Who's getting rich in rural America?

Income in rural America is rising. But it comes with a big asterisk.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Census released data earlier this month showing remarkable gains in income and drops in poverty in 2015. But some reporters noticed that for rural areas specifically, the situation was reversed: The 2015 recovery was leaving rural America behind. This made immediate sense to a lot of reporters — including this one. Of course, as cities grew increasingly wealthy and desirable, they would attract job seekers from the countryside while pushing the poor farther afield.

Except the data was wrong.

The Census numbers were based on the Current Population Survey (CPS), which had significantly altered how it categorizes "rural" areas. The change dropped about six million people out of CPS's definition of "rural" between 2014 and 2015, making any comparisons between the two years completely apples-to-oranges. The Census itself included a caveat noting the change, but no one realized what was going on until the Center on Budget and Policy Priorities pointed it out.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Two days later, the Census released another report based on the American Community Survey (ACS). It didn't change its definition of "rural," and it boasts a far greater sample size. The ACS showed median household income rising 3.4 percent in rural areas and 3.6 percent in metro areas from 2014 to 2015. Poverty rates fell 0.9 percent and 0.8 percent, respectively.

On the surface, this seems like great news. Perhaps the economic recovery has been more widely shared after all! But this kind of thinking would be almost as misguided as the original error. The only thing the surveys tell us is that the economic split between the city and the countryside is not a tidy one.

First, these definitions are slippery: There are dense downtowns with skyscrapers; suburbs within commuting distance and suburbs that aren't; exurbs way out in wooded areas, but linked to metro systems; and honest-to-God farmland. Some of America's wealthiest counties actually lie in "rural" areas outside major cities like Washington, D.C., and New York. Poverty, long thought of as a city problem, really is being pushed to the suburbs as the educated upper class reclaims city cores. And poverty in white, non-metro areas is woefully under-discussed.

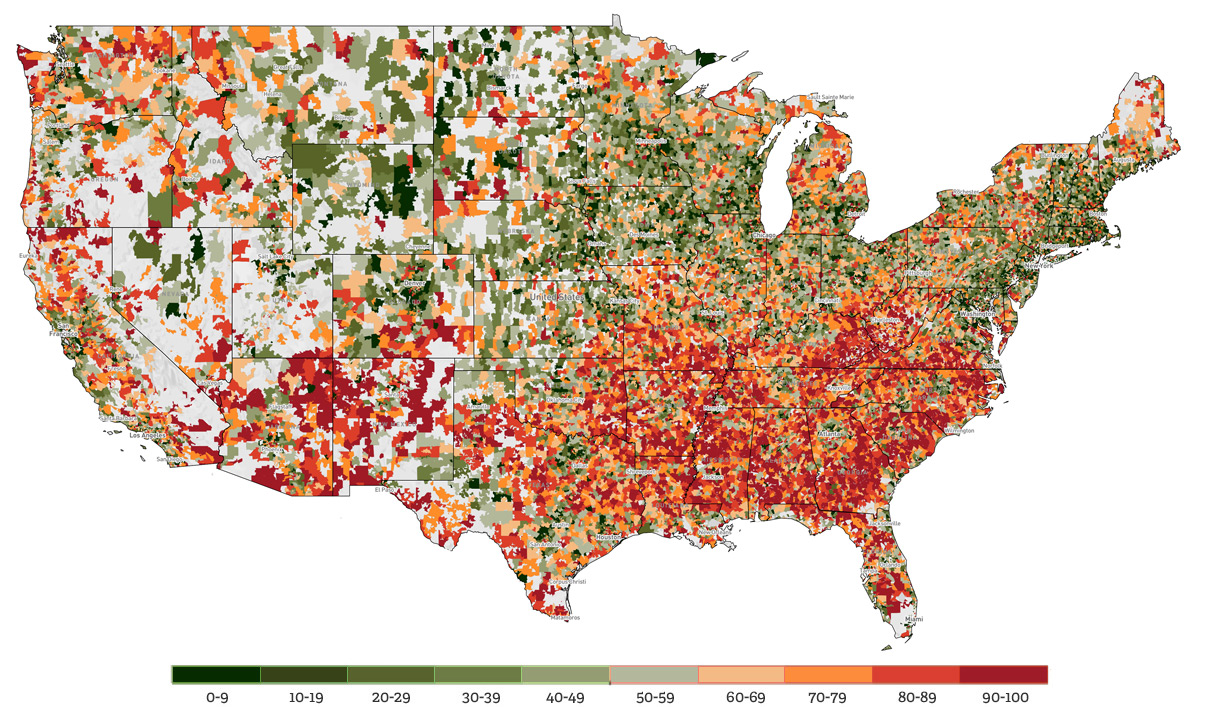

One study that can help untangle this was put together by the Economic Innovation Group. It combines rates of education, poverty, and unemployment with more esoteric measures, like how far an area's median income diverges from its state's median. Here's a map of their findings, with red indicating the most distressed areas and green the least.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Some of the healthiest regions can be found in the northeastern corridor from Washington, D.C., to New York City to Boston, which you'd expect. But zoom in on those cities themselves, and they have deep pockets of distress. The traditionally rural regions of the Midwest and the Mountain West are also pretty healthy. The most distressed regions sweep along both urban and rural areas in the South and Appalachia, and through New Mexico and Arizona. They're also found in the Rust Belt where the country's manufacturing base was hardest hit — but right alongside large areas that are doing fine.

