Help to Buy Isas: all the best buys and saving options

The government hopes the Help to Buy ISA will put young people on the property ladder

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Help to Buy Isas explained: do you stand to benefit?

17 June

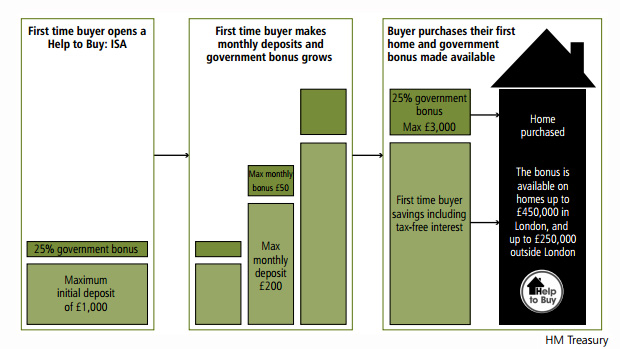

In his Budget speech in March, Chancellor George Osborne revealed the government's latest plan to ease pressure on young people struggling to get on the property ladder due to unattainably high house prices and deposits.

Due to go into effect in autumn 2015, the Help to Buy ISA will offer first-time buyers a government bonus of up to £3,000 on their savings for a mortgage deposit.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And with banks and building societies now getting ready to roll out their Help to Buy ISAs, the finer details of the scheme are coming to light.

What is the Help to Buy ISA?

The new scheme will work much like a normal cash ISA, with savers benfiting from tax-free interest on their savings, while providers will set their own rules regarding interest rates and withdrawals. Like normal cash ISAs, savers will be free to transfer between providers.

However, for every £200 an individual saves in the Help to Buy ISA, the government has pledged to top it up with £50 more, up to a total bonus of £3,000. The money can be used as a mortgage deposit on homes worth up to £250,000 (up to £450,000 in London).

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

There are also a few extra regulations for the Help to Buy ISA, the most significant of which is a cap on the amount that savers can pay into the account each month. The maximum monthly deposit is £200, with an additional lump sum of up to £1,000 permitted in the first month. There is no minimum deposit, and no limits to how long an account can remain open.

How does the government bonus work?

To be eligible for the government's 25 per cent bonus, you need to have saved at least £1,600 (which, with the government top-up, would become £2,000). Conversely, the maximum amount on which you can claim a bonus is £12,000, bringing your total savings up to £15,000. Assuming the ISA holder makes the maximum monthly contribution of £200, it would take over four years of saving to reach the £12,000 limit.

Savers will not get the government top-up until they are in the process of buying their first property, at which point the bonus they have accrued will be paid directly to the mortgage lender. This means that any additional interest earned from the bank or building society will be based only on your own contributions. Savers are free to withdraw money from their Help to Buy ISA to spend on something other than a mortgage, but would forfeit the government bonus on that amount. (Click on the image below to expand).

Who is eligible for the Help to Buy ISA?

To apply for a Help to Buy ISA, the key qualification is that you must be a first-time buyer. This means you don't own or pay a mortgage on an existing property.

Otherwise, the eligibility rules are similar to any other cash ISA. The account holder must be at least 16 (or 18, depending on the policy of your bank or building society) and be in possession of a national insurance number.

The new ISAs will be limited to one per person, to avoid savvy savers cashing in on two government bonuses.

If you are looking to buy as a couple, the good news is that you can both open separate Help to Buy ISAs, potentially leaving you with £30,000 saved for a deposit on a property.

Are there any 'catches' to watch out for?

According to ThisIsMoney, if you have already paid into a cash ISA this financial year, you may have to wait until April 2016 to become eligible to open a Help to Buy ISA. This is because the Help to Buy ISA counts as a cash ISA, and only one of these can be opened per tax year.

Unfortunately for regular savers, paying into an existing ISA also counts as 'opening', so if you have topped up a cash ISA since 6 April, it looks as though you will have to wait until next year to join the Help to Buy scheme. If you have a cash ISA but haven't made a deposit since April, you may want to hold fire until the individual Help to Buy ISA providers clarify their terms.

Potential savers should also be aware that Help to Buy ISAs cannot be used to buy property to be rented out, or properties located outside of the UK, says the Money Advice Service.

-

5 superbly funny cartoons about the Superbowl

5 superbly funny cartoons about the SuperbowlCartoons Artists take on historical reenactment, biased bowls, and more

-

Political cartoons for February 7

Political cartoons for February 7Cartoons Saturday’s political cartoons include an earthquake warning, Washington Post Mortem, and more

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more