Rothermere’s Telegraph takeover: ‘a right-leaning media powerhouse’

Deal gives Daily Mail and General Trust more than 50% of circulation in the UK newspaper market

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

“The Lords of England have stopped the barbarians at the gate of The Telegraph,” said Due Diligence in the Financial Times.

After a drawn-out sale, described as the “auction from hell”, the media group is set to end up in the hands of Lord Rothermere – owner and chair of Daily Mail and General Trust (DMGT), whose great-grandfather co-founded the Daily Mail in 1896. If the government and competition regulators clear the £500 million deal, “the tie-up will create one of the most powerful right-leaning media groups in Britain”.

The UK likes to present itself as “open for business”. Not in this case. For more than two years, ministers and the newspaper’s own reporters have “helped fend off potential buyers from New York to Abu Dhabi”. When Gerry Cardinale’s RedBird Capital withdrew earlier this month, it cleared the way for Rothermere to pounce.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It’s not clear how DMGT (which also owns Metro and The i Paper) will fund the deal, which will give it more than 50% of circulation in the UK newspaper market, said Dominic Ponsford in Press Gazette. But given that newspapers are “a far smaller part of the media than they were”, it’s unlikely to be blocked.

Plenty of Britons will have misgivings about the creation of “a right-leaning media powerhouse” when the populist Reform UK party is riding so high in the polls, said Bloomberg. But regulators should consider that the Telegraph has been “a stranded asset” for several years, said media analyst Claire Enders. “It’s a case of industrial logic”: there should be “operational synergies” of £40 million to £50 million annually. And after the spurning of so many foreign suitors, there’s also “a face-saving dimension to this deal”. As former FT editor Lionel Barber told The Guardian: “This is a very British stitch-up.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Media: Why did Bezos gut ‘The Washington Post’?

Media: Why did Bezos gut ‘The Washington Post’?Feature Possibilities include to curry favor with Trump or to try to end financial losses

-

Jeff Bezos: cutting the legs off The Washington Post

Jeff Bezos: cutting the legs off The Washington PostIn the Spotlight A stalwart of American journalism is a shadow of itself after swingeing cuts by its billionaire owner

-

The Washington Post is reshaping its newsroom by laying off hundreds

The Washington Post is reshaping its newsroom by laying off hundredsIn the Spotlight More than 300 journalists were reportedly let go

-

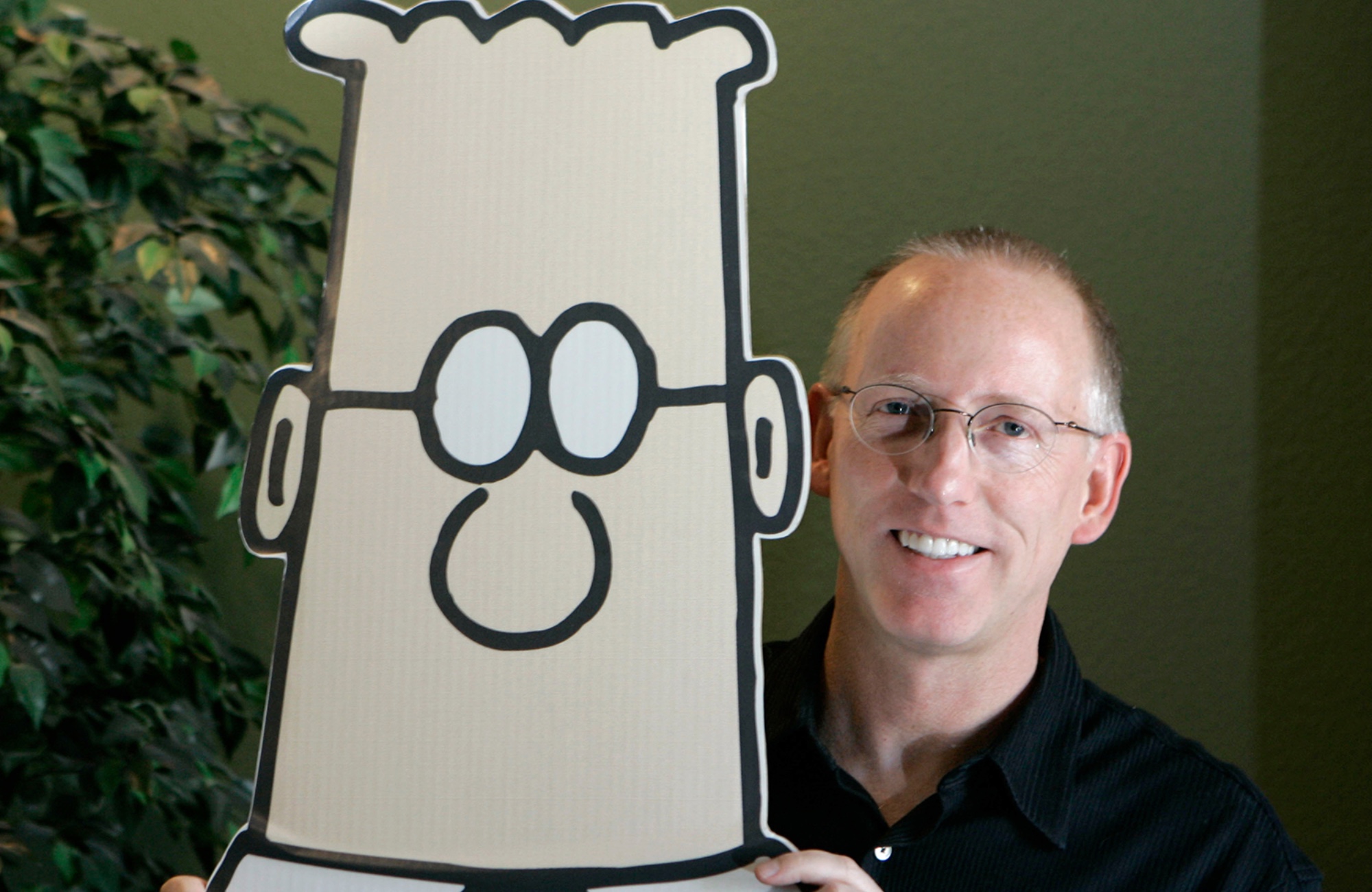

Scott Adams: The cartoonist who mocked corporate life

Scott Adams: The cartoonist who mocked corporate lifeFeature His popular comic strip ‘Dilbert’ was dropped following anti-Black remarks

-

Why is the Pentagon taking over the military’s independent newspaper?

Why is the Pentagon taking over the military’s independent newspaper?Today’s Big Question Stars and Stripes is published by the Defense Department but is editorially independent

-

‘Netflix needs to not just swallow HBO but also emulate it’

‘Netflix needs to not just swallow HBO but also emulate it’instant opinion Opinion, comment and editorials of the day

-

The best tabloid stories of 2025

The best tabloid stories of 2025In the Spotlight From a child named after the devil to a pothole-based theme park, some strange stories hit the headlines this year

-

Paramount fights Netflix for Warner as Trump hovers

Paramount fights Netflix for Warner as Trump hoversSpeed Read Paramount Skydance is seeking to undo Netflix’s purchase of Warner Bros. Discovery