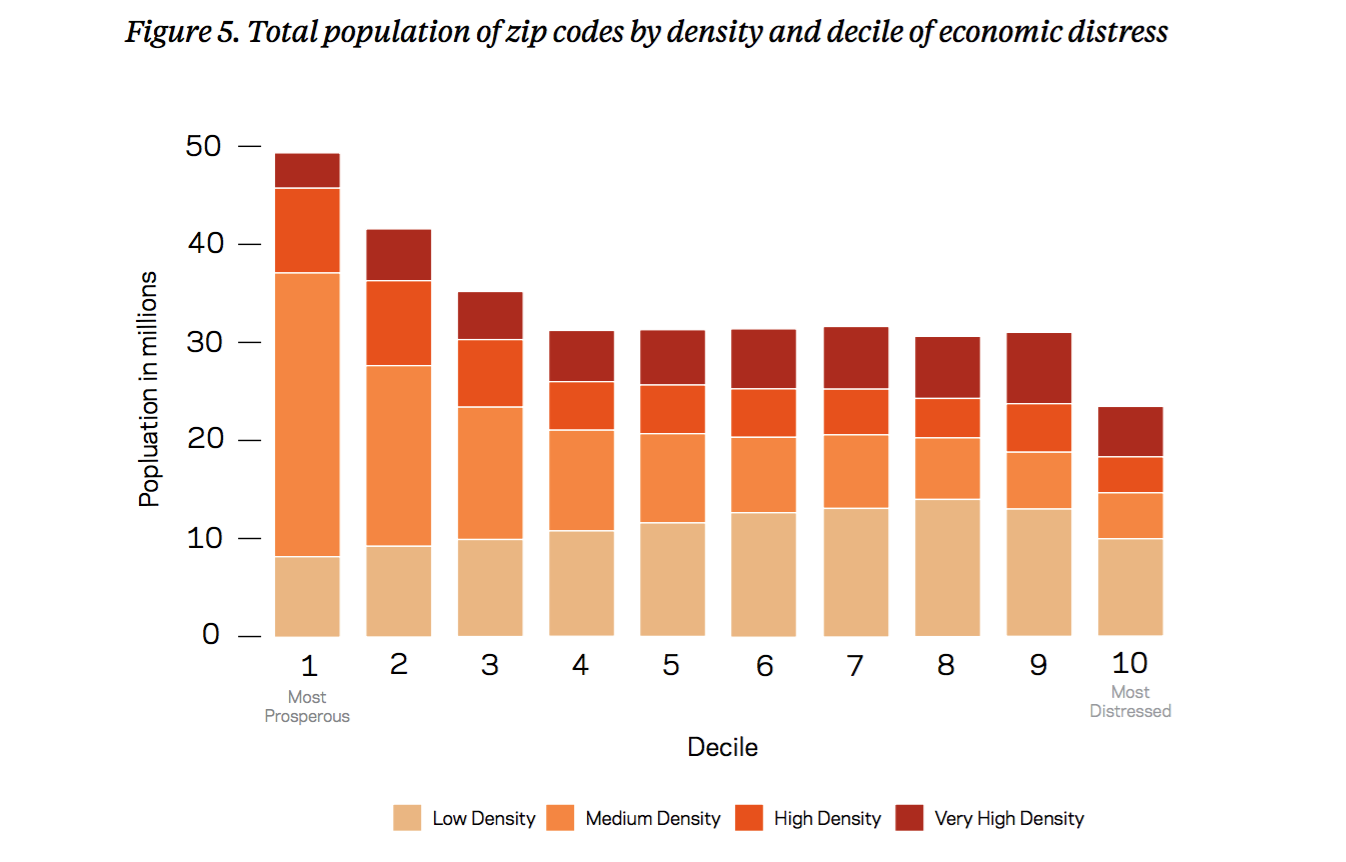

As a result, both the least and the most distressed areas include a healthy mix of the most and least densely populated zip codes:

The most distressed states were Appalachian and Southern: Tennessee, Kentucky, and South Carolina. The least distressed ran the gamut form North Dakota to Utah to Massachusetts. Major Rust Belt cities like Cleveland, Detroit and Newark are suffering, while others are doing pretty well.

Moreover, there can be a profound intimacy to the divergences. Many of the wealthiest zip codes sit within a few miles of the poorest. It's a far more granular divide than merely "the city versus the countryside." Yet economic growth isn't spilling over from healthy areas to help their neighbors. Why?

Alana Semuels recently published a smart piece in The Atlantic arguing the nature of modern finance is probably a big reason. Economics 101 says that money pouring into the financial markets should recirculate into new investments that create jobs and economic production. But since the 1980s, that recirculation has largely stopped. Corporate profits are still near record highs, so money is still pouring into finance — it's just not coming back out again. Investors now make their money by shuttling cash around financial markets. "The 10 states with the biggest jumps in the top 1 percent share from 1979 to 2007 were the states with the largest financial service sectors," Semuels observed.

This could also explain another oddity: The fact that almost all new job and business creation since the Great Recession was concentrated in highly populated areas. How could that be, if incomes grew in rural (i.e. low population) and urban (i.e. high population) areas alike?

Well, the Census' definition of income includes interest, dividends, capital gains, rents, and royalties — i.e. all forms of income people gain from owning financial securities or other forms of wealth. So a rural area of struggling Americans and a rural area of mostly upper-class types plugged into the financial markets could both see job and business creation in their communities drop. But the income of people in the second rural area could still be fine, because they're reaping the rewards of global finance. They might be hedge-fund managers sitting on vast acreage or retired lawyers who spent their nest egg on a chalet — but just like in cities, their lives are very far removed from the day-to-day struggles of their poorer neighbors.

In other words, the city and the country share something pretty big in common: income inequality.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.