The biggest policy mistake of the last decade

The evidence is in: Austerian economists got everything wrong

In the great economic battle of the past decade, the winner is the tried and true — in a rout.

After the 2008 financial crisis, old-fashioned Keynesians offered a simple fix: Stimulate the economy. With idle capacity and unemployed workers, nations could restore economic production at essentially zero real cost. It helped the U.S. in the Great Depression and it could help the U.S. in the Great Recession too. But during and immediately after the crisis, neoliberal and conservative forces attacked the Keynesian school of thought from multiple directions. Stimulus couldn't work because of some weird debt trigger condition, or because it would cause hyperinflation, or because unemployment was "structural," or because of a "skills gap," or because of adverse demographic trends.

Well going on 10 years later, the evidence is in: The anti-Keynesian forces have been proved conclusively mistaken on every single argument. Their refusal to pick up what amounted to a multiple-trillion-dollar bill sitting on the sidewalk is the greatest mistake of economic policy analysis since 1929 at least.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Let's take the culprits in turn.

The contrarianism began in earnest in early 2010, when two papers were published apparently finding that austerity — increasing taxes and/or cutting spending to reduce the budget deficit — was actually beneficial. First, economists Alberto Alesina and Silvia Ardagna outlined a theory of "expansionary austerity," arguing that governments could increase taxes, cut spending, and grow strongly. Meanwhile, economists Carmen Reinhart and Kenneth Rogoff demonstrated an apparent trigger point of a 90 percent debt-to-GDP level beyond which more borrowing would cause economic stagnation.

Both of these papers turned out to have major conceptual problems. Alesina and Ardagna basically cherry-picked their data, using unusual cases in which countries were not suffering a recession or could export their way out of problems. Reinhart and Rogoff got their causality backwards, and even had a humiliating Excel formula error that badly dented their correlation.

More clues that Alesina, Ardagna, Reinhart, and Rogoff got everything wrong can be found in the real world, where the Obama administration's modest stimulus package, while too small to fix the Great Recession entirely, did make things much better. Conversely, the European countries that subjected themselves to severe austerity regimens saw their employment and production collapse, just like Keynes would have predicted. Greece, in particular, has suffered economic disaster considerably worse than the Great Depression in terms of output and unemployment.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Next up: the inflation alarmists.

In late 2010, a bunch of conservative financial and economics luminaries, including Michael Boskin, John Cogan, Niall Ferguson, Kevin Hassett, Douglas Holtz-Eakin, Bill Kristol, and John Taylor, signed an open letter to then-Fed Chair Ben Bernanke warning that "[t]he planned asset purchases risk currency debasement and inflation." (Bernanke went ahead with his stimulus program anyway.) A related argument from 2011-12 came from economists Tyler Cowen and Robert Gordon in their books The Great Stagnation and The Rise and Fall of American Growth, respectively. They argued that the slow post-recession growth problem was a structural one caused by lack of innovation, meaning the economy was running up against supply constraints. We simply couldn't grow any faster.

What connects the monetary stimulus skeptics (Boskin, Cogan, et al.) and the supply-siders (Cowen and Gorden) is the implication that there should be at least some inflation. If the economy is bumping up against maximum capacity, then there should be price pressure as firms bid against each other for scarce labor and materials.

