The end of bitcoin

This is how bitcoin ends, not with a bubble, but with a regulatory crackdown

The bitcoin boom may be over. And the death of the cryptocurrency craze may well come at the hands of government regulators.

Earlier this week, Bloomberg reported that Chinese authorities plan to block domestic access to central cryptocurrency trading platforms and related services. Subsequent stories suggested officials in Russia and South Korea might pull similar moves.

In response, the price of a single bitcoin — the world's premiere digital currency — has plummeted. Over the weekend, bitcoins were valued at nearly $14,500. That price tag plunged below $9,500 on Wednesday, before bouncing back Thursday — though still only to $12,000. Worse still, bitcoin has been on a slow slide since December, when it topped out at almost $20,000 per coin.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Is the bubble really bursting? Only time will tell. But if China and other governments really do crack down on cryptocurrencies, it's hard to see much of a future for bitcoin.

China's government actually already banned official cryptocurrency exchanges late last year. What's new is a potential crackdown on unofficial homegrown trading and offshore trading as well. Similar reports of a coming reckoning surfaced from state-run Chinese media as well. Reuters even reported on a meeting of Chinese financial and regulatory authorities, where one central banker argued that all centralized trading of digital currencies by individuals and businesses should be banned.

On Tuesday, Russian President Vladimir Putin said that "legislative regulation [of cryptocurrencies] will be definitely required in [the] future." And on Thursday, South Korean officials said they were considering following China's lead, and shutting down crypotcurrency trading via exchanges.

Some of the resulting selloff was clearly a news-induced panic. But the news also landed right in the middle of what is pretty obviously a massive bitcoin bubble. The digital currency rocketed from around $900 in December 2016 to almost $20,000 in December 2017. Then it fell around 40 percent in a month.

Something like 15 percent of all bitcoin trading reportedly occurs in South Korea. Meanwhile, around 58 percent of all bitcoin mining occurs in China. Snuffing out trading in either country, but in China especially (never mind both), could be devastating to the bitcoin market and its investors.

All of this ultimately points back to a question that has never really been answered well: What the hell is bitcoin for?

To really work as money, bitcoin needs to be widely used. There need to be lots of actors providing a wide array of goods and services who are all willing to take bitcoin as payment.

But why would anyone use it? Contrary to the libertarian romanticism that inspired bitcoin's creation, most Western fiat currencies work really well as money. There's no need for most businesses to saddle themselves with bitcoin's extra headaches. It doesn't offer the speed or convenience of standard mainstream payments systems like credit cards or PayPal. And bitcoin's volatility and the extreme run-up in its price have made transaction fees highly volatile and expensive.

To find a devoted economy, bitcoin needs to stabilize in value. To stabilize in value, bitcoin needs a devoted economy. It's a bit of a catch-22.

The final use of bitcoin and other cryptocurrencies, of course, is to evade government oversight and dodge law enforcement. Which brings us back to China, Russia, South Korea, and their possible crackdowns.

There are plenty of governments in the world that deserve to be evaded. But they generally do not like being evaded. Especially more authoritarian ones like China or Russia. Not only can they kill trading of a cryptocurrency within their borders, they can use their power over other payment systems — the legal and mainstream ones — to cut off all the access points where a cryptocurrency is converted into any other currency.

If that happened, bitcoin could (maybe) still survive in the shadows. But only if it fixed all the problems that prevent it from functioning as money. That would require a cryptocurrency based on design philosophies unlike any we've seen so far.

As a boutique investment asset, bitcoin can really only survive as long as governments tolerate its presence. If governments cut them off, bitcoin and its fellow digital currencies have no other home to retreat to.

No wonder bitcoin investors are having a panic attack.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Today's political cartoons - April 19, 2025

Today's political cartoons - April 19, 2025Cartoons Saturday's cartoons - free trade, judicial pushback, and more

By The Week US

-

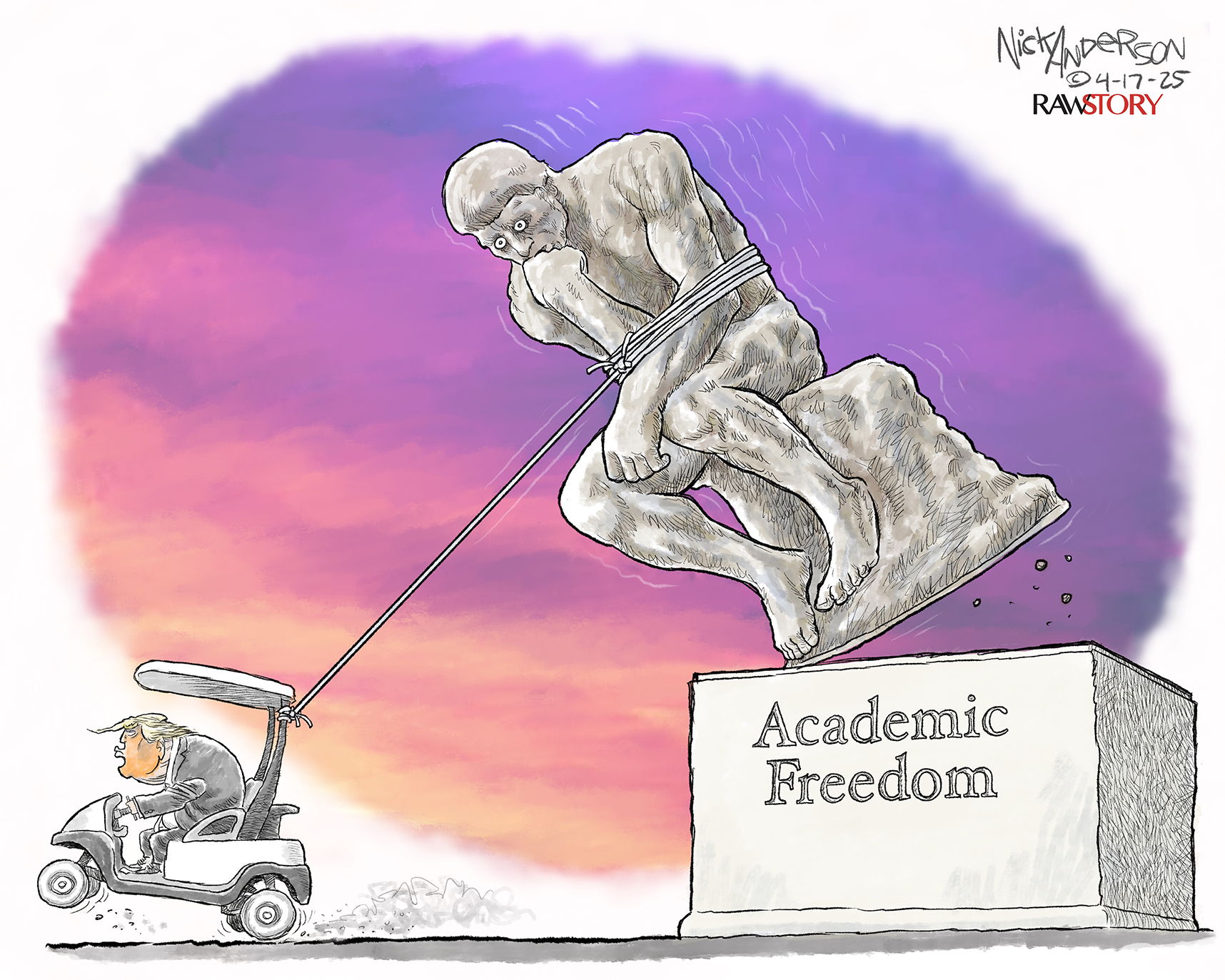

5 educational cartoons about the Harvard pushback

5 educational cartoons about the Harvard pushbackCartoons Artists take on academic freedom, institutional resistance, and more

By The Week US

-

One-pan black chickpeas with baharat and orange recipe

One-pan black chickpeas with baharat and orange recipeThe Week Recommends This one-pan dish offers bold flavours, low effort and minimum clean up

By The Week UK

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

By Peter Weber

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

By Brendan Morrow

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

By David Faris

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

By The Week Staff

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

By Tonya Russell

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

By Noah Millman

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

By The Week Staff

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy

By Jeff Spross