Trump's tax plan that wasn't

The president' tax plan isn't really a tax plan. It's a one-pager of bullet points. There's a difference.

The biggest problem with President Donald Trump's new tax plan is that he still doesn't have one. Not really.

What Treasury Secretary Steven Mnuchin and economic adviser Gary Cohn presented Wednesday was really more of a synopsis of a summary of a sketch of some old campaign ideas, with a few (far too few) numbers thrown in.

All in all, the "2017 Tax Reform for Economic Growth and American Jobs Act" might have been an okay campaign document in the summer of 2015, but falls far short of a serious proposal now that Trump is sitting in the Oval Office. And to think that not long ago Trump advisers wanted their boss to sign a tax bill by August of his first year in office, just like Ronald Reagan did in 1981. Now August 2018 looks more realistic.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But even considered as Trump's opening bid, the one-pager represents a missed opportunity for deep reform to the U.S tax code. Republicans keep saying their top priority is passing policies that accelerate the pace of economic growth. And, indeed, if the American economy has any chance of growing as fast in the future as it has in the past, it will need a better, more efficient, pro-investment tax code. But also one that raises enough revenue to meet government's social insurance obligations.

But that's not the reality of Trump's initial offer. Sure, it lowers the top corporate tax rate from 35 percent to 15 percent. The steep reduction would, for instance, reduce the incentive for companies to invest overseas and earn profits there rather than here. All else equal, such a rate reduction might modestly boost the economy's long-term growth potential.

But the tax cut is also the centerpiece of a plan that would almost certainly increase the federal budget deficit by several trillion dollars over a decade. Not assuming any faster growth, the tax cuts — including personal rate reductions and repeal of the estate and alternative minimum taxes — look like they might lose $5.5 trillion, according to an analysis by the Committee for a Responsible Federal Budget. Even the most aggressive "dynamic scoring" models won't show the plan generating enough economic growth to pay for itself.

That 15 percent headline rate is sure to rise as negotiations commence, undoing some of its pro-growth impact. (Something around 25-ish percent is what Wall Street is looking for.) At the same time, there is nothing in the outline — unlike in the House GOP tax reform plan — about allowing the cost of new capital investment to be fully and immediately deductible. That's too bad. Models that dynamically score the economic feedback of tax plans, such as the Tax Foundation's, find such immediate expensing to be one of the growthiest things tax reformers can do.

So what Trump has done is offered a cobbled-together, detail-light plan that is sub-optimal for growth while also managing to generate a tidal wave of red ink. As a final legislative product, congressional Republicans would certainly be right to ask themselves if such tax reform was really worth doing at all. Maybe focus on health care or start on education reform. And of course Democrats will hate this plan given that it lowers tax rates for corporations and wealthier Americans. Surely some Democrats will notice that Trump would return the top individual rate to where it was under George W. Bush, a presidency few remember as a golden age for American workers.

Had Trump taken economic policy more seriously during the campaign, he might have had a more detailed and coherent plan ready to go at this point. Sure, slash corporate taxes, but do so in a fiscally responsible manner. My AEI colleague Alan Viard has a co-authored a plan offsetting such a deep rate cut by raising taxes on dividends and capital gains received by American shareholders. Smart reform would also scale back or eliminate economy-distorting tax breaks, like that for home mortgage interest.

To his credit, one big provision Trump does want to repeal is the one which allows individuals to deduct state and local taxes. Blue-staters, Democrat and Republican, will scream, of course. If it happens. Because it might not. Not any of it, actually. Because a one-page list of bullet points isn't a plan.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

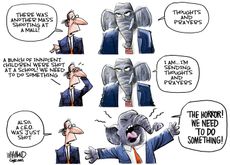

Today's political cartoons - December 18, 2024

Today's political cartoons - December 18, 2024Cartoons Wednesday's cartoons - thoughts and prayers, pound of flesh, and more

By The Week US Published

-

Honda and Nissan in merger talks

Honda and Nissan in merger talksSpeed Read The companies are currently Japan's second and third-biggest automakers, respectively

By Peter Weber, The Week US Published

-

Luigi Mangione charged with murder, terrorism

Luigi Mangione charged with murder, terrorismSpeed Read Magnione is accused of murdering UnitedHealthcare CEO Brian Thompson

By Peter Weber, The Week US Published

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

By Peter Weber Published

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

By Brendan Morrow Published

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

By David Faris Published

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

By The Week Staff Published

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

By Tonya Russell Published

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

By Noah Millman Published

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

By The Week Staff Published

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy

By Jeff Spross Published