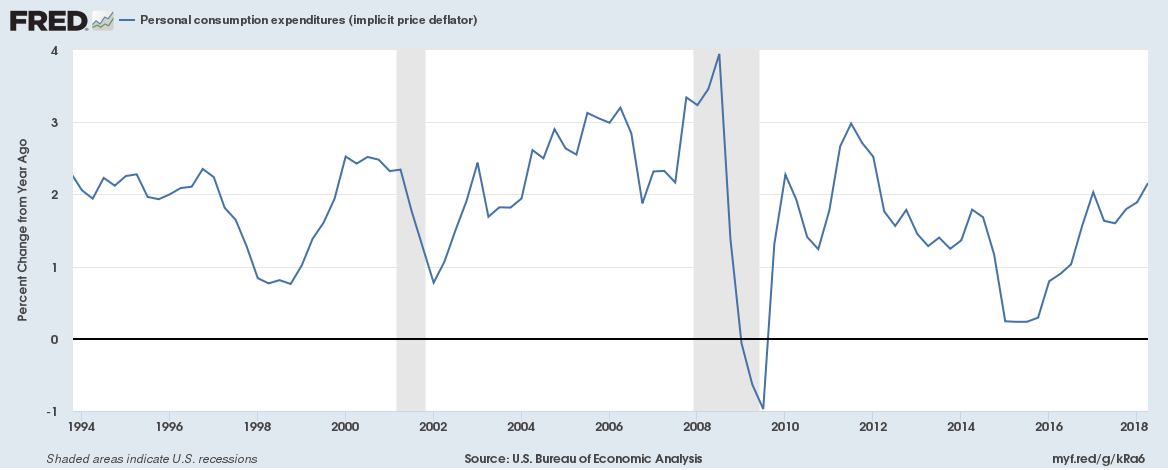

Yet it's been six to eight years since their arguments and there's hardly been a glimmer of the kind of inflation they warned about. Here is the Fed's inflation measure (over the past couple of decades for full context):

In fact, not only has there been no hyperinflation, inflation has consistently come in under the Fed's supposed target value of 2 percent.

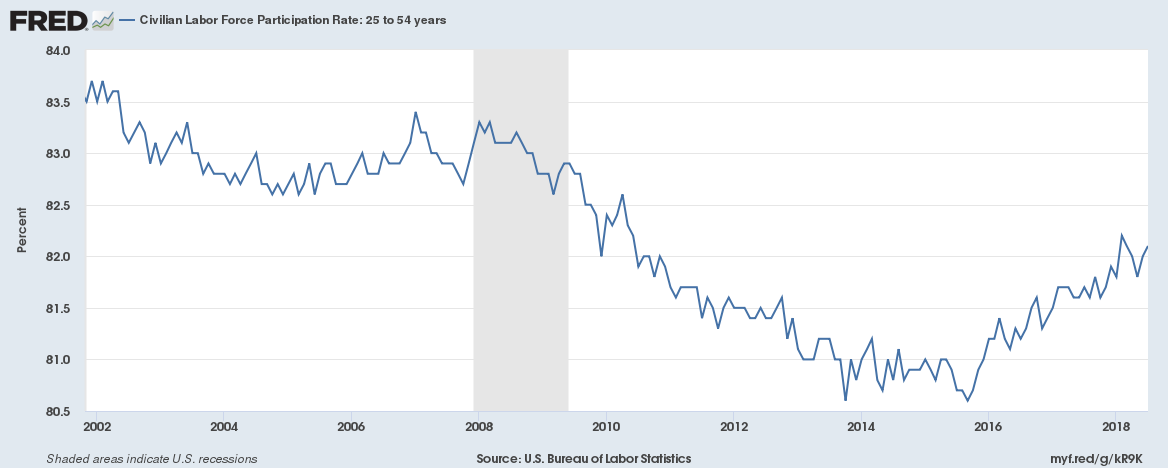

Then there are two more related theories: First, the "skills gap," referring to the supposed reality of American workers being unprepared to take available jobs. This was a major focus of Barack Obama's State of the Union address in 2012, in which he proposed a number of worker retraining and job placement programs. Second, there is the demographic trend argument, which explains a declining fraction of the prime working-age population participating in the labor market (that is, being either employed or looking for work) as some kind of cultural development. As Bill McBride wrote in early 2016, pointing to stay-at-home dads: "[M]ost of the decline in the labor force participation rate is due to ongoing trends … and demographics[.]"

