Don't be fooled: Republicans aren't simplifying the tax code

In fact, if your taxes get any simpler under the GOP tax bill, it's probably because you're paying more

Ask Paul Ryan why the Republican tax plan is so terrific and there's a good chance he'll reach into his pocket and pull out a postcard. It's one the Republicans had printed up to communicate the powerful message that once they're done simplifying the tax code, you'll be able to file your taxes on a postcard! This visual is so compelling that when they gave one to President Trump, he was so overwhelmed by his passion for tax simplification that he kissed the card.

But I have some bad news: No matter how many times Ryan says it, it isn't true. The tax bill Republicans are working to pass won't simplify our extremely complex tax code, and it won't allow you to file your taxes on a postcard.

Actually, you can already (almost) file your taxes on a postcard, if you have very simple finances; the 1040EZ form is still just one page. And many countries use a system in which most people don't even have to file returns; since the government already knows what you made, it sends you what it thinks you owe (or what it owes you), and if you think it's not right you can correct it. Some people have tried to bring that system to the U.S., but they've been defeated by a lobbying partnership of the tax software companies and conservative anti-tax activists who worry that if paying taxes was too easy, people might not hate it.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But isn't the Republican plan going to fix that? It does eliminate some deductions, that's true. Depending on whether you take those deductions, you may find your taxes a little simpler — but if you do, it's because your taxes are probably being raised.

For instance, if you're someone with significant health-care expenses — let's say because you have a family member with a disability — the good news is you won't have to gather up all your receipts and count up how much you spent on health care this year, which could save you as much as an hour when you're making your way through your tax software. The bad news is that you won't be able to deduct those expenses (depending on which version of the tax bill finally gets passed), which could mean your tax bill will go up by thousands of dollars. Ditto for your state and local taxes: Congratulations on not having to enter them into your tax software; sorry that you won't be able to deduct them anymore.

The truth is that the "simplification" represented by the elimination of those deductions is miniscule — and at the same time, Republicans are adding complication to the code. One big way is with the gigantic loophole they want to open up with "pass-through" income. Right now, most businesses are organized as pass-throughs, meaning the profits go directly to a person or group; they pay taxes on that income at the regular individual rates. But because Republicans want to give special privileges to pass-through income, they'll create a gigantic incentive to classify all kinds of work as a pass-through. There will be a whole new avenue for tax avoidance for anyone (especially the wealthy) who can find creative ways to take advantage of this loophole.

To deal with that, Republicans have proposed a three-part rate structure depending on what sort of relationship the person has to the business, with rates phasing in and out over time (see this chart for a sense of it). Does that sound like it's getting simpler, or more complex?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

And that's before we even get to the corporate side, which is where the real complexity in the tax code comes. That code was written in large part by corporate lobbyists crafting carve-outs and exceptions and loopholes and credits, all so that their clients wouldn't have to pay taxes. And guess what? Those lobbyists are scurrying through the halls of Capitol Hill at this very moment, making sure that their favored provisions survive. While there may be a few corporate deductions that are modified or eliminated, most of that complex latticework of loopholes will remain in place.

There's one other thing to consider as well. The last time we undertook a large tax reform, it was negotiated with both parties over the course of a couple of years, with extensive public hearings — the House Ways and Means Committee heard from over 450 witnesses. As complicated as it was, both those who were voting on it and the public at large at least had the opportunity to understand what it did.

This time, though, Republicans are pushing their tax bill through with almost no public hearings, and all in the matter of a couple of weeks. As one budget analyst wrote me in an email, "the rush to pass the bill means that all of these implications are poorly understood by the public and by legislators, leaving the possibility that there are new loopholes and opportunities for avoidance that we don't even yet understand."

There are ways we could simplify taxes if that's what we really wanted — for instance, we could tax all income the same, no matter where it comes from. Right now we have different rate schedules for wage income, investment income, inheritance income — and Republicans want to create yet another system for pass-through income, which would get an entirely new set of rates. The principle currently embodied in the code is that money you work for should be taxed at the highest rate, while money you got because your money made you more money should be taxed at a lower rate. If the GOP has its way, the most honored form of income will be inheritance, or money you got because somebody died and gave it to you, which wouldn't be taxed at all.

If we taxed all income the same, we wouldn't have to worry about any of those distinctions. Income would be income. Wouldn't that be simpler and fairer? Yes it would. But if you think simplicity or fairness have anything to do with the "reform" effort that's happening now, Republicans have fooled you in just the way they wanted to.

Paul Waldman is a senior writer with The American Prospect magazine and a blogger for The Washington Post. His writing has appeared in dozens of newspapers, magazines, and web sites, and he is the author or co-author of four books on media and politics.

