Climate change and your money: how will environmental pressures affect your investments?

Climate change is on the agenda for many countries and companies, and it should increasingly be a concern for investors too

The world we live in is changing. We're part of a growing population with growing levels of affluence resulting in an ever increasing demand on our environment for natural capital, in other words water, clean air, energy, food and forestry. Alongside this is the threat of climate change – a consequence of our fossil fuel powered economies.

When in abundance, this natural capital is often given no economic value, and companies and society regard it as a free good. However once it becomes scarce, the value of these environmental goods becomes all too evident, through competitive pricing, regulation or taxation.

Climate change, and its subsequent fallout, is on the agenda for many countries and companies, and it should increasingly be a concern for investors too. A report from the Intergovernmental Panel on Climate Change (IPCC), a global authority on climate change, says: "Taken as a whole, the range of published evidence indicates that the net damage costs of climate change are likely to be significant and to increase over time." Investors should be thinking of the opportunities and threats this presents.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Opportunities from the development of low carbon technologies; but also threats to currently successful companies as our economies and societies adapt to the consequences of a changing climate. The move away from fossil fuels and environmentally damaging activities due to regulation, new technology and different patterns of consumption, will bring about investment winners and losers. Something that informed investors need to take into account.

Savvy investors understand how much emphasis is put on the management of environmental impacts by any company in which they are considering investing; for example, how much exposure the company has to fossil fuels; and what would be the firm's reaction to more stringent future regulation of carbon dioxide emissions.

Investors can find out about the carbon emissions of big companies through the CDP, previously the Carbon Disclosure Project, which works to make climate change strategies of big companies as transparent as possible. Good investment firms like Alliance Trust will typically adhere to strict environmental and social governance factors too, to ensure that any business included in an investment fund is run responsibly, and that they are aware of the risks of climate change.

Many investors will already be exposed to investments related to environmental pressures without even realising it. Some of the FTSE 100's biggest companies are involved in oil and gas and other resources, these companies are typically held in a huge number of investment funds. But it's not just the energy sector that is affected by environmental issues. The clothing industry for instance is a very intense user of water in the growing, and dyeing of their products, often in already water scarce areas. Many other sectors too are affected in some way, such as transport and manufacturing, which is something to bear in mind for your investment portfolio.

Investors can guard against these environmental risks like climate change and water scarcity in several ways – one of which is to think about what is known as 'impact investing'. This means investing in companies and funds that have a positive influence on the environment, with a focus on specific themes like climate change and environmental technologies. Also investors and investment managers, through their ownership of shares can also pressure companies to better prioritise the management of their environmental resources.

Remember that the value of your investments can go down as well as up and you may get back less than you originally invested. Alliance Trust does not give advice. You need to ensure that you understand the risks and the commitments before investing. If you are unsure, do consult a financial adviser.

Sources: Bloomberg, Cleantechnica, IEA, Energy and Carbon, One World, Climate Action, FT, The Guardian, White House.

To find out more about investment themes and how to get started with your portfolio, check out Alliance Trust's Investment Focus, which offers insight and knowledge into all areas of investment.

Remember that the value of your investments can go down as well as up and you may get back less than you originally invested. Alliance Trust does not give advice. You need to ensure that you understand the risks and the commitments before investing. If you are unsure, do consult a financial adviser