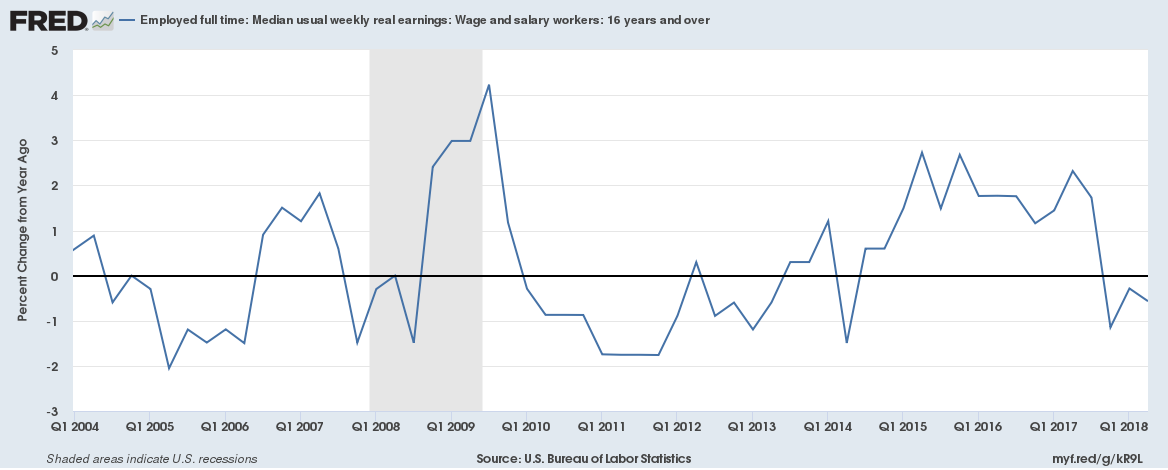

Both of these arguments (as well as the structural ones above) imply a labor shortage — if unemployed workers are essentially unemployable, and declining labor force participation is due to unshakable cultural trends, then workers that do have jobs should enjoy bigger wages as firms compete for scarce labor. Here is inflation-adjusted wage growth for full-time workers over 16:

There was a few years of moderately okay wage growth from 2015-17, but that was largely due to ultra-low inflation and nothing like the sustained increases implied by the structural or labor shortage argument. And in terms of the overall wage share of business output, it fell to historic lows during the crisis and remains there to this day. Now, low wages might also be due in part to corporations rigging the economy against workers, particularly recently. But at minimum it delivers yet another body blow to the anti-Keynesian case.

But let's also look directly at prime working-age labor force participation, which indeed fell steadily from the crisis through late 2015. But since then, as unemployment passed 5 percent and kept falling, lo and behold, labor force participation rose.

There was no skills gap, nor an innovation shortage, nor an explosion of stay-at-home dads. There was a collapse in aggregate demand that was left to rot, while a lot of people who should have known better made things worse.

One nauseating irony about this blizzard of nonsense is that many of the anti-Keynesian arguments were premised on avoiding future negative growth effects. For instance, in a 2010 op-ed flogging his erroneous pro-austerity paper, Rogoff wrote, "The sooner politicians reconcile themselves to accepting adjustment, the lower the risks of truly paralyzing debt problems down the road."

As we have seen, the evidence for the Keynesian position is overwhelming. And that means the decade of pointless austerity has severely harmed the American economy — leaving us perhaps $3 trillion below the previous growth trend. Through a combination of bad faith, motivated reasoning, and sheer incompetence, austerians have directly created the problem their entire program was supposed to avoid. Good riddance.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

The best new cars for 2026

The best new cars for 2026The Week Recommends From SUVs to swish electrics, see what this year has to offer on the roads

-

Trekking with gorillas in the warm heart of Africa

Trekking with gorillas in the warm heart of AfricaThe Week Recommends Great apes and an unforgettable encounter with elephants in the forests and swamps of the Congo

-

New START: the final US-Russia nuclear treaty about to expire

New START: the final US-Russia nuclear treaty about to expireThe Explainer The last agreement between Washington and Moscow expires within weeks

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred