America's raggedy economic fundamentals

Everyone claims the economy has 'strong fundamentals' despite the volatile stock market. Everyone is wrong.

What on Earth is happening to the stock market? The business world was riveted Monday by a good old-fashioned crash, as the Dow Jones Industrial Average plunged by over 1,100 points. Then it was captivated Tuesday by a good old-fashioned rally, when the Dow surged to close up 568 points.

Americans, still scarred by the 2008 crash, have watched these wild swings with trepidation. Are these the first tremors of another market collapse?

Nobody knows for sure. But like clockwork, uncertain stock market news prompted the classic incantation from nervous business analysts and politicians about strong "fundamentals." The White House issued a statement reading, "The president's focus is on our long-term economic fundamentals, which remain exceptionally strong, with strengthening U.S. economic growth, historically low unemployment, and increasing wages for American workers."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

We can't predict the next crash with any certainty. But we can say the fundamentals are not strong.

As John Kenneth Galbraith famously noted in his book The Great Crash, the simple invocation of "strong fundamentals" itself bodes deeply ill. It's what business conservatives always say before the bottom falls out from under everything. It's what John McCain said in 2008, and it's what Irving Fisher said in 1929. As Galbraith advised, "All who hear those words should know that something is wrong."

Galbraith explained the motivation behind these statements:

In Wall Street, as elsewhere, there is deep faith in the power of incantation. When the market fell [in 1929] many Wall Street citizens immediately sensed the real danger, which was that income and employment — prosperity in general — would be adversely affected. This had to be prevented. Preventive incantation required that as many important people as possible repeat as firmly as they could that it wouldn't happen. This they did. They explained how the stock market was merely the froth and the real substance of economic life rested in production, employment, and spending, all of which would be unaffected. No one knew for sure that this was so. [The Great Crash]

Again, it's anybody's guess what will happen in the short term. But America has a few profound structural defects in its economy that anyone can see.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

1. Inequality. Galbraith identified the "bad distribution of income" as a major factor behind why the Great Depression was as bad as it was. Because rich people consume a smaller fraction of their income, a very unequal economy must be propped up by some combination of heavy investment or a giant luxury goods market. Both of these tend towards more violent swings than mass consumption, and thus raise the possibility of a crash. Moreover, inequality also saps the incentive to invest, because mass-market products will be harder to sell. Why build a big new factory if people don't have the money to buy the product? And indeed, corporations today are investing at quite low levels, especially relative to the massive profits they have been raking in for the last decade.

Today, income inequality is very nearly as bad as it was in the late 1920s.

2. Household indebtedness. This is very largely a product of the first factor. One way to reconcile the drag inequality has on aggregate demand is by consumer borrowing. With credit cards, home equity loans, and other such devices, the broad population can continue to consume without increased wages. But obviously, that can only continue for so long. When a crash does happen, the resulting downturn will be much worse, as everyone tries to pay off their debts at once and sucks demand out of the economy.

Today, total household debt has finally exceeded its pre-crisis levels. The household debt-to-GDP ratio is not as high as it was at the peak of the bubble, having fallen from about 95 percent to hovering around 80 percent since 2014. However, that's still far above the pre-bubble figure of about 65 percent. What's more, today debt is more heavily concentrated on young people graduating from college with massive student loan burdens — which is not dedicated towards purchasing an asset that might appreciate, unlike home loan debt. Millennials are struggling to stay above water, not entering their prime of life with lots of disposable income.

3. Corporate corruption. America has had a galloping case of white-collar crime since at least the second Bush administration. Under President Obama, big Wall Street banks got what amounted to a license to commit crimes, and took full advantage of it. Now under President Trump, Wall Street scam artists are actually running the government. Indeed, the tireless investigative reporters at the Capitol Forum have been racking up story after story of price abuse, swindles, government rip-offs, and on and on. Practically every day there is another staggering case of some manner of fraud, legal or otherwise.

Criminals are not involved in real economic production; instead they suck the value out of others. To the extent that American businesses are essentially parasites, the actual value-producing parts of the economy will be undermined.

