The GOP tax law could spark a mad rush to divorce court

Starting in 2019, for the first time in 77 years, alimony won't be deductible for U.S. taxpayers, thanks to the Republican tax overhaul passed in December. That means that the new tax law "could soon lead to a surge in married couples calling it quits," Politico reports, citing divorce lawyers. "Now's not the time to wait," said Mary Vidas, former chairwoman of the American Bar Association's family law section. "If you're going to get a divorce, get it now."

For wealthy divorcés, especially, the deduction meant they could pay roughly 60 cents for every dollar of alimony. Divorce lawyers say the change in the tax law could lead to more contentious divorce cases and lower alimony payments when it kicks in, disproportionally hurting women. But ending the deduction is also projected to raise $6.9 billion over 10 years, helping defray the $1 trillion-plus cost of the tax bill. "This is one of the many provisions of the law that removes special rules applicable only in certain circumstances in order to help simplify the code and reduce tax rates for all Americans," said a spokesman for House Ways and Means Chairman Kevin Brady (R-Texas), who put together much of the tax legislation.

Couples have all of 2018 to "use the alimony deduction as a bargaining chip in their negotiations with estranged spouses," Politico says, but in some states, the clock starts running down fast, thanks to cooling-off periods of up to six months. "You can't just file for a divorce today, and expect that you're going to be divorced tomorrow," said Los Angeles lawyer Ed Lyman. You can read more about the ramifications for divorce settlements at Politico.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Political cartoons for January 10

Political cartoons for January 10Cartoons Saturday’s political cartoons include a warning shot, a shakedown, and more

-

Courgette and leek ijeh (Arabic frittata) recipe

Courgette and leek ijeh (Arabic frittata) recipeThe Week Recommends Soft leeks, tender courgette, and fragrant spices make a crisp frittata

-

Trump’s power grab: the start of a new world order?

Trump’s power grab: the start of a new world order?Talking Point Following the capture of Nicolás Maduro, the US president has shown that arguably power, not ‘international law’, is the ultimate guarantor of security

-

‘One Battle After Another’ wins Critics Choice honors

‘One Battle After Another’ wins Critics Choice honorsSpeed Read Paul Thomas Anderson’s latest film, which stars Leonardo DiCaprio, won best picture at the 31st Critics Choice Awards

-

Son arrested over killing of Rob and Michele Reiner

Son arrested over killing of Rob and Michele ReinerSpeed Read Nick, the 32-year-old son of Hollywood director Rob Reiner, has been booked for the murder of his parents

-

Rob Reiner, wife dead in ‘apparent homicide’

Rob Reiner, wife dead in ‘apparent homicide’speed read The Reiners, found in their Los Angeles home, ‘had injuries consistent with being stabbed’

