The daily business briefing: June 7, 2018

Mulvaney fires his entire consumer watchdog advisory board, two of EPA chief Scott Pruitt's top aides resign, and more

1. Mulvaney fires consumer watchdog's entire advisory board

Mick Mulvaney, the interim director of the Consumer Financial Protection Bureau, has fired all 25 members of the agency's Consumer Advisory Board, days after some of them publicly criticized his leadership. The panel advises the watchdog agency's leaders on regulations and policies. The decision came after Mulvaney made a series of moves to shift from the pro-enforcement positions of his predecessor, Richard Cordray, and align the organization more closely with business interests. An agency spokesman said the critics appeared "more concerned about protecting their taxpayer-funded junkets to Washington, D.C.," than protecting consumers. National Consumer Law Center attorney Chi Chi Wu, a board member, called the dismissals "a huge red flag in this administration's ongoing erosion of critical financial protections that help average families."

2. Two top Pruitt aides leave EPA

Two of Environmental Protection Agency chief Scott Pruitt's top aides resigned Wednesday after coming under scrutiny in connection with Pruitt's spending and ethics issues. The aides, scheduler Millan Hupp and senior counsel Sarah Greenwalt, worked for Pruitt in Oklahoma, where he was attorney general, and followed him to the EPA, where they received substantial raises that bypassed normal White House procedures. The departures came as Pruitt faced more allegations of misusing his position, including having aides help in an effort to get his wife a Chick-fil-A franchisee position. Democrats on a House committee investigating Pruitt released an interview transcript Monday in which Hupp said Pruitt had her do personal errands for him, including asking the Trump International Hotel if Pruitt could buy a used mattress.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Venezuela releases two Chevron executives

Venezuela released two local Chevron executives jailed since April in an oil industry corruption investigation, Reuters reported Wednesday, citing authorities and sources. "They are free," the state prosecutor's office said, explaining that the men, Carlos Algarra and Rene Vasquez, had been offered an unspecified alternative to remaining behind bars. One source said Algarra and Vasquez were required to report to authorities every two weeks. The arrests at Chevron's Puerto La Cruz offices were the first involving a foreign oil firm since the government started detaining dozens of executives at the state oil company PDVSA and its partners.

4. Global stocks rise after Dow closes above 25,000

Asian markets gained on Thursday as global stocks got a boost from Wednesday's gains on Wall Street. The Dow Jones Industrial Average rose Wednesday by 1.4 percent to close above the 25,000 mark, while the S&P 500 rose by nearly 0.9 percent and the Nasdaq Composite gained almost 0.7 percent. In Asia, Japanese stocks led Thursday's gains, with the Nikkei 225 rising by 0.9 percent. European stocks also gained early Thursday after European Central Bank officials indicated conditions were right to start discussing unwinding their massive bond-buying program. U.S. stock futures rose early Thursday, pointing to a higher open.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Report: Solar-panel tariff blamed for stalling power projects

President Trump's solar-panel tariff has resulted in the elimination or stalling of more than $2.5 billion in major solar power projects, Reuters reported Thursday, citing developers. The projects involved thousands of jobs. The losses are only partially offset by plans companies have announced to build or expand solar panel factories in the U.S., which total about $1 billion so far. The White House did not immediately comment on the report. Trump announced the tariff in January over industry protests that the policy would hurt one of the nation's fastest-growing industries. Solar developers installed $6.8 billion in utility-scale projects last year, and the industry employs more than 250,000 people in the U.S., three times as many as the coal industry.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Political cartoons for January 4

Political cartoons for January 4Cartoons Sunday's political cartoons include a resolution to learn a new language, and new names in Hades and on battleships

-

The ultimate films of 2025 by genre

The ultimate films of 2025 by genreThe Week Recommends From comedies to thrillers, documentaries to animations, 2025 featured some unforgettable film moments

