Why China will never be as rich as America

China's economic miracle has always been something of a mirage

What would the esteemed Chinese Professor make of China's currency devaluation and plunging stock market?

The fictional academic was the star of this fear-mongering viral ad — nearly three million YouTube views — made for the 2010 midterm elections by Citizens Against Government Waste.

In the year 2030, the Chinese Professor lectures his students on America's economic downfall: "America tried to tax and spend itself out of a great recession," he sneers, "Enormous so-called stimulus spending, massive changes to health care, government takeover of private industries, and crushing debt." And the kicker: Since China owned all that debt, it's now America's boss. Cackles all around.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Chinese Professor would actually make a great campaign ad for Donald Trump. As the billionaire businessman has put it, "This country is in big trouble. We don't win anymore. We lose to China. … We lose to everybody." America is a loser with stupid leaders. China is a winner with smart leaders. Only The Donald can save us of all from having to work for Beijing.

Maybe Trump is right about the quality of American politicians these days. But even so, America itself is doing kind of okay right now. The economy has generated nearly eight million net new jobs in the past three years. And job growth overall has been led by high-wage occupations, reports a new Georgetown University study. Sure, GDP growth has been slow, but there is good reason to believe government stats are missing the impact of the expanding digital economy. Silicon Valley remains white hot. Even the budget deficit is way down.

It's not a boom. It's certainly not some new golden age. But America is doing okay.

And China? Certainly most countries would be delighted to be growing at 7 percent a year, as China boasts it does. Those sorts of growth numbers are one big reason why a recent Pew study found "most people around the world continue to believe that China either will eventually replace or already has replaced the U.S. as the world's leading superpower." But many economists don't believe China's self-reported stats — probably even less so given the country's current troubles. And experts aren't so sanguine about China's economic direction. China needs growth. Although it may be the second-largest national economy, it is still a poor nation. China has reported disposable income per person — money in consumer pockets — of less than a tenth of America's. Just as important, the economy must become more productive and innovative to keep growing at a good clip. But one study suggests Chinese productivity actually declined from 2008 through 2012. This is a terrible omen for the prospects of future Chinese growth.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The odds are against China ever becoming a rich nation by U.S., European, or Japanese standards. Since World War II, South Korea is the only large country to get rich for the first time. Once promising up-and-comers like Argentina and Thailand have fallen victim to the "middle-income trap," stuck in an economic halfway house between poverty and first-world wealth. China is a likely addition to that list, according to my AEI colleague Derek Scissors:

It would not be unusual if there were cities in China with income levels similar to, say, France. It would be highly unusual for China as a whole to reach French levels of income. … The single most likely result is that China will share the fate of many other economies and fall far short of being wealthy. [AEI]

That's why the Chinese Professor ad was actually pretty stupid. It imagined an American economy that eventually loses out to China's because Uncle Sam embraces big government. But it is actually China that is increasingly favoring state intervention over market reforms as the path to greater national prosperity. And it isn't working out so well for them. China needs to shrink the state sector if it is to have any chance of generating broad-based wealth. And if a more market-driven capitalism drives a new era of economic growth for China, it also means a China where there is a lot more economic freedom — and probably political freedom, too — than exists today. And that would be a great thing for global prosperity and peace — not something for economic populists to rage against.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

