The Fed did a clumsy job fighting inequality in the Great Recession. Here's how it can do better.

The Fed's monetary policy tools are good, but not good enough

One of the longstanding accusations against quantitative easing — the "unconventional monetary policy" the Federal Reserve cooked up to combat the 2008 crisis — is that it inflates inequality.

When you consider how quantitative easing (QE) operates, you can understand why people would think that. The Fed prints a bunch of money, then buys up a bunch of financial instruments on the stock market in an effort to downshift long-term interest rates and boost the economy. In short, it's paying a bunch of rich people to take portions of their investment portfolios off their hands.

But a trio of working papers just released by Brookings suggest that, on balance, QE either had no effect on inequality, or slightly reduced it. So all good, right?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Well, sort of. The studies do show that. But they also suggest monetary policy works via a trickle-down, six-degrees-of-Kevin-Bacon sort of way; one that relies on upper class Americans as the middle men between the policy and any boost to the economy as a whole.

The first study looked at who QE helped and how much. It estimated QE boosted stock prices by 5 percent and bond prices by 9 to 14 percent. The top 1 percent of Americans hold roughly half of stocks and bonds, and the top 10 percent hold roughly another 40 percent. The bottom 90 percent account for 9 percent or less of stock and bond ownership. So those price increases definitely disproportionately helped the elite.

But a lot of QE involved buying up financial instruments in the housing market, which boosted home prices 7 percent. The bottom 90 percent of Americans boast 60 percent of housing wealth, and in fact the middle 60 percent of Americans (which excludes the richest or the poorest 20 percent) own two-thirds of housing wealth. So QE's effect on housing was much more progressive. The effects on housing versus stocks and bonds basically canceled each other out in terms of income inequality.

However, as you might be thinking, home ownership isn't that progressively distributed. Americans in the top half of the income distribution are far more likely to own a home than rent. But in the bottom half it's much more of a split.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So for Americans near the bottom, the big boost QE brought was through job creation. The ultimate point of all monetary policy, after all, is to combat recessions and encourage healthy economic growth. And the easier it is for workers to get jobs, the more bargaining power they have — which translates into higher wages. The study calculated that QE kept unemployment about 5 percent lower between 2009 and 2014 than it would have been had the Fed done nothing. And that translated into a 10 percent boost for the wages of the poorest tenth of Americans, and a 4 percent boost for the wages of Americans at the exact middle of the economy.

So the story is multi-pronged: QE boosted stocks and bonds for the top, boosted housing for the middle, and boosted employment for the bottom. And the whole thing shook out to either no effect on inequality or a slight reduction.

With the next two studies, things get even more complicated. But in a bad way.

Higher inflation is also part and parcel of what monetary policy aims for when it stimulates the economy. The second study found that higher inflation benefits middle-aged and middle-class households the most, since they have the biggest debt loads and mortgages, and thus see the greatest reduction in their burdens. Poorer and younger homeowners see less benefit. And there's a counter-force, in which house prices rise the most for older homeowners looking to use the gains to upgrade, which pushes some of the benefit back up the income ladder.

Finally, the third study looked at the regional effects of the first round of QE. (There were two more.) It found that QE could have actually exacerbated inequality between regions, depending on how many underwater homeowners a region had — "underwater" defined here as owing more than 80 percent of the value of their home. Basically, QE made mortgage refinancing easier, but the majority of that easing flowed to more well-off homeowners.

This was a problem for this specific recession, given how central the housing bust was to the 2008 collapse. But more generally, helping people refinance their mortgages presumably helps local economies because it loosens their financial straightjacket and allows them to borrow and spend more. But poverty tends to be communal — poor people live around other poor people. So multiply that effect across a lot of homeowners and that disparity across a lot of neighborhoods, and the boost to local economic activity was more likely to go to the neighborhoods and areas that needed it less.

So what to take away from this? Well, the first thing to remember is these are working papers. They may yet be revised by review from other experts. But what they say is monetary policy helped: It boosted employment at the bottom and avoided exacerbating inequality. This is especially true since state and federal governments spent most of the last few years cutting spending, thus dragging the economy down with fiscal policy. The Federal Reserve getting ambitious with QE probably put a floor under how much damage Congress and statehouses did.

But monetary policy can also be a rather imprecise instrument. The poorest Americans, who need the most aid, tend to be the furthest removed from its effects, helped only when better-off Americans respond to changing house, stock, and bond prices by pumping more money into the economy.

It's worth remembering that just about everything the Fed does boils down to printing money and injecting it into the economy. The way it's always done the latter is by buying up financial instruments. This holds true even when when the central bank is just fiddling with interest rates in normal times. The difference between quantitative easing and "conventional" monetary policy is just the strategy and schedule of the money printing, and what sorts of financial instruments are bought.

So what if the Fed chose a different way of injecting money entirely? By say, just taking the money they print and divvying it up into a check of the same amount for every American? It's an idea that's been proposed in multiple corners. (Including by The Week's own Ryan Cooper.) It would clear out the underbrush of monetary policy's causal chain, collapse the distinction between monetary and fiscal policy, and probably amp up monetary policy's effect: a dollar given to a poor person is more likely to boost aggregate demand than one given to a rich person, since the poor person is much more likely to spend it.

U.S. monetary policy has a good-but-not-good-enough-problem. That's a reason to be grateful for what the Fed did. But it's also a reason to wonder if it could do it even better next time.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The best dark romance books to gingerly embrace right now

The best dark romance books to gingerly embrace right nowThe Week Recommends Steamy romances with a dark twist are gaining popularity with readers

-

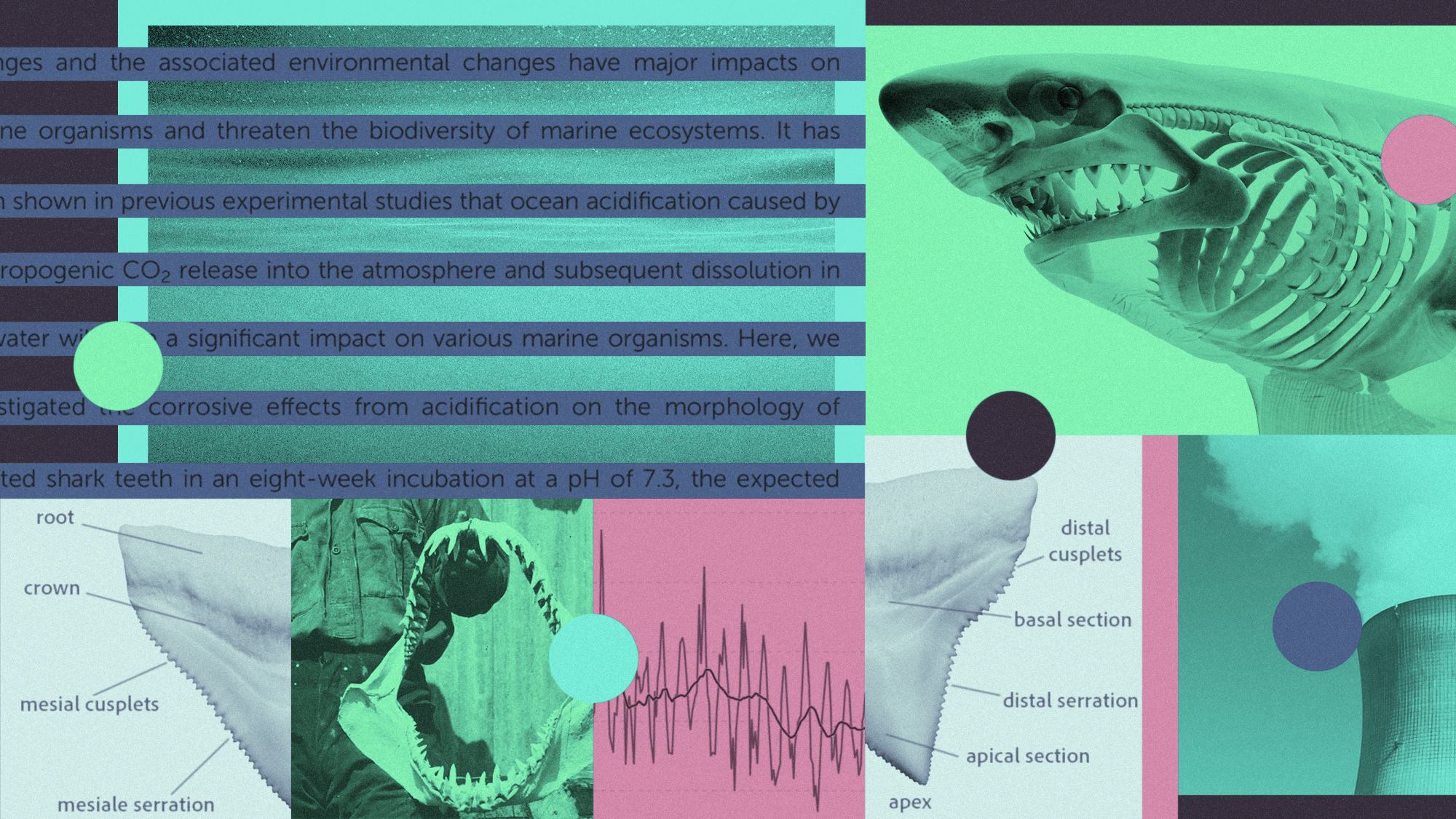

The ocean is getting more acidic — and harming sharks’ teeth

The ocean is getting more acidic — and harming sharks’ teethUnder the Radar ‘There is a corrosion effect on sharks’ teeth,’ a study’s author said

-

6 exquisite homes for skiers

6 exquisite homes for skiersFeature Featuring a Scandinavian-style retreat in Southern California and a Utah abode with a designated ski room