Here's the nerdiest reason for cheering Andrew Jackson's removal from the $20 bill

There are many reasons why this is a great move. But here's the nerdiest.

Andrew Jackson is set to be booted off the front of the $20 bill in 2020 — and replaced with none other than Harriet Tubman.

The announcement from Treasury Secretary Jack Lew turned heads on Wednesday: Tubman will be the first African-American, and only the third woman, to ever appear on U.S. currency.

Moreover, when the Treasury originally floated the redesign idea last year, Alexander Hamilton was going to be demoted from the $10 in favor of a woman. That plan sparked protests from a slew of Hamilton admirers. Replacing Andrew Jackson instead was the most oft-cited alternative: He was a plantation owner, a slave trader, and, as the seventh president of the United States, he forced the relocation and death of thousands of Native Americans. So axing him in favor of a more progressive and inclusive vision for America's currency seemed uniquely appropriate.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But if you're an economics nerd, there's yet another reason why striking Andrew Jackson from the $20 bill has a certain poetic resonance: Namely, the man hated paper money.

Jackson was a fan of the gold standard, where the supply of dollars in circulation is tied to the physical amount of gold the U.S. government has on hand. Jackson even passed a law at one point requiring people who bought government land to only pay for it with actual gold or silver coins. In 1836, he fought a successful battle to kill the Second Bank of the United States, a kind of precursor to our modern Federal Reserve. In so doing, Jackson drove the country off the bimetal standard it had been on (i.e. gold and silver) and onto the gold standard exclusively.

Our modern fiat currency system — where the supply of dollars isn't tied to anything, and is controlled by the government and its various organs, like the Fed — would have driven Jackson round the bend.

Unfortunately for him, anchoring the supply of the currency to some physical commodity like gold is a terrible idea. The advantage of a fiat currency is the supply of money can adapt to the needs of the moment: If the economy is sluggish or in recession, the supply can be increased to boost growth. If the economy is overheating and inflation is rising, the supply can be decreased to put on the brakes. But when the supply is fixed to some physical commodity like gold, however, the economy is forced to adapt to the supply of money. If there's not enough currency to match the amount of real goods and services being sold, for example, prices will be forced into a deflationary spiral and you'll get an economic contraction.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In fact, more than a few economists and historians argue Jackson's land purchase law and the death of the Second Bank of the United States set the stage for the Panic of 1837, a massive recession that lasted five years in some parts of the country.

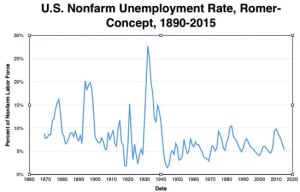

For all practical purposes, the U.S. got off the gold standard right after WWII. And if you look at historical data put together by economist Brad DeLong and a few others, you can literally see the economy pass out of a period of routine collapses and massive unemployment spikes, and into the modern era of comparatively stable and steady growth.

(Graph courtesy of Brad DeLong.)

You can see that even the Great Recession of 2008 paled in comparison to the kind of economic disasters that preceded this switch away from Jackson's preferred monetary system. It's yet another reason to cheer his removal from the $20.