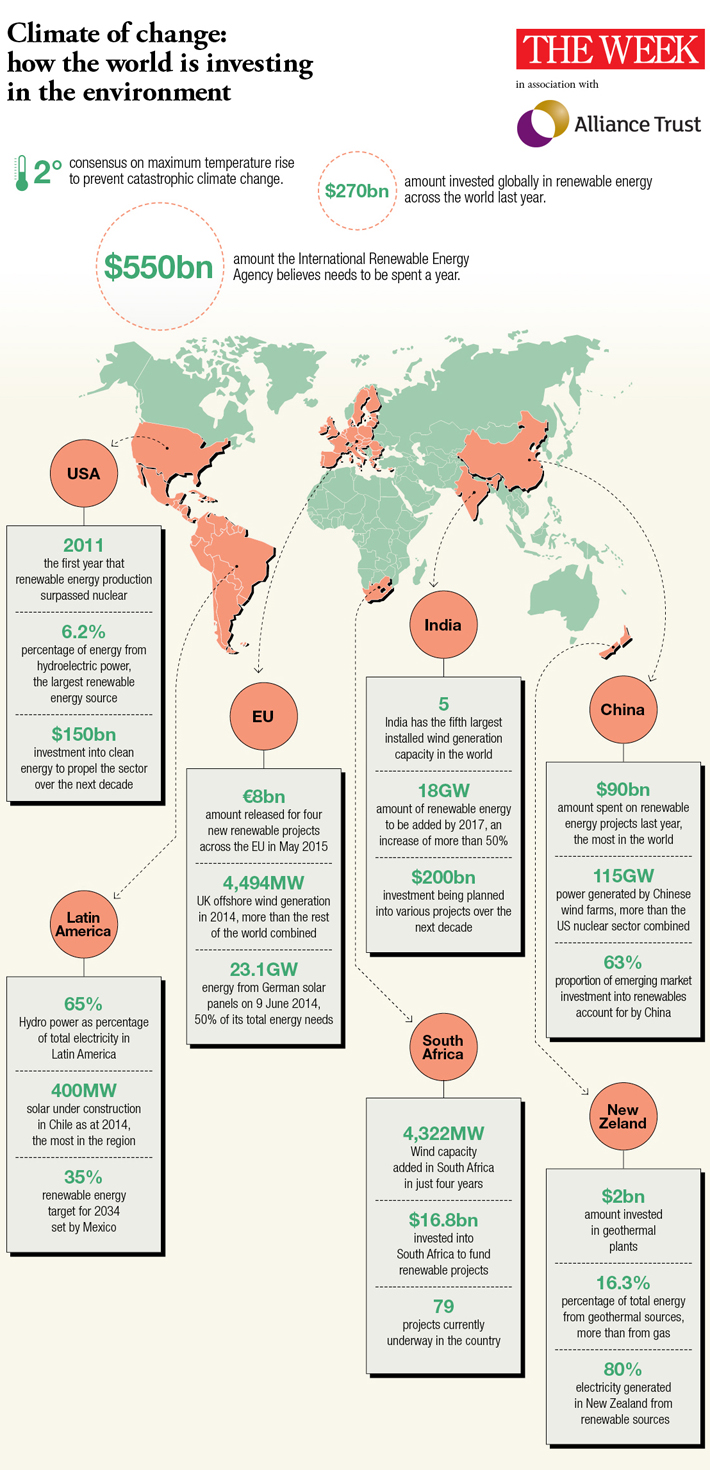

Illustration by Sue Macartney-Snape

Graphic by Carlo Apostoli

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

Received a windfall? Here is what to do next.

Received a windfall? Here is what to do next.The Explainer Avoid falling prey to ‘Sudden Wealth Syndrome’

-

How to invest in the artificial intelligence boom

How to invest in the artificial intelligence boomThe Explainer Artificial intelligence is the biggest trend in technology, but there are fears that companies are overvalued

-

What’s the difference between a bull market and bear market?

What’s the difference between a bull market and bear market?The Explainer How to tell if the market is soaring or slumping.

-

Is it a good investment to buy a house?

Is it a good investment to buy a house?The Explainer Less young people are buying homes, opting to rent and invest in the stock market instead

-

What is day trading and how risky is it?

What is day trading and how risky is it?the explainer It may be exciting, but the odds are long and the risks high

-

What to know about investing in ETFs

What to know about investing in ETFsThe Explainer Exchange-traded funds can be a great choice for beginners

-

Retail investors drive a flurry of IPOs

Retail investors drive a flurry of IPOsFeature After years of slowness, companies like Klarna and Gemini are reviving the IPO market