What is an investment trust?

How investment trusts can offer savers a stable long-term return

To the uninitiated investor, investment trusts can seem complicated and long-winded. But for savers looking for a stable long-term return, they may offer a sound bet.

Investment trusts, like open-ended funds, are collective investments. That means your money is pooled with that of other investors to spread risk, and a dedicated fund manager will decide which stocks to purchase.

Investment trusts, also called investment companies, are often referred to as 'closed-ended'. This means there is a set number of shares in the trust in issuance, meaning they are structured more like a standard company such as Tesco, BP or HSBC. But rather than manufacturing goods and services, they make their money by investing in other companies.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There are far fewer investment trusts than open-ended funds, which number in the thousands. By contrast, there are just 399 investment trusts available on the market, according to statistics from the Association of Investment Companies (AIC) at the end of June. They're popular with investors, too. At the end of May, assets under management in investment trusts hit a record high of £137 billion, up £15bn from end-December, according to the AIC.

Typically, trusts hold between 20 and 100 companies in them, usually running along an investment theme. This theme could be anything from technology or forestry stocks to aircraft rental, or possibly along a geographical theme, such as UK-focused stocks.

While investment trusts share many similarities with open-ended funds, some investment companies will offer investors two versions of the same fund – there are several key differences in the way they trade.

The first point to note on investment trusts is that they trade on a stock exchange like the London Stock Exchange, and are bought and sold like any other stock. Several of the large generalist investment trusts are included in the FTSE 250, including Alliance Trust PLC, one of the largest and oldest on the market.

As their shares are bought and sold like those of other companies, investment trust managers – unlike open-ended fund managers – don't have to keep a cash cushion to give investors their money back if they suddenly want to liquidate their shares.

Another difference is how they are priced. The share price of an investment trust is determined by the supply and demand for its shares. This means that most of the time, investment trust shares trade at a premium or discount to the Net Asset Value (NAV) – i.e. the value of its assets divided by the number of shares in issue. A discount to NAV means the shares are cheap, and the obverse is true if the shares are selling at a premium. A discounted investment trust doesn't necessarily mean that it is performing poorly, though. It means it's not popular at that time, which could be an expression of investor confidence in the investment trust or sector. Buying an investment trust trading at a premium means you'll pay more for your holding, so tread carefully. While investors will generally make more money when selling shares at a premium, there's a risk it will narrow back to the underlying NAV, meaning investors could lose out.

Then there's one thing that investment trusts can do that open-ended funds can't, and that's to employ gearing. Gearing is the ability of trusts to borrow money against the value of its assets to buy more stocks. Most investment companies borrow less than 10 per cent of their assets, but it means investors have greater exposure to the market – ideal when it's rising, not so ideal when it's plunging.

The cost of holding an investment trust also tends to be much lower. The average total expense ratio on an investment trust tends to hover below the 1 per cent mark, compared to an average of around 1.5 per cent for an open-ended fund. Additionally, many investment trusts have admirable dividend policies. Some of the biggest trusts commit to increasing them each year. In fact, Alliance Trust PLC has increased its dividend each year over the past 48 years.

Then there's performance. Typically, investment trusts will outperform investment funds. Research from broker and analyst Canaccord Genuity last year says closed-ended funds outperformed their open-ended equivalents in 12 out of 14 sectors over a 10-year timeframe. Although you should remember that the value of any investments and any income from them can fall as well as rise, meaning investors may get back less than they originally invested.

Investment trusts aren't for everybody, but as with all investments they should be considered part of a diversified portfolio.

Alliance Trust does not give advice. Speak to a financial adviser if you are unsure before placing an investment.

To find out more about investment themes and how to get started with your portfolio, check out Alliance Trust's Investment Focus, which offers insight and knowledge into all areas of investment.

Illustration by Sue Macartney-Snape

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Why the catastrophe bond market is growing

Why the catastrophe bond market is growingThe Explainer The bonds pay for climate change disaster damages