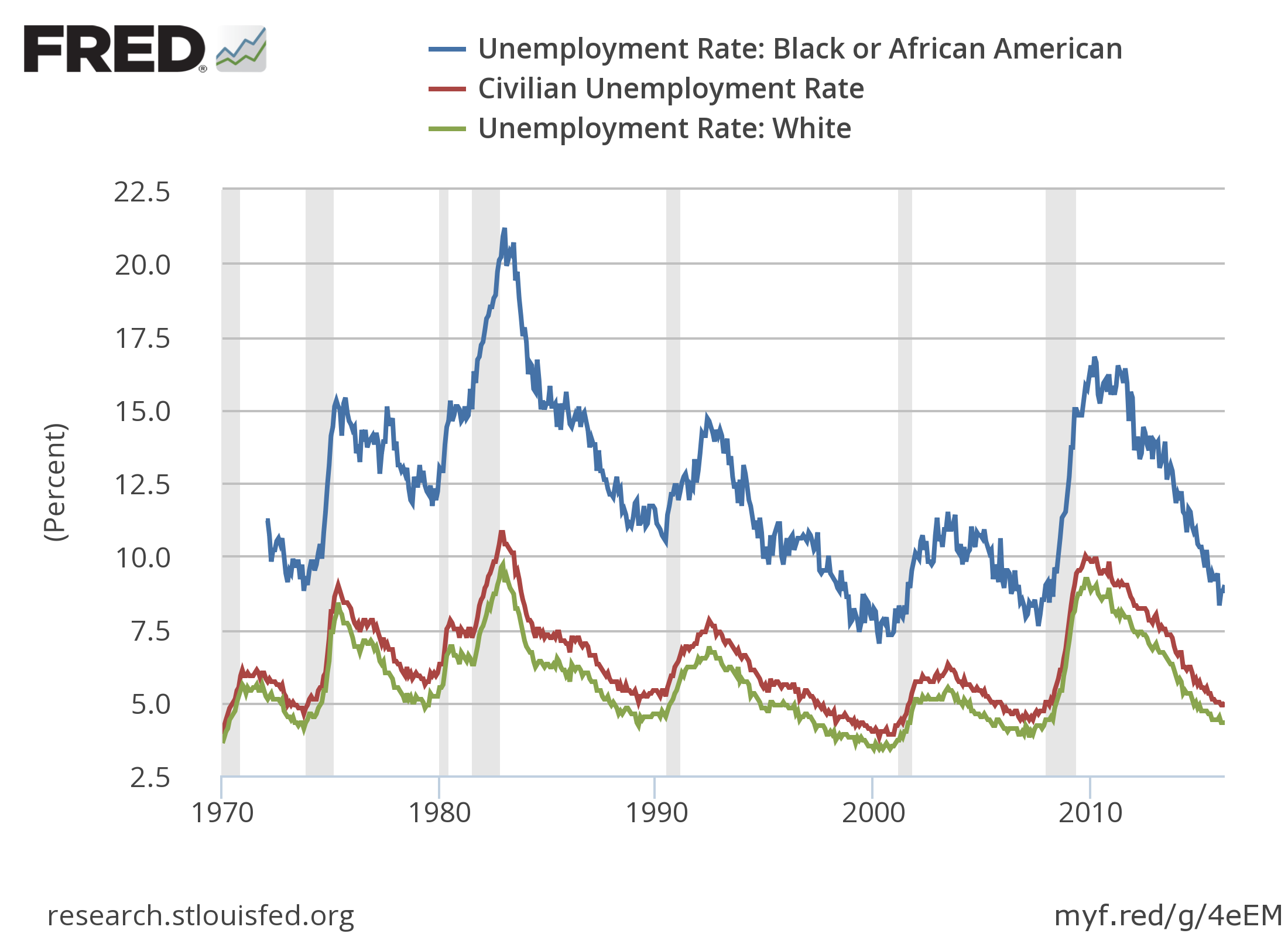

But now that our modern monetary system has given us more power to stabilize the economy, there's something else worth noting, too: Recessions have historically been far worse for African-Americans. The data only goes back to the 1970s, but their unemployment rate (the blue line below) has always been considerably higher than the national unemployment rate (the red line below). In contrast, the unemployment rate for white Americans (the green line below) has always been a hair lower than the national rate.

On the flipside, periods of healthier employment disproportionately benefit African-Americans and other groups more often pushed to the margins of the economy. Their hours increase more and their wages grow faster than more privileged workers; and as the national unemployment rate goes lower, the gap between it and the African-American unemployment rate shrinks.

That's why economists like Hyman Minksy argued that reaching and staying at an extremely low national unemployment rate — we're talking 2 or 3 percent here — should be a goal of national policy. Thanks to our fiat currency system, policymakers in Congress and at the Federal Reserve arguably have the tools to make that happen, should they so choose. It's not merely a matter of good technocratic economic management, but one of basic racial justice.

Perhaps having Harriet Tubman on the $20 will remind them of that.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Striking homes with indoor pools

Striking homes with indoor poolsFeature Featuring a Queen Anne mansion near Chicago and mid-century modern masterpiece in Washington

-

Why are federal and local authorities feuding over investigating ICE?

Why are federal and local authorities feuding over investigating ICE?TODAY’S BIG QUESTION Minneapolis has become ground zero for a growing battle over jurisdictional authority

-

‘Even those in the United States legally are targets’

‘Even those in the United States legally are targets’Instant Opinion Opinion, comment and editorials of the day

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy