza in decline?In the Spotlight The humble pie is getting humbler

-

Ski town strikers fight rising cost of living

Ski town strikers fight rising cost of livingThe Explainer Telluride is the latest ski resort experiencing a patroller strike

-

How prediction markets have spread to politics

How prediction markets have spread to politicsThe explainer Everything’s a gamble

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform