Only in America: The perils of prayer

A New York man sues after his leg is crushed by the crucifix he prayed to every day — and more in our collection of strange revelations about the nation

A man is suing a New York church after the crucifix he prayed to every day toppled over and crushed his leg. David Jimenez, 45, says he was cleaning the heavy marble statue in gratitude for Jesus having cured his wife's cancer when it fell on him. Claiming the church was negligent, Jimenez seeks $3 million in damages.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

-

5 hilariously slippery cartoons about Trump’s grab for Venezuelan oil

5 hilariously slippery cartoons about Trump’s grab for Venezuelan oilCartoons Artists take on a big threat, the FIFA Peace Prize, and more

-

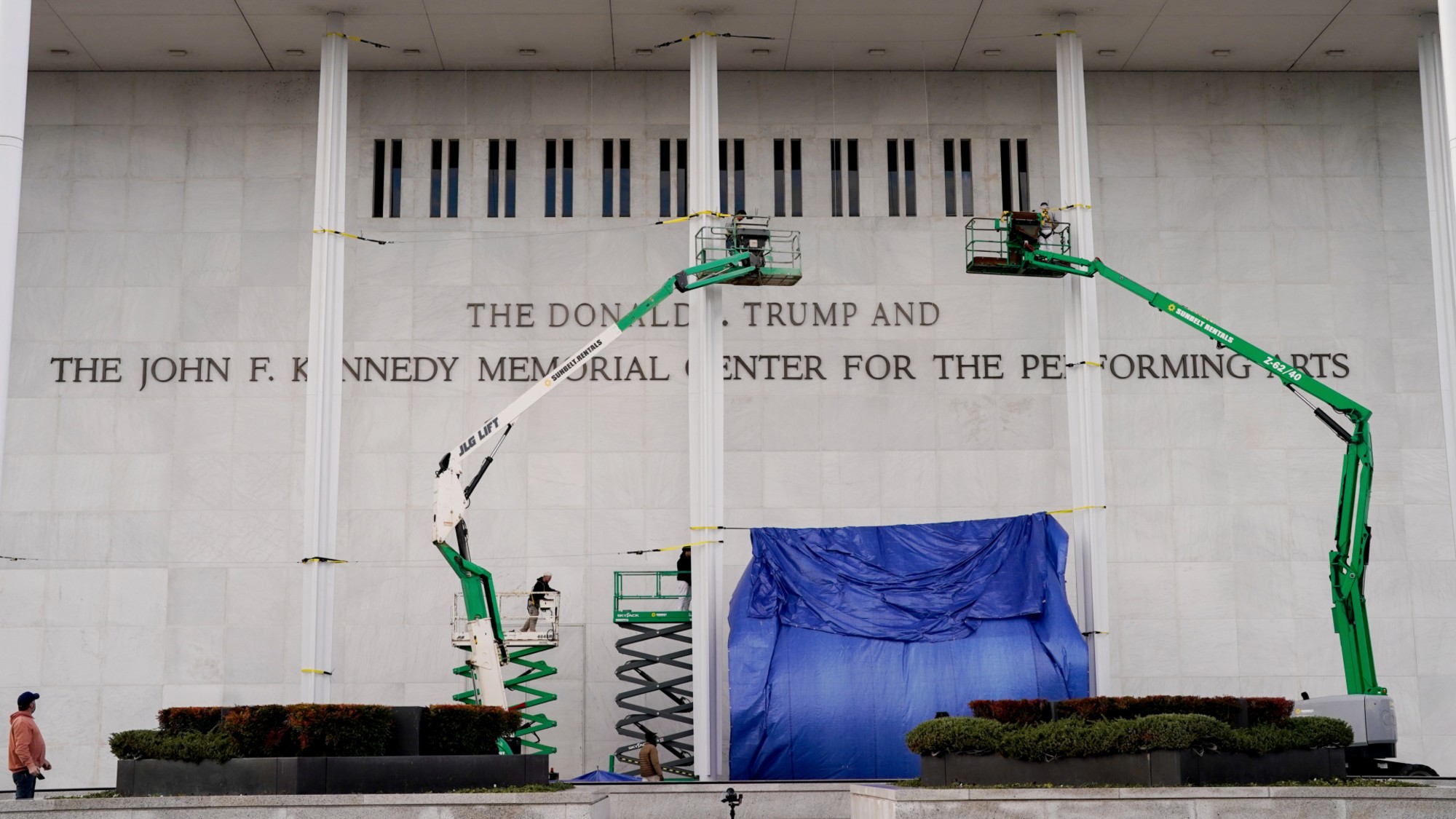

A running list of everything Trump has named or renamed after himself

A running list of everything Trump has named or renamed after himselfIn Depth The Kennedy Center is the latest thing to be slapped with Trump’s name

-

Do oil companies really want to invest in Venezuela?

Do oil companies really want to invest in Venezuela?Today’s Big Question Trump claims control over crude reserves, but challenges loom

-

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstances

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstancesSpeed Read

-

Western mountain climbers allegedly left Pakistani porter to die on K2

Western mountain climbers allegedly left Pakistani porter to die on K2Speed Read

-

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governor

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governorSpeed Read

-

Los Angeles city workers stage 1-day walkout over labor conditions

Los Angeles city workers stage 1-day walkout over labor conditionsSpeed Read

-

Mega Millions jackpot climbs to an estimated $1.55 billion

Mega Millions jackpot climbs to an estimated $1.55 billionSpeed Read

-

Bangladesh dealing with worst dengue fever outbreak on record

Bangladesh dealing with worst dengue fever outbreak on recordSpeed Read

-

Glacial outburst flooding in Juneau destroys homes

Glacial outburst flooding in Juneau destroys homesSpeed Read

-

Scotland seeking 'monster hunters' to search for fabled Loch Ness creature

Scotland seeking 'monster hunters' to search for fabled Loch Ness creatureSpeed Read