All in all, this is not a picture of a fundamentally strong economy. It's a picture of one that was never remotely healed after the last crisis, that is carrying a giant tumor in the form of a bloated and crime-ridden financial sector and a huge gut in the form of the top 1 percent, and whose bones and muscles — its people and basic infrastructure — have been neglected for decades. I would not be confident of its ability to withstand financial shocks.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

6 exquisite homes for skiers

6 exquisite homes for skiersFeature Featuring a Scandinavian-style retreat in Southern California and a Utah abode with a designated ski room

-

Film reviews: ‘The Testament of Ann Lee,’ ’28 Years Later: The Bone Temple,’ and ‘Young Mothers’

Film reviews: ‘The Testament of Ann Lee,’ ’28 Years Later: The Bone Temple,’ and ‘Young Mothers’Feature A full-immersion portrait of the Shakers’ founder, a zombie virus brings out the best and worst in the human survivors, and pregnancy tests the resolve of four Belgian teenagers

-

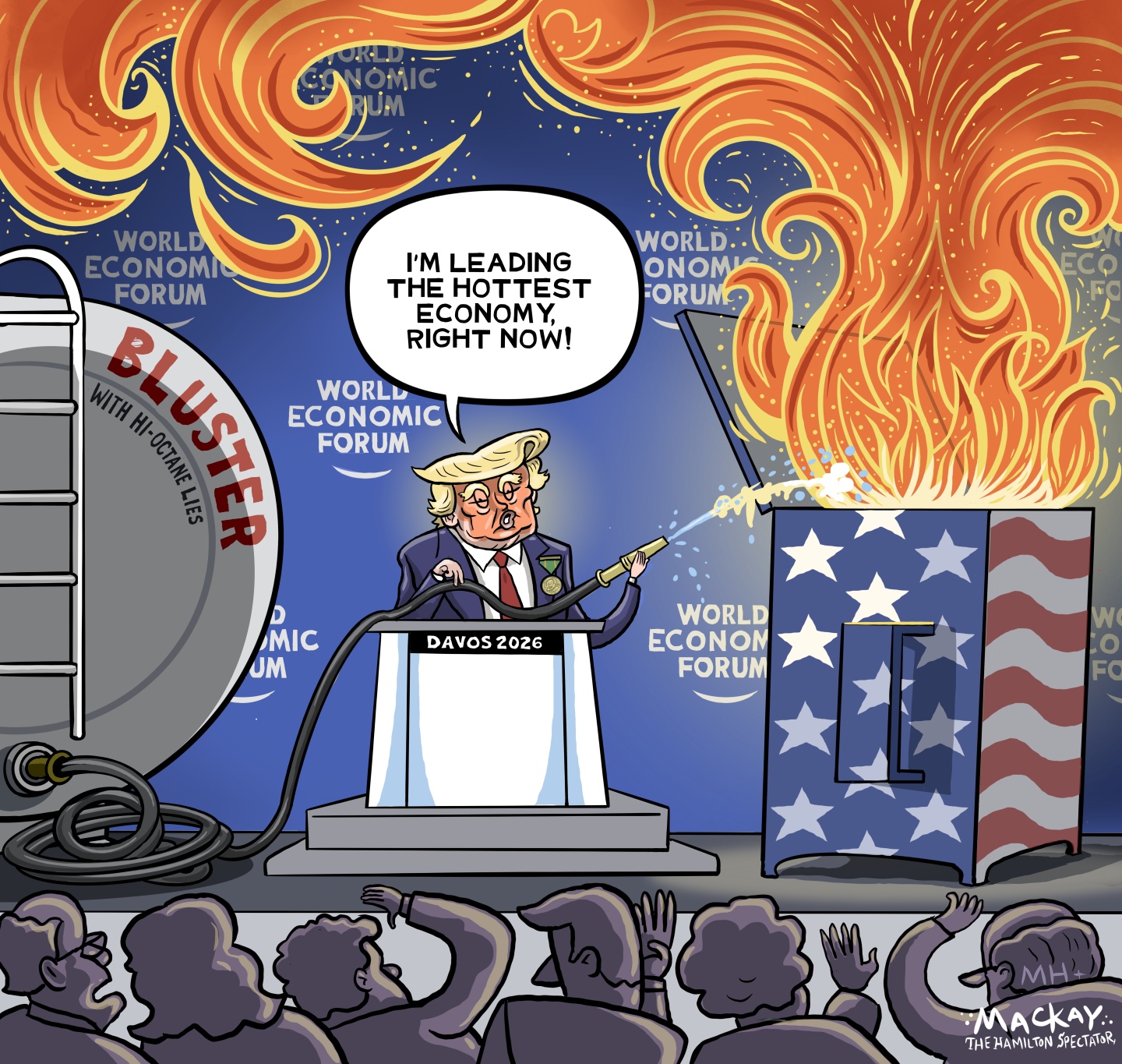

Political cartoons for January 25

Political cartoons for January 25Cartoons Sunday's political cartoons include a hot economy, A.I. wisdom, and more