-

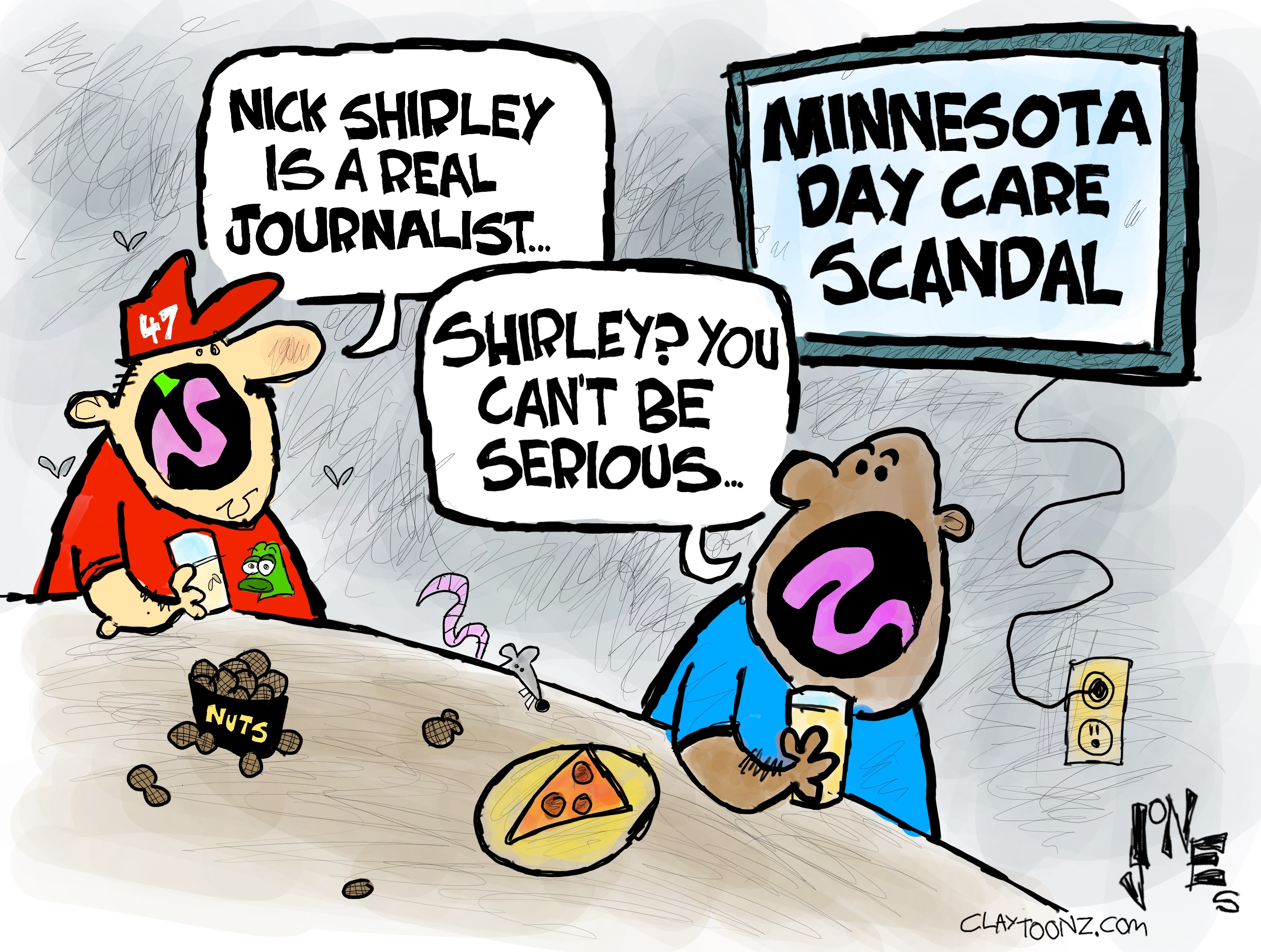

Political cartoons for January 3

Political cartoons for January 3Cartoons Saturday's political cartoons include citizen journalists, self-reflective AI, and Donald Trump's transparency

-

How Bulgaria’s government fell amid mass protests

How Bulgaria’s government fell amid mass protestsThe Explainer The country’s prime minister resigned as part of the fallout

-

Femicide: Italy’s newest crime

Femicide: Italy’s newest crimeThe Explainer Landmark law to criminalise murder of a woman as an ‘act of hatred’ or ‘subjugation’ but critics say Italy is still deeply patriarchal

-

Brazil’s Bolsonaro behind bars after appeals run out

Brazil’s Bolsonaro behind bars after appeals run outSpeed Read He will serve 27 years in prison

-

Americans traveling abroad face renewed criticism in the Trump era

Americans traveling abroad face renewed criticism in the Trump eraThe Explainer Some of Trump’s behavior has Americans being questioned

-

Nigeria confused by Trump invasion threat

Nigeria confused by Trump invasion threatSpeed Read Trump has claimed the country is persecuting Christians

-

Sanae Takaichi: Japan’s Iron Lady set to be the country’s first woman prime minister

Sanae Takaichi: Japan’s Iron Lady set to be the country’s first woman prime ministerIn the Spotlight Takaichi is a member of Japan’s conservative, nationalist Liberal Democratic Party

-

Russia is ‘helping China’ prepare for an invasion of Taiwan

Russia is ‘helping China’ prepare for an invasion of TaiwanIn the Spotlight Russia is reportedly allowing China access to military training

-

Interpol arrests hundreds in Africa-wide sextortion crackdown

Interpol arrests hundreds in Africa-wide sextortion crackdownIN THE SPOTLIGHT A series of stings disrupts major cybercrime operations as law enforcement estimates millions in losses from schemes designed to prey on lonely users