-

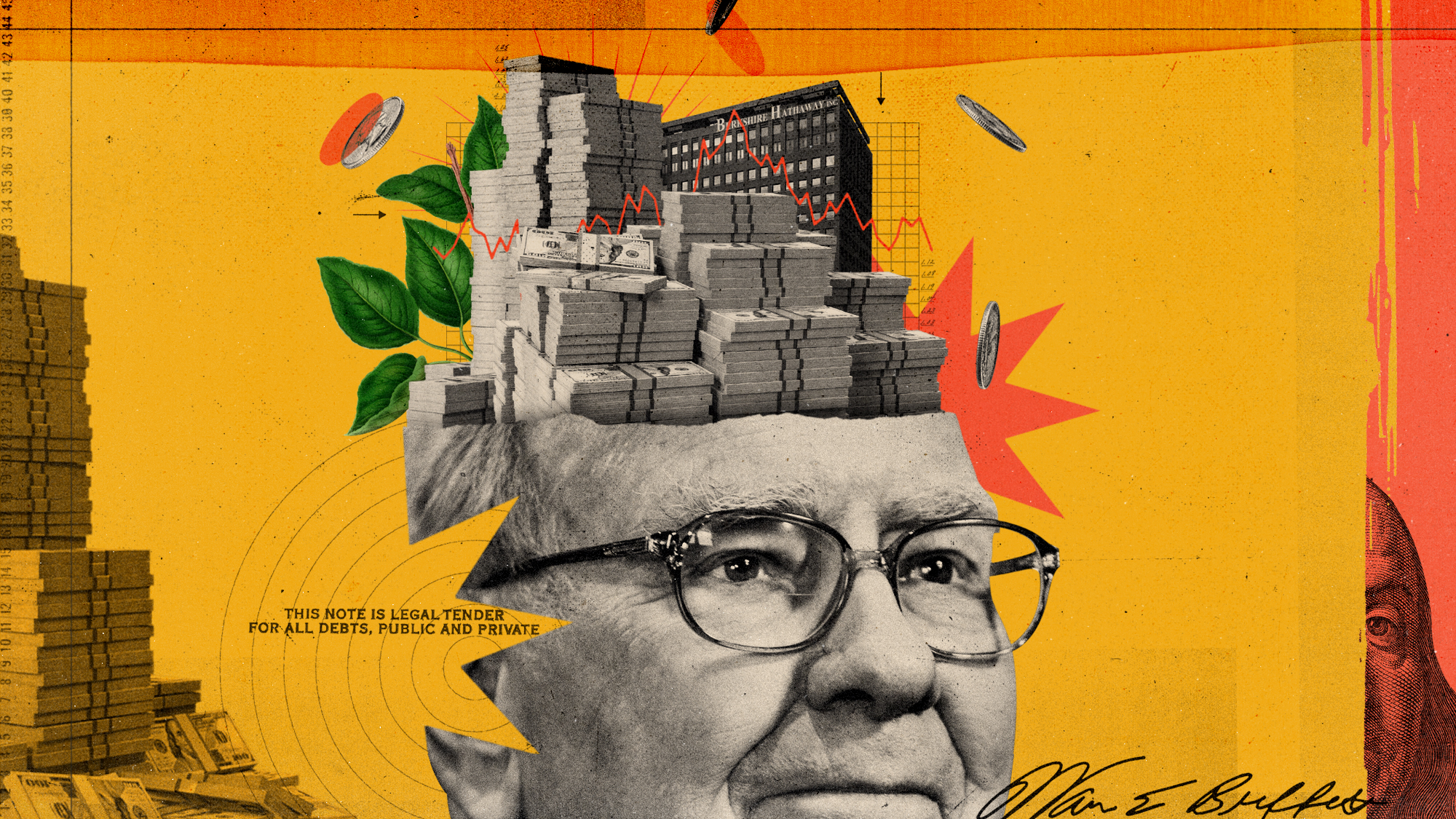

What will be Warren Buffett's legacy?

What will be Warren Buffett's legacy?Talking Points Observers call him 'the greatest investor of all time.'

-

Making money: space diamonds and meteorite collecting

Making money: space diamonds and meteorite collectingfeature ‘The Enigma’ black diamond is expected to sell at auction for £5m

-

Investing in China: what do the experts think?

Investing in China: what do the experts think?feature Some have been predicting a full-scale ‘China crisis’ for years, while others are spying opportunities

-

HSBC to cut 35,000 jobs: why profits plunged

HSBC to cut 35,000 jobs: why profits plungedIn Depth British bank announces 33% drop in profits and plans to slash branches in US

-

Sustainable investment: a round-up of Alliance Trust's collaboration with The Week

Sustainable investment: a round-up of Alliance Trust's collaboration with The Weekfeature From investment basics to the impact of your money on the world around you – a look back on our collaboration with Alliance Trust

-

Take the stress out of investment

Take the stress out of investmentfeature With the right knowledge and tools, you can create a fertile soil in which your investments can flourish