-

Syria’s Kurds: abandoned by their US ally

Syria’s Kurds: abandoned by their US allyTalking Point Ahmed al-Sharaa’s lightning offensive against Syrian Kurdistan belies his promise to respect the country’s ethnic minorities

-

The ‘mad king’: has Trump finally lost it?

The ‘mad king’: has Trump finally lost it?Talking Point Rambling speeches, wind turbine obsession, and an ‘unhinged’ letter to Norway’s prime minister have caused concern whether the rest of his term is ‘sustainable’

-

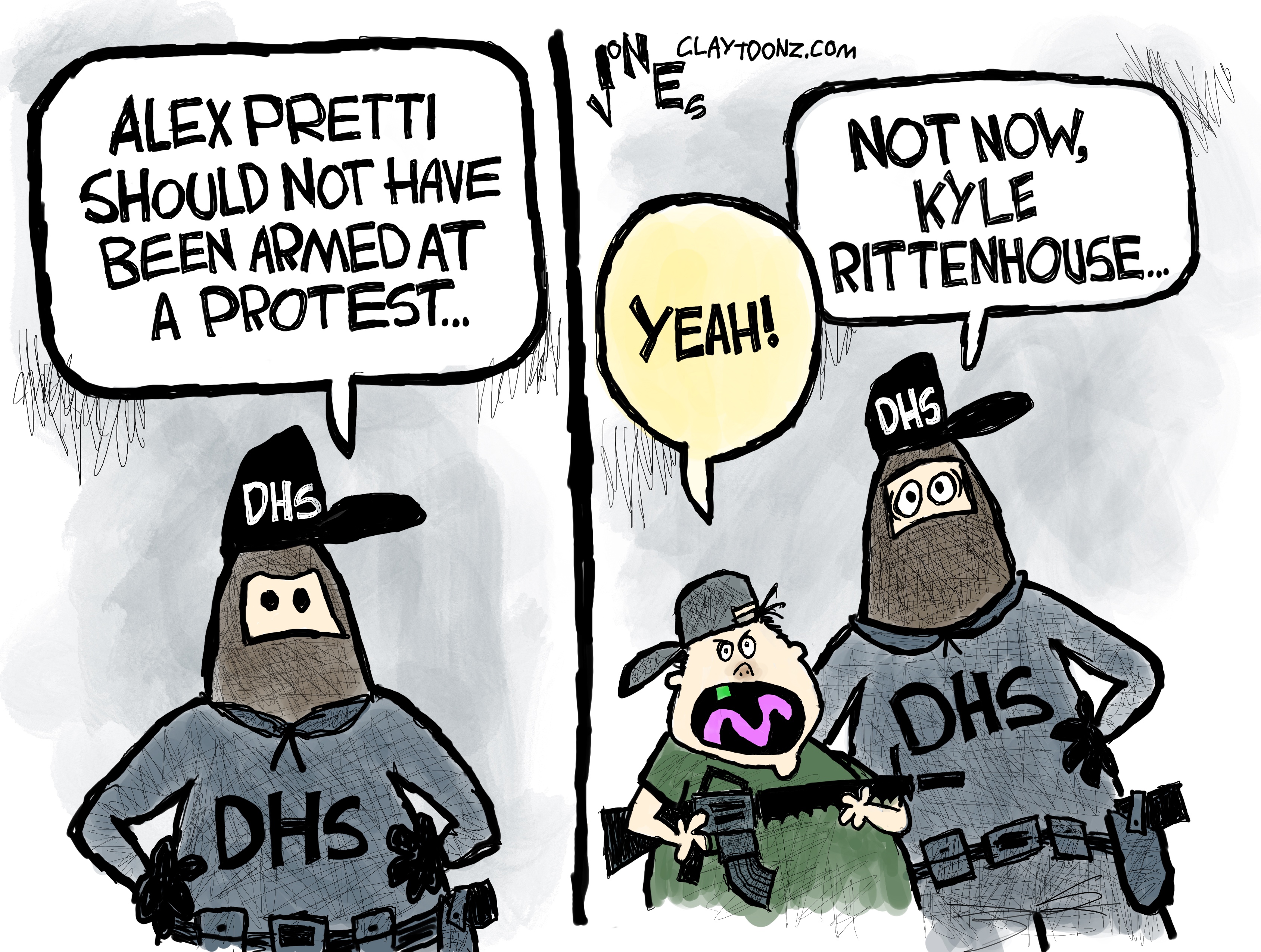

5 highly hypocritical cartoons about the Second Amendment

5 highly hypocritical cartoons about the Second AmendmentCartoons Artists take on Kyle Rittenhouse, the blame game, and more

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred