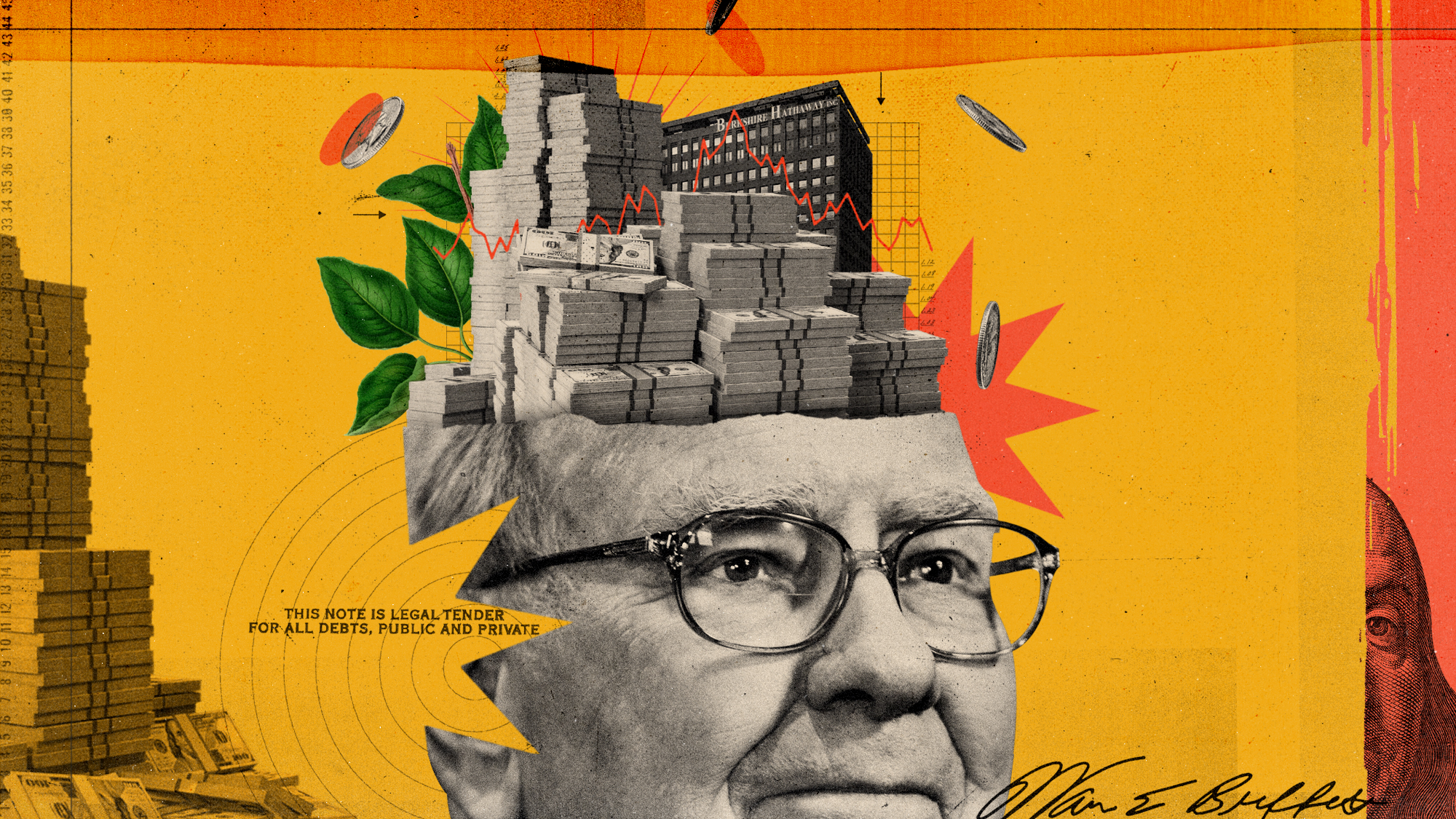

What will be Warren Buffett's legacy?

'The greatest investor of all time'

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Warren Buffett is retiring. The 94-year-old "Oracle of Omaha" led Berkshire Hathaway for more than a half-century, accruing a fortune and ascending to the status of capitalist-cultural icon along the way.

Buffett is the "greatest investor of all time," said Nir Kaissar at Bloomberg. Investing is a "notoriously difficult endeavor," and even those who can beat the market's rate of return usually only do so "for a short time or by a modest amount." But the market value of Berkshire's shares grew by nearly 20% a year between 1964 and 2024 — nearly double the 10.4% rate of the S&P 500 over the same period. And Buffett did that while showing "you don't need a fancy Wall Street address to be a great investor."

'One in a million'

The Omahan was an "anchor of endurance" in an "age of insecurity," biographer Roger Lowenstein said at The New York Times. But the investment numbers don't measure the fullness of Buffett's impact: He was also "among the greatest corporate leaders" of his era, bolstering the financial system by investing in Goldman Sachs during the 2008 financial crisis. That made Buffett the "capitalist version of a national security blanket."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There is a danger that other CEOs will learn the wrong lesson from Buffett's tenure, said the Financial Times. His 55 years atop Berkshire made him the "longest-serving chief in the S&P 500." Research, though, shows "there is such a thing as too long." The average CEO's value starts to decline after about 14 years. Buffett, in other words, is a "happy outlier" in the corporate world. The moral is that "bosses like Berkshire Hathaway's are one in a million."

Buffett's "great fortune was not being born today," said Megan McArdle at The Washington Post. He was born in 1930, right after the stock market crash that launched the Great Depression, leaving "traumatized investors" cautious about investing a generation later when his career began. And he was good at spotting undervalued companies before "computers made it much easier to spot pricing anomalies" and erased that advantage. Buffett would likely be a success if he started out now, but it's fair to "doubt he'd become one of the richest people in the world."

Stewards and dreamers

Some observers have criticized Buffett for a "lack of ambition," Maxwell Meyer said at The Free Press. The billionaire has "no space company" or other side gigs and has "lived in the same modest house since the 1960s." Instead of being a pioneer, Buffett has been a "steward for the people whose money he's looked after for all these years." There is no shame in that. "We need stewards every bit as much as we need dreamers."

Greg Abel, Buffett's longtime heir apparent, will take over Berkshire at the end of 2025. The question now is how "anyone other than Warren Buffett can profitably operate a sprawling amalgamation" of companies under Berkshire's brands, said Fortune. The company relied "as much on Buffett's magnetic personality as his investment acumen." That "intangible asset" may be difficult for Abel to replace.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Companies are increasingly AI washing

Companies are increasingly AI washingThe explainer Imaginary technology is taking jobs

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is pizza in decline?

Why is pizza in decline?In the Spotlight The humble pie is getting humbler

-

How prediction markets have spread to politics

How prediction markets have spread to politicsThe explainer Everything’s a gamble

-

SiriusXM hopes a new Howard Stern deal can turn its fortunes around

SiriusXM hopes a new Howard Stern deal can turn its fortunes aroundThe Explainer The company has been steadily losing subscribers

-

How will China’s $1 trillion trade surplus change the world economy?

How will China’s $1 trillion trade surplus change the world economy?Today’s Big Question Europe may impose its own tariffs