Why did conservatives abandon monetary stimulus?

Reform conservatives used to be part of the "market monetarist" crowd. Not anymore.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

During the dog days of the Great Recession, several economists developed a persuasive case that the Federal Reserve was badly bungling monetary policy. Led by Scott Sumner, these "market monetarists" argued that the Fed should be far more prepared to unleash monetary stimulus. To do this, the central bank would have to abandon its dual mandate of keeping unemployment and inflation low, and adopt a much simpler metric: a nominal gross domestic product (NGDP) growth target.

Nominal GDP is the total economic output not adjusted for inflation (as opposed to "real" GDP, which is adjusted). The yearly change in GDP is thus the sum of real growth plus inflation. As Steve Randy Waldman explains, if we kept NGDP on a clear and consistent growth path, as opposed to trying to balance the competing forces of inflation and employment, we could very well banish mass-unemployment recessions forever, since it would act as a kind of informal trigger to activate stimulus when necessary. If the economy were ever hit with another 2008-style shock, it would merely result in a brief burst of inflation. There are examples of this working in the real world: Israel seems to have managed this trick.

The high-water mark of the market monetarists' intellectual and political influence was in 2011 and 2012, when market monetarism was a key economic plank for reform conservatives, those who have been trying, with little success thus far, to push the Republican Party in a new, less dogmatic direction. Since then, however, the NGDP chorus has quieted somewhat, and the movement's key political allies have abandoned it.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Ramesh Ponnuru, previously a strong advocate of monetary stimulus, claims that he has not abandoned the NGDP target, just that the times have changed:

I was never going to be a dove for very long. Being a hawk on monetary policy in all circumstances, or being a dove in all circumstances, makes as little sense as being either of those things on foreign policy in all circumstances... My preference would be for a steady rate of increase in nominal spending, say at 4.5 percent a year. If the Fed had pursued that policy over the last half-century, it would have been much tighter during the 1960s and 1970s, a bit tighter during 2003-06, and much looser in 2008-11. [National Review]

He points to a previous piece of his, which argues that the case for monetary stimulus is decaying over time. In this view, monetary stimulus at this point will simply juice inflation without supplying growth.

[T]he Fed (along with those of us in the "market monetarist" camp) has to face the fact that what's done is done. Our economy suffered enormous harm because the Fed failed to maintain the old trend. We should go partway back to it, but the amount of good it would do falls a little bit every month. [Bloomberg View]

There are two problems here. First is the choice of target: 4.5 percent is lower than Sumner's typical 5 percent, and could mean enforcing unnecessarily low growth. Adopting a 4.5 percent target in the 1960s, as he suggests in his first piece, would have choked off a tremendous economic boom in which real GDP increased by 53 percent (as compared to 15 percent during the 2000s).

The other problem is much more important, and it entails a truly enormous downside risk. Ponnuru argues that a return to the previous economic trend is rapidly becoming impossible. But what if he's wrong?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

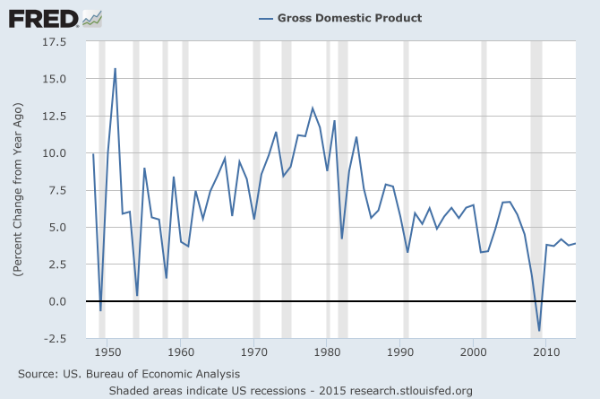

It could also be the case that the American economy is not as damaged as he suggests. To put it in market monetarist terms, I calculate that from 1990 to 2007, NGDP grew at an average rate of 5.31 percent. From 2010 to 2014, the average was 3.86 percent. If we include 2008 and 2009, the average drops to 2.70 percent. The shift can be seen in this chart:

A permanent 1.45 percentage point decline in America's nominal growth path would be indescribably disastrous. As Brad DeLong calculates, by 2014 the cumulative lost output of the Great Recession through that year amounted to roughly $60,000 per person. If nothing restores the trend, the amount lost could reach into the hundreds of thousands, per person.

Conversely, if we could return to trend with a period of explosive catch-up growth, like what happened during World War II, the overall benefits in terms of output and employment could be enormous.

The market monetarists made a good case that the Fed made an utter hash of things during the Great Recession, particularly in 2008. But today might be a chance to make up for some of those mistakes — or make new disastrous errors. With the economic recovery (particularly in job growth) finally accelerating, the Fed is considering its first rate hike in the coming months since it dropped rates to zero seven years ago, even though inflation is below its target and has been for years now. The central bank justifies this by hewing to the conventional wisdom that monetary policy operates with "long and variable lags," so you have to get out ahead of inflation.

Under normal conditions, that wouldn't be so bad. But coming out of a catastrophic recession, this may foreclose the possibility of desperately needed rapid catch-up growth — thus risking a self-fulfilling prophecy of economic stagnation. As Paul Krugman writes, the Fed should delay rate hikes until it sees "the whites of inflation's eyes," because then we'll know for sure that our productive potential is being reached. Overshooting inflation a bit is no big deal and may actually help the economy — while it's very easy to imagine the Fed knocking itself right back into the zero lower bound sandpit.

For those who truly believe in NGDP targeting, right now is perhaps the most critical time since 2008 to press the case for more monetary stimulus. Key decisions are being made right now that could define the trajectory of the American economy for decades to come. Scott Sumner, though he does not write so much about NGDP targeting anymore, still understands and accepts this logic, using the exact same line as Krugman does.

But Ponnuru and his conservative brethren apparently do not. NGDP targeting has practically vanished from the political discourse.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.