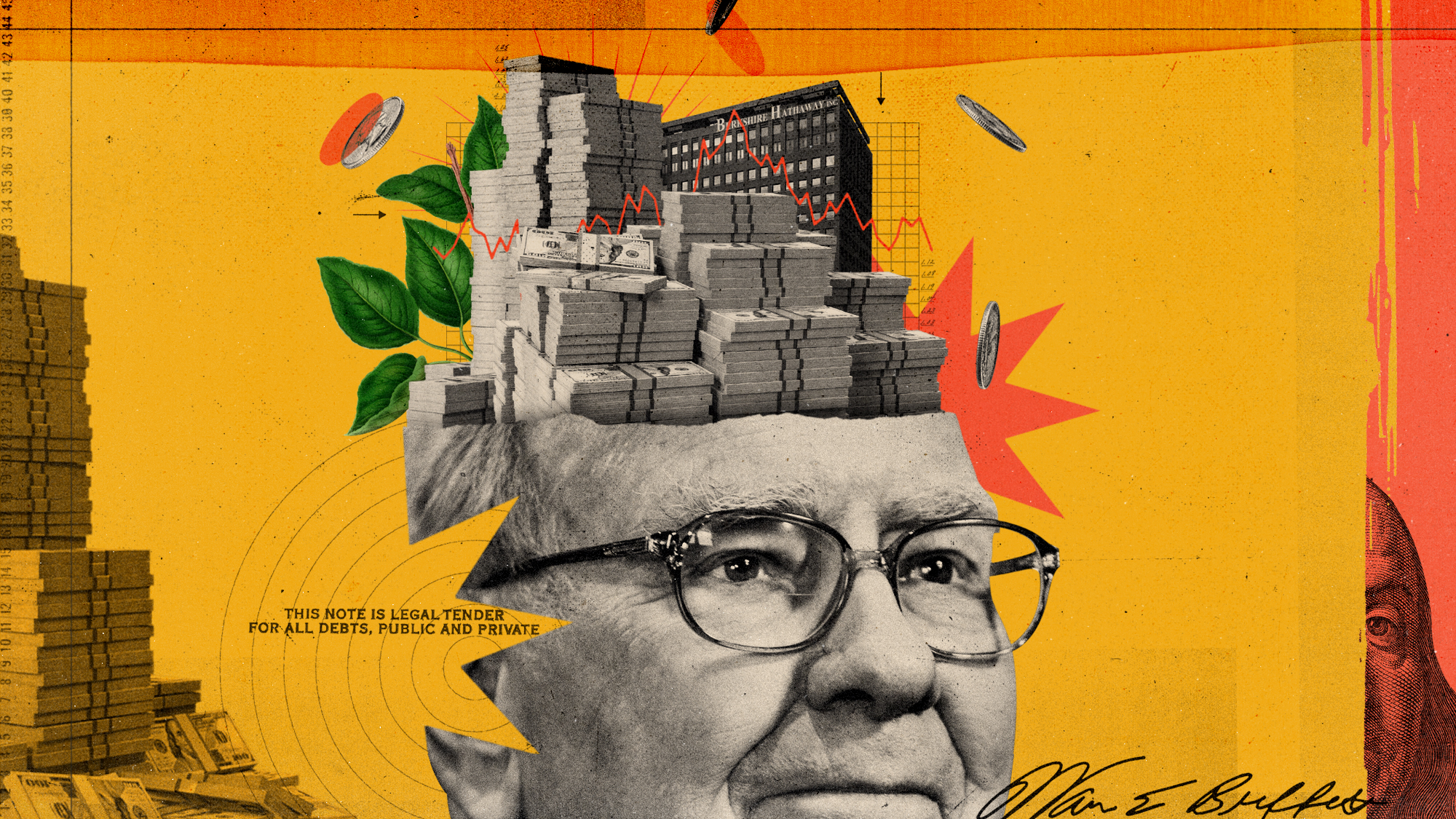

What will be Warren Buffett's legacy?

'The greatest investor of all time'

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Warren Buffett is retiring. The 94-year-old "Oracle of Omaha" led Berkshire Hathaway for more than a half-century, accruing a fortune and ascending to the status of capitalist-cultural icon along the way.

Buffett is the "greatest investor of all time," said Nir Kaissar at Bloomberg. Investing is a "notoriously difficult endeavor," and even those who can beat the market's rate of return usually only do so "for a short time or by a modest amount." But the market value of Berkshire's shares grew by nearly 20% a year between 1964 and 2024 — nearly double the 10.4% rate of the S&P 500 over the same period. And Buffett did that while showing "you don't need a fancy Wall Street address to be a great investor."

'One in a million'

The Omahan was an "anchor of endurance" in an "age of insecurity," biographer Roger Lowenstein said at The New York Times. But the investment numbers don't measure the fullness of Buffett's impact: He was also "among the greatest corporate leaders" of his era, bolstering the financial system by investing in Goldman Sachs during the 2008 financial crisis. That made Buffett the "capitalist version of a national security blanket."

Article continues belowThe Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There is a danger that other CEOs will learn the wrong lesson from Buffett's tenure, said the Financial Times. His 55 years atop Berkshire made him the "longest-serving chief in the S&P 500." Research, though, shows "there is such a thing as too long." The average CEO's value starts to decline after about 14 years. Buffett, in other words, is a "happy outlier" in the corporate world. The moral is that "bosses like Berkshire Hathaway's are one in a million."

Buffett's "great fortune was not being born today," said Megan McArdle at The Washington Post. He was born in 1930, right after the stock market crash that launched the Great Depression, leaving "traumatized investors" cautious about investing a generation later when his career began. And he was good at spotting undervalued companies before "computers made it much easier to spot pricing anomalies" and erased that advantage. Buffett would likely be a success if he started out now, but it's fair to "doubt he'd become one of the richest people in the world."

Stewards and dreamers

Some observers have criticized Buffett for a "lack of ambition," Maxwell Meyer said at The Free Press. The billionaire has "no space company" or other side gigs and has "lived in the same modest house since the 1960s." Instead of being a pioneer, Buffett has been a "steward for the people whose money he's looked after for all these years." There is no shame in that. "We need stewards every bit as much as we need dreamers."

Greg Abel, Buffett's longtime heir apparent, will take over Berkshire at the end of 2025. The question now is how "anyone other than Warren Buffett can profitably operate a sprawling amalgamation" of companies under Berkshire's brands, said Fortune. The company relied "as much on Buffett's magnetic personality as his investment acumen." That "intangible asset" may be difficult for Abel to replace.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.