Sustainable investment: a round-up of Alliance Trust's collaboration with The Week

From investment basics to the impact of your money on the world around you – a look back on our collaboration with Alliance Trust

Over the past eight months we have teamed up with Alliance Trust to bring you an insight into the world of investing. Whether you’re saving for something now or thinking more long term, we’ve got a range of different articles to help guide you through the maze of information available and help to making investing more simple. Here we summarise some of the key points – you can read them all in full here.

Understanding investments: a guide to cash, equities and bonds

If you’re a beginner, the idea of placing your money into the stock market can be daunting. But in reality, understanding the markets and how to invest in different assets can lead to greater returns and a more sustainable investment over time when compared to keeping all of your money in cash with your bank. There are three main asset classes – cash, equities (or stocks/shares) and bonds and this article looks at how each of these can be used to create a diversified portfolio to spread your risk and increase returns.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Read more about investing and how to get started by clicking here.

Understanding investment risk… and returns

Are you the kind of person who would do a skydive without a moment's thought? Or does the idea of it make you feel ill? We're all different, and this translates into how we feel about risk generally, and therefore how we feel about taking risks with our finances. It's well known that investing in the stock market is riskier than keeping your money in cash in the bank – but the more risk you take, the potentially higher your returns can be.

Understand more here about weighing up the potential risk and return of your investments.

What is an open-ended investment fund?

It's well-known that returns on savings accounts are pitiful right now. It's also well-known that historically, equities have outpaced returns from cash. But the stock market can seem a daunting place if you don't know where to start – even though it might be a good move for your portfolio. This is where open-ended investment companies (OEICs – pronounced 'oik') come in as a good halfway house. Funds are a collective investment – your money is pooled with that of other investors to spread and reduce risk. They also mean instant diversification to a wide range of stocks. They are typically actively managed, which means a dedicated fund manager will make day-to-day decisions about where and when to invest.

Find out more about OEICs by clicking here.

What is an investment trust?

To the uninitiated investor, investment trusts can seem complicated and long-winded. But for savers looking for a stable long-term return, they may offer a sound bet. Investment trusts, like open-ended funds, are collective investments. That means your money is pooled with that of other investors to spread risk, and a dedicated fund manager will decide which stocks to purchase. However unlike Oeics investment trusts are split into a finite number of parts – or shares, to complicate matters further. Each of a trust's shares will hold a certain spread of underlying assets, in the same way as funds. However, because shares in a trust cannot be easily created, the share price in a trust can go up and down as demand fluctuates. This means the share price could be higher than the value of the underlying assets, meaning it is trading at a premium, or it could be lower – trading at a discount.

To learn more about investment trust basics, click here.

Compounding success

Albert Einstein once called compound interest the “eighth wonder of the world”. It might not rank up there with the Taj Mahal and the Hanging Gardens of Babylon, but the eccentric physicist knew what he was talking about. Whether you’re investing in cash, stocks and shares or bonds, in today’s climate of low interest rates the effect of compound interest can help your investment grow far quicker than you realise. If you reinvest the money you make from your investments that money will be put to work as well. Over time, this will in theory accelerate any gains. If you have £100 and it grows by 10 per cent, you'll have £110. If that grows by 10 per cent, you'll have £121 – meaning the amount you gained increases. This is called compounding and is one of the most powerful forces in investment.

Find out more on compound interest by clicking here.

Economics: understanding interest rates and inflation

Economic forces such as interest rates, inflation and exchange rates might seem complicated terms when you're a first-time investor, but how they work and relate to one another can have a huge impact on your portfolio. Of course, it's also important to pay attention to the cash flow and underlying investments of an individual company – or pooled fund – as well, but these 'macro' economic factors can have a significant effect.