-

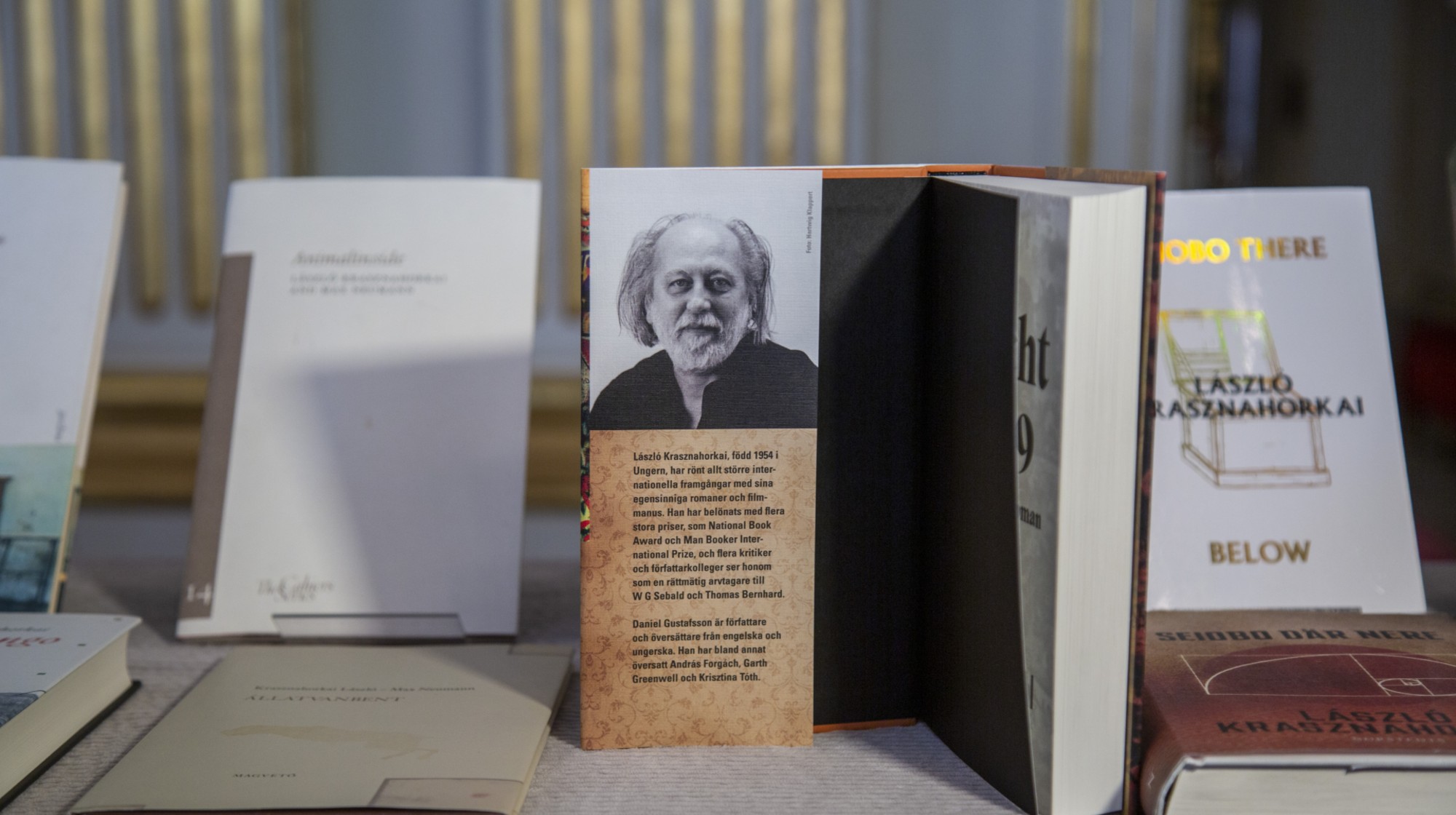

Hungary’s Krasznahorkai wins Nobel for literature

Hungary’s Krasznahorkai wins Nobel for literatureSpeed Read László Krasznahorkai is the author of acclaimed novels like ‘The Melancholy of Resistance’ and ‘Satantango’

-

Primatologist Jane Goodall dies at 91

Primatologist Jane Goodall dies at 91Speed Read She rose to fame following her groundbreaking field research with chimpanzees

-

Florida erases rainbow crosswalk at Pulse nightclub

Florida erases rainbow crosswalk at Pulse nightclubSpeed Read The colorful crosswalk was outside the former LGBTQ nightclub where 49 people were killed in a 2016 shooting

-

Trump says Smithsonian too focused on slavery's ills

Trump says Smithsonian too focused on slavery's illsSpeed Read The president would prefer the museum to highlight 'success,' 'brightness' and 'the future'

-

Trump to host Kennedy Honors for Kiss, Stallone

Trump to host Kennedy Honors for Kiss, StalloneSpeed Read Actor Sylvester Stallone and the glam-rock band Kiss were among those named as this year's inductees