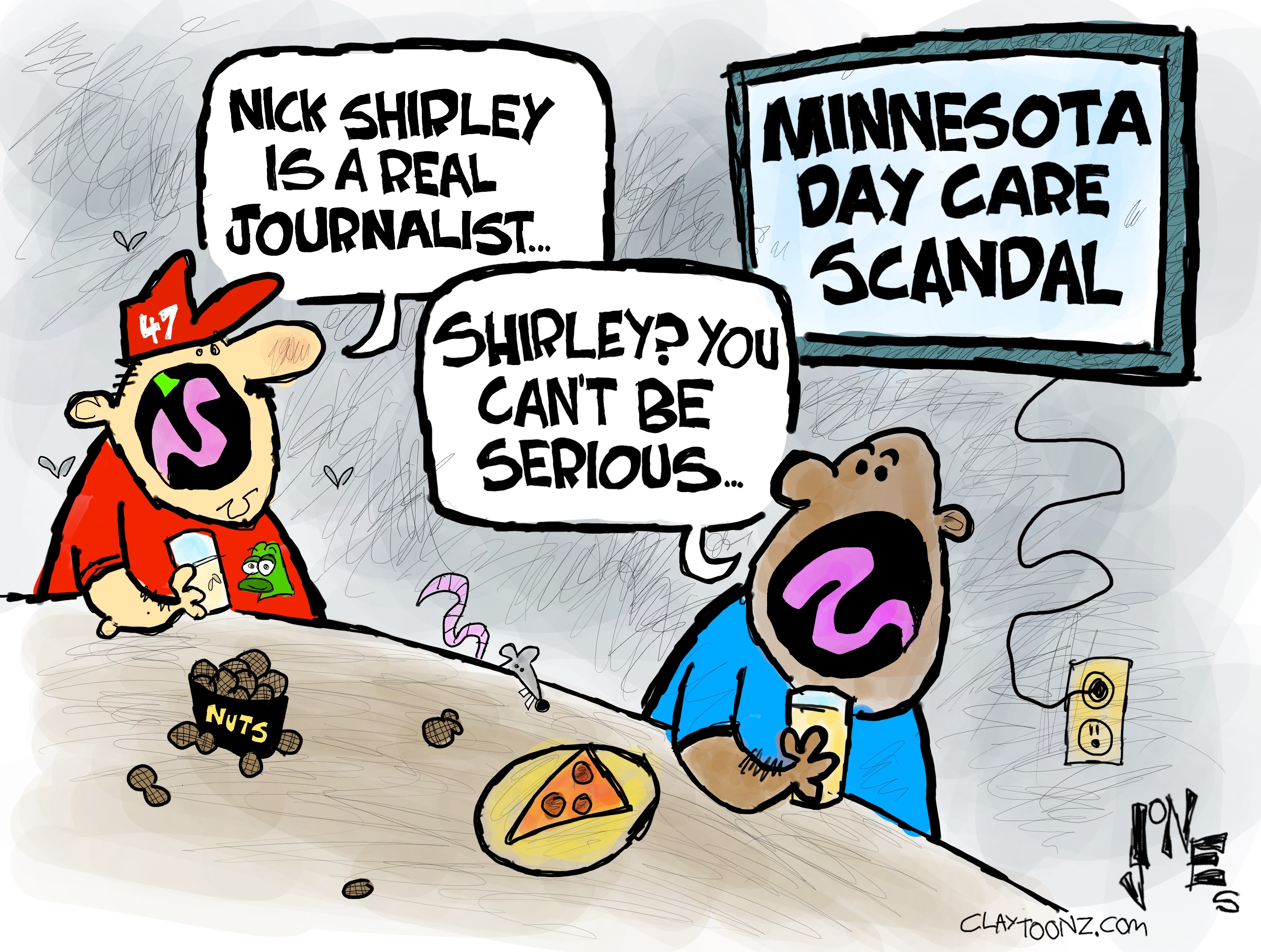

Political cartoons for January 3

Political cartoons for January 3Cartoons Saturday's political cartoons include citizen journalists, self-reflective AI, and Donald Trump's transparency

-

Into the Woods: a ‘hypnotic’ production

Into the Woods: a ‘hypnotic’ productionThe Week Recommends Jordan Fein’s revival of the much-loved Stephen Sondheim musical is ‘sharp, propulsive and often very funny’

-

‘Let 2026 be a year of reckoning’

‘Let 2026 be a year of reckoning’Instant Opinion Opinion, comment and editorials of the day