Investing: Ten guidelines to long-term investment

As we are all living longer, it's never been more important to build up a solid nest egg for the future. It might seem a long way away if you're a young, first-time investor, but start investing in your twenties or thirties and you'll reap the benefits in years to come. However this can be difficult as anyone who even vaguely follows money matters in the UK these days will be aware that we have been gripped by a prolonged period of rock-bottom interest rates. Very low rates mean bank interest rates will be lower, which in turn means that your cash will grow much more slowly as it sits in your account. So what can you do? Well, one option is to take the bull by the horns and invest your cash in the hope of making returns that are higher than inflation – or at least higher than what you would have got from your bank.

How long-term investing can offer a sustainable return

The stock market can sometimes seem like a rollercoaster ride, but historically, it has delivered far superior returns over the long term when compared to other asset classes such as cash and bonds. If you've just taken the plunge, it can be tempting to constantly check up on your portfolio, and panic when your investment dips below the initial amount you invested, but taking a long-term view means your portfolio has the potential to smooth out the short-term fluctuations in value. You might be tempted to sell a holding as soon as it starts to lose money. Obviously it is important to keep an eye on it but don't forget that all companies are likely to have their ups and downs, if you are truly a long-term investor it might be worth holding tight.

Find out more here why taking a long-term view can help to ride out short-term fluctuations.

Five companies that typify sustainable investment

Your investment doesn’t have to benefit just you; it can also benefit the world around you. That’s the principle behind sustainable investments – namely that investing in well-managed businesses with interests in improving the environment or quality of life can deliver superior returns over time. Many investment firms will have made a commitment to invest in sustainable stocks. Some even offer specialist sustainable pooled funds that specifically invest in companies involved in ethical or green industries. Investor appetite for these kinds of investments is on the rise. Sustainable investment research firm EIRIS puts the amount invested in green and ethical funds at a record £13.5bn at the end of June 2014. You might think that the worthier the investment, the lower the return – when in fact, it’s rarely the case. Many sustainable companies plug into growing social and environmental trends, producing products and technology that an increasing population will need 10, 20, and 50 years down the line, which means a greater and more robust return.

How will climate change affect your investments?

The world we live in is changing. We're part of a growing population with growing levels of affluence resulting in an ever increasing demand on our environment for natural capital, in other words water, clean air, energy, food and forestry. Alongside this is the threat of climate change – a consequence of our fossil fuel powered economies. When in abundance, this natural capital is often given no economic value, and companies and society regard it as a free good. However once it becomes scarce, the value of these environmental goods becomes all too evident, through competitive pricing, regulation or taxation. Climate change, and its subsequent fallout, is on the agenda for many countries and companies, and it should increasingly be a concern for investors too.

Find out more about the impact climate change could have on your investments here.

How to foster investment skills in your children

When it comes to investment, it's never too early to teach your children about the best ways to save for the future. As for the best home for savings for children, there are a myriad of options to choose from, with the most popular being a child savings account, Junior ISAs (JISAs for short) or Child Trust Funds (which were scrapped in 2011, read on for more information). Another option which isn't so widely recognised is Child pensions. Child savings accounts can be a good starting point. Banks and building societies will offer cash savings plans, and they will typically accrue interest tax-free, but with interest rates at a record low, there are other options to help grow your child's savings from a young age.

From all of these articles we hope to have given you a wider perspective on investing and helped to broaden your knowledge. But it’s always important to remember that you need to understand the risks in full before investing and that investments can go down as well as up and you may get back less that you originally invested. And finally if you are at all unsure about investing, seek financial advice.

To find out more about investment themes and how to get started with your portfolio, check out Alliance Trust's Investment Focus, which offers insight and knowledge into all areas of investment.

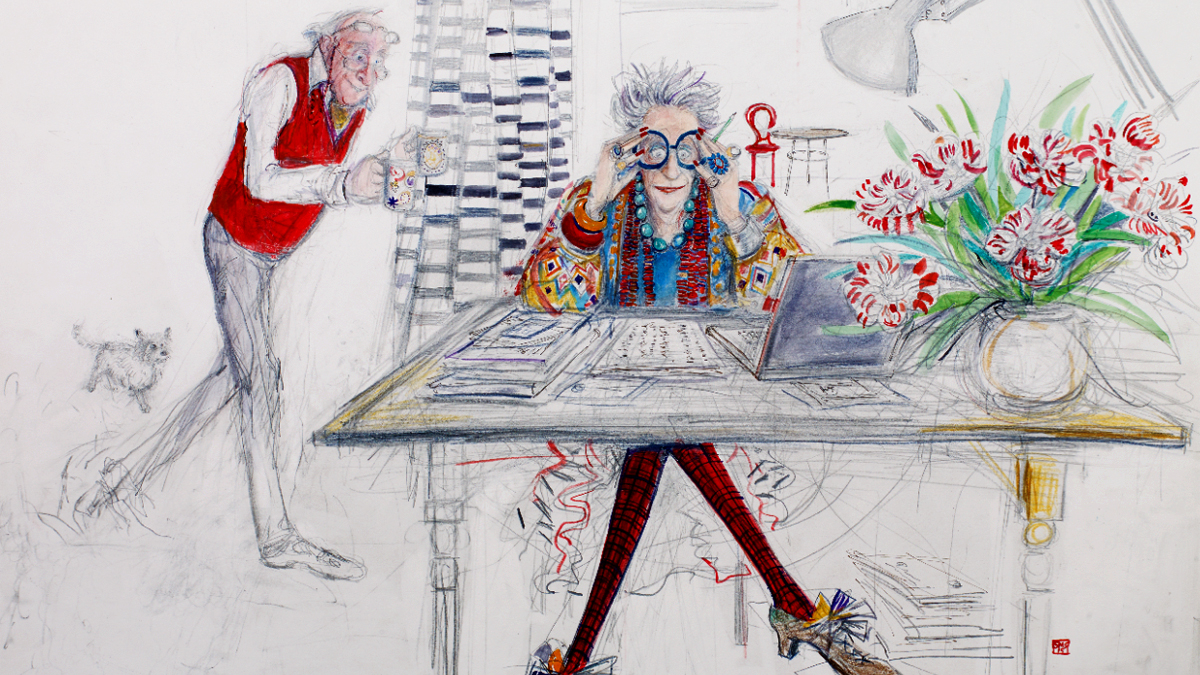

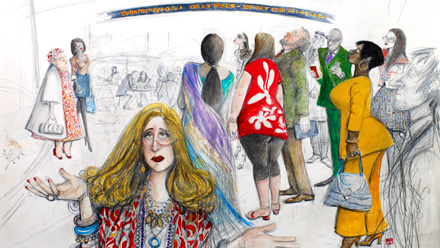

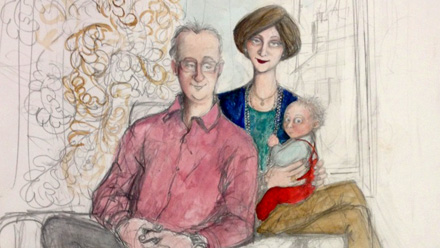

Illustrations by Sue Macartney-Snape

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Will Trump’s 10% credit card rate limit actually help consumers?

Will Trump’s 10% credit card rate limit actually help consumers?Today's Big Question Banks say they would pull back on credit

-

What will the US economy look like in 2026?

What will the US economy look like in 2026?Today’s Big Question Wall Street is bullish, but uncertain

-

Is $140,000 the real poverty line?

Is $140,000 the real poverty line?Feature Financial hardship is wearing Americans down, and the break-even point for many families keeps rising

-

Fast food is no longer affordable for low-income Americans

Fast food is no longer affordable for low-income AmericansThe explainer Cheap meals are getting farther out of reach

-

Why has America’s economy gone K-shaped?

Why has America’s economy gone K-shaped?Today's Big Question The rich are doing well. Everybody else is scrimping.

-

From candy to costumes, inflation is spooking consumers on Halloween this year

From candy to costumes, inflation is spooking consumers on Halloween this yearIn the Spotlight Both candy and costumes have jumped significantly in price

-

Why are beef prices rising? And how is politics involved?

Why are beef prices rising? And how is politics involved?Today's Big Question Drought, tariffs and consumer demand all play a role