Herbalife's 'pyramid scheme' problem

The Federal Trade Commission stopped just short of labeling Herbalife a flat-out pyramid scheme

The smartest insight and analysis, from all perspectives, rounded up from around the web:

"Judgment Day has come for Herbalife," said Michelle Celarier at New York. The Los Angeles–based seller of diet shakes, nutritional supplements, and other weight loss products last week agreed to pay $200 million in order to settle charges with the Federal Trade Commission, which stopped just short of labeling the business a flat-out pyramid scheme. The FTC, which has been investigating the multi-level marketing firm for the past two years, concluded that Herbalife "deceives" its more than 680,000 independent contractors in the U.S. by promising them they can quit their jobs and get rich quick by buying Herbalife products and reselling them to friends and acquaintances for a profit. "The truth is," said the FTC, "that the overwhelming majority of distributors...earn little or no money." More than half the distributors known as "sales leaders" make less than $5 a month, and many lose money. Those who do earn large sums make the bulk of their earnings from recruiting large numbers of new distributors, who are then required to purchase Herbalife products to sell.

Beyond its effect on Herbalife, this settlement ends a "Wall Street dogfight between two billionaire investors," said Matthew Goldstein and Alexandra Stevenson at The New York Times. Activist hedge funder Bill Ackman has for years lobbied regulators to crack down on Herbalife, famously shorting its stock by $1 billion in a bet that the company would be shut down for its "predatory" behavior. In response, famed investor Carl Icahn bought gobs of the company's stock, betting that it "would weather the regulatory scrutiny." At first glance, "it looks like Icahn came out on top," said Brooke Sutherland and Gillian Tan at Bloomberg. Herbalife shares jumped more than 20 percent after news broke that the FTC wouldn't be shutting down the firm completely. But Ackman "has reason to feel at least somewhat vindicated." Herbalife has agreed to completely revamp its business model — rewarding salespeople based on what they sell rather on how many people they recruit, with distributors having to prove with detailed records that 80 percent of their earnings come from retail sales.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"The FTC couldn't have been clearer that it thinks that Herbalife is a pyramid scheme, without actually using the words 'pyramid scheme,'" said Matt Levine, also at Bloomberg. So why did the regulator allow Herbalife to survive? The company's most believable defense may have been that many of its distributors aren't actually in it to make money, but to get discounts on Herbalife products for their own use. That could be true, but we'll see whether the company can continue to recruit new salespeople now that it's specifically barred from featuring "images of opulent mansions, private jets, and yachts" in its marketing materials. The rest of the multilevel marketing industry, including companies like USANA, Nu Skin, Amway, and Avon, has been watching warily, said Roger Parloff at Fortune. Already, the FTC is poised to issue new "guidance" for such companies based on this decision, perhaps including requirements to hand over records of sales. Herbalife may survive the new restrictions that have been imposed on it, but those same terms "would likely cripple, if not kill off, many of its competitors."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

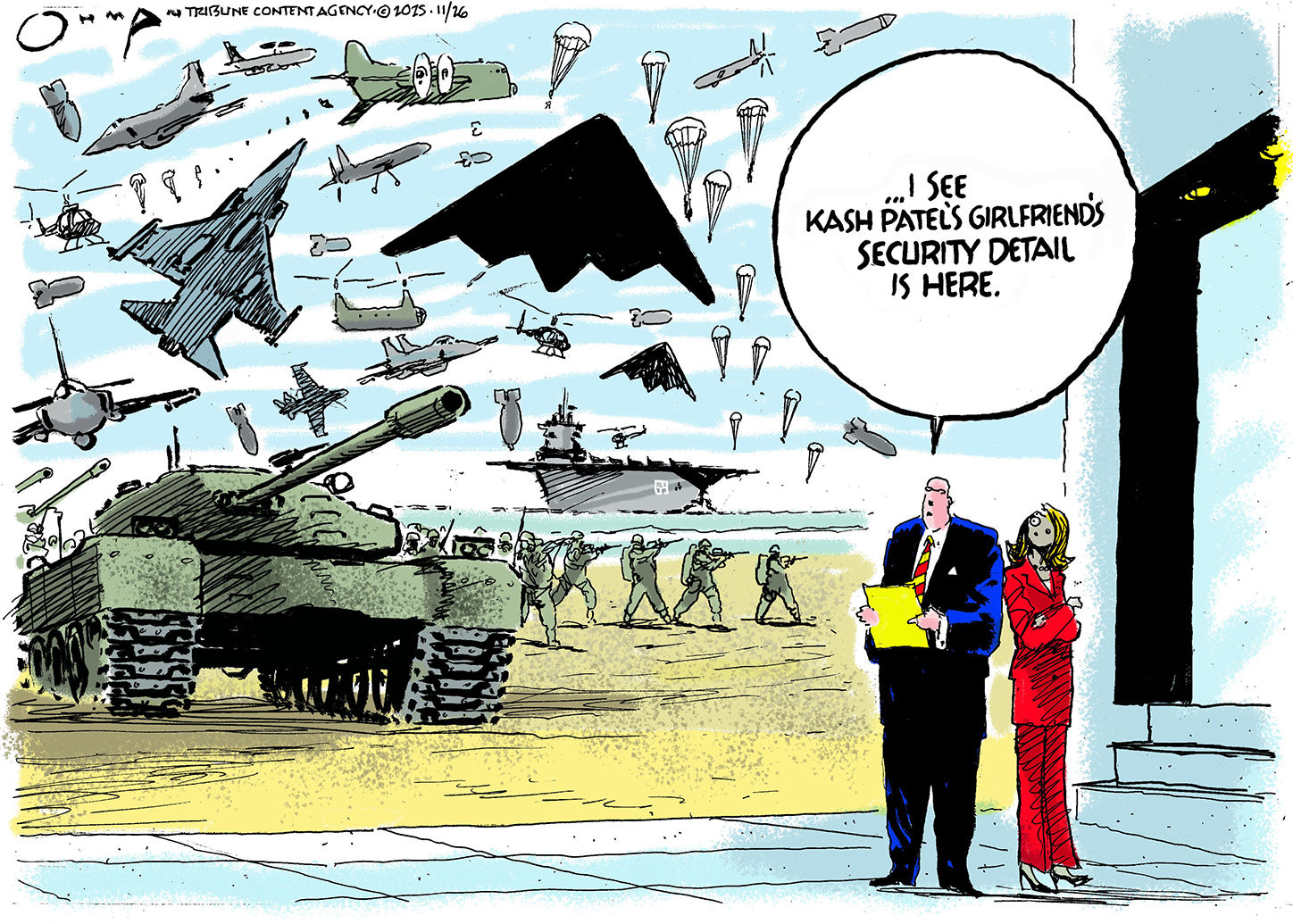

Political cartoons for November 29

Political cartoons for November 29Cartoons Saturday's political cartoons include Kash Patel's travel perks, believing in Congress, and more

-

Nigel Farage: was he a teenage racist?

Nigel Farage: was he a teenage racist?Talking Point Farage’s denials have been ‘slippery’, but should claims from Reform leader’s schooldays be on the news agenda?

-

Pushing for peace: is Trump appeasing Moscow?

Pushing for peace: is Trump appeasing Moscow?In Depth European leaders succeeded in bringing themselves in from the cold and softening Moscow’s terms, but Kyiv still faces an unenviable choice

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy