Should CEOs be forced to disclose how much more they earn than you do?

The SEC just proposed making CEO-to-worker pay ratios public knowledge. Does that promote transparency or class warfare?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

On Wednesday, the Securities and Exchange Commission voted to formally propose a new rule that would require publicly traded companies to disclose the ratio between what their chief executives earn and the median compensation of their employees. The vote was a close one, 3-2, along partisan lines.

Under the plan, companies will have to produce three data points in their annual filings: The total compensation of their CEOs — something they have to do anyway, under a provision of the 2010 Dodd-Frank financial reform law — plus the median annual compensation of their employees, and the ratio between those two amounts.

Nobody really knows the current ratio of CEO-to-worker pay, but there are a lot of estimates. They are all pretty steep.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

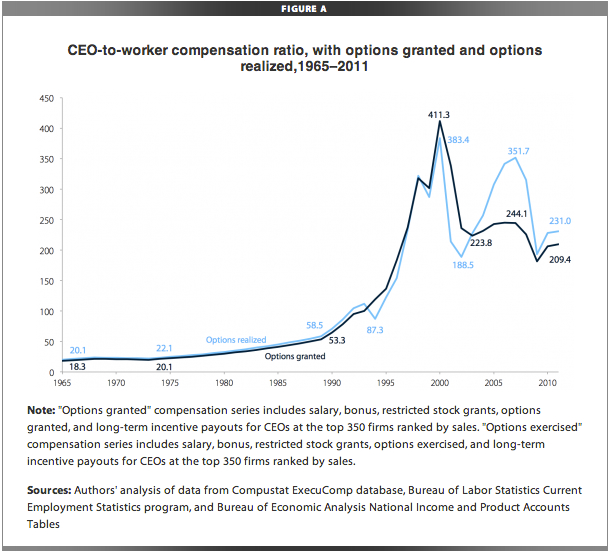

Kevin Murphy at the University of Southern California estimates that CEOs earned 319.7 times more than their typical worker in 2011, while an analysis of S&P 500 companies by the labor group AFL-CIO pegged the CEO-to-worker ratio at 380 to 1. The liberal Economic Policy Institute, in a May 2012 report, found that as of 2011, CEO-to-worker pay was 231 to 1 (or 209 to 1, if you count non-exercised stock options). That number has since risen to 277 to 1. The EPI helpfully charts out how that number has changed since 1965:

The Wall Street Journal's Andrew Ackerman has a helpful Q&A about the new proposal, which is also mandated under Dodd-Frank, though with no deadline for action. Ackerman outlines some of the parameters of the debate: "Labor unions and their supporters in Congress" support the proposal, arguing that knowing how companies spend their money will help investors decide where to put their cash. Who's opposed?

Republican commissioners and lawmakers who say the disclosures provide no meaningful information to investors about a company's financial health. Trade groups representing corporate executives have also lodged complaints that the proposal is too costly to implement. [Wall Street Journal]

Those are the public arguments, but, of course, both sides have other reasons for backing or fighting the measure. CEOs and the companies that pay them huge amounts of money don't want the added scrutiny from activist investors and the large majority of Americans who have seen their incomes stagnate or decline while the super-wealthy get wealthier. And supporters of the law want to "shame companies into lowering CEO pay," as the AFL-CIO's call-to-action puts it bluntly.

Opponents of the pay-ratio measure appear to be winning the volume war. This mandate from Dodd-Frank is "probably the most poorly conceived and drafted statute in the history of U.S. executive compensation," says James D.C. Barrall, partner in a compensation-focused law firm, at The Wall Street Journal. And it has nothing to do with the SEC's mandate to ensure that investors have "access to information that enables them to make informed investment decisions," says Hester Pierce at Point of Law:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

While of great interest to CEO pay activists, for most investors, the pay ratio — which is based on an arbitrary calculation — simply is not material to their investment decisions.... Perhaps the SEC will next turn its attention to mandating disclosure of the menus at corporate cafeterias. Knowing what's for lunch tells me a lot about worker morale and productivity and a company's investment in human capital. [Point of Law]

Along with being of little value and expensive to implement, argues Alissa Ponchione at CFO.com, the "hated pay ratio rule" isn't even popular among investors, "even though providing more information for investors is the stated reason for the measure." She cites Tim Bartl of the Center on Executive Compensation, who found that of 14 shareholder proposals asking companies to list its pay ratio, investor opposition has averaged 93 percent. (On a side note: The wealthiest 10 percent of U.S. households own about 90 percent of all stock.)

Oh, cry me a river, says Hamilton Nolan at Gawker. Yes, the SEC's rule is "little more than an attempt to shame public companies into bringing the ratio under control, somewhat," but it doesn't go far enough. "Corporate lobbyists" are outraged over the rule, but "most working people, I'd wager, would feel that a ratio of 230-1 goes against common fairness."

Ideally, we would tie worker pay to executive pay. The maximum ratio would be enforced by law. In order for those at the very top to enrich themselves more, they'd have to raise the wages of their employees. Companies would no longer be able to pay minimum wage to many of those at the bottom and tens of millions to those at the top. All the happy corporate talk about "team members" would finally mean something real. [Gawker]

Oh, right, says Terence Corcoran at Canada's National Post, "Imagine the blast of increased productivity, creative power, fresh employment, and investor benefits that will flow when all U.S. listed public companies are forced to formally declare that the total compensation of their CEOs is some giant multiple of all the employees in the company." Seriously, he says, what will "these markers of plutocracy" do, other than "promote class warfare within each corporation directly between the CEO and the company's employees"?

We already know, for example, that the CEO of Abercrombie & Fitch appears to earn 1,640 times the average salary earned by rank-and-file Abercrombie & Fitch employees, and that the CEO of Starbucks earns 1,135 times what the average Starbucks employee does.... It's hard to see what will come of this new disclosure effort to reveal the median income of all employees in a company. One thing is certain: It will do nothing to boost productivity, growth, or jobs. [Financial Post]

The SEC's proposal is now open to 60 days of public comment before the SEC votes to either approve or reject it. Expect a lot of commentary.

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Film reviews: ‘Send Help’ and ‘Private Life’

Film reviews: ‘Send Help’ and ‘Private Life’Feature An office doormat is stranded alone with her awful boss and a frazzled therapist turns amateur murder investigator

-

Movies to watch in February

Movies to watch in Februarythe week recommends Time travelers, multiverse hoppers and an Iraqi parable highlight this month’s offerings during the depths of winter

-

ICE’s facial scanning is the tip of the surveillance iceberg

ICE’s facial scanning is the tip of the surveillance icebergIN THE SPOTLIGHT Federal troops are increasingly turning to high-tech tracking tools that push the boundaries of personal privacy