Jackson Hole: Why is the three-day event so important?

When bankers meet for their annual symposium in Wyoming tomorrow the topic will be how to foster a dynamic global economy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In a matter of hours, the eyes of the financial world will be on the small town of Jackson in the western US state of Wyoming.

At the Jackson Hole Lodge, a group of the world's most influential market movers, including central bankers, finance ministers, academics, financial services executives and journalists, will gather for a three-day symposium.

But why has this event in such a seemingly innocuous location become such a key part of the economic calendar? And what can we expect this time around?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How did the event come about?

In 1978 the Kansas City Federal Reserve, one of 12 regional central banks across the US, hosted its inaugural policy symposium focusing mainly on agricultural issues of prime importance to the local economy.

But by the early 1980s it was still "struggling to attract economists" to the annual event, says the Financial Times.

It decided to revamp the event in 1982, switching the focus to broader monetary policy and moving it to Jackson Hole, Wyoming (which is in the Kansas City Fed district) because of the prospect of "excellent trout fishing".

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

It was hoped that doing so might encourage keen fly-fisher Paul Volcker, then chairman of the US Federal Reserve, to leave balmy late-August Washington and attend.

Volcker was feeling the heat that summer for other reasons, according to the Kansas Fed in its official history of the symposium. A change to US monetary policy meant he had overseen a rise in the base interest rates to a record 20 per cent and inflation had hit 13 per cent in 1981.

He accepted the invitation and continued to do so every year until his tenure as Fed chairman ended in 1987.

"In a textbook case of network effects, Volcker's regular attendance attracted other policymakers and made the event an unequalled gathering for big economic hitters," says The Economist.

Why do markets care?

Because when you have that many senior figures in one place it becomes an unparalleled touch point to assess sentiment in the wider economy.

For attendees the real benefit of the event is participating in the "informal conversations that take place at meal tables and on hiking trails between events," says the Economist.

People are able to speak freely because of the "Jackson Hole Rules" observed by the journalists in attendance. They can report on anything said during the formal conference programme, but everything else over the three days is "off the record".

That's not to say the core conference programme isn't interesting enough, though.

It's organised around a central theme – this year it's "Fostering a dynamic global economy" – but in principle it's simply a place where some of the most important people in financial markets make speeches on the state of the economic world right now.

They've also used their platform to forewarn of big changes in policy, like when then-Fed chairman Ben Bernanke "signalled a readiness to take a third stab at quantitative easing" in 2012. He formally announced the policy the following month, says Bloomberg.

In 2014, European Central Bank president Mario Draghi warned that inflation expectations in the eurozone were falling fast. This was a "very strong signal that the central bank would soon embark on quantitative easing" – and it did so the following March.

What are markets looking for this year?

Most of the speculation is about US interest rates and whether the Federal Reserve will go ahead with its planned third increase this December.

The Financial Times says that recent concerns about the effect of low rates on financial stability could be echoed in Fed chair Janet Yellen's speech, a potentially hawkish signal that it might press on with gradual rates hikes.

Earlier this week the FT reported that the US dollar was rising in anticipation of just such a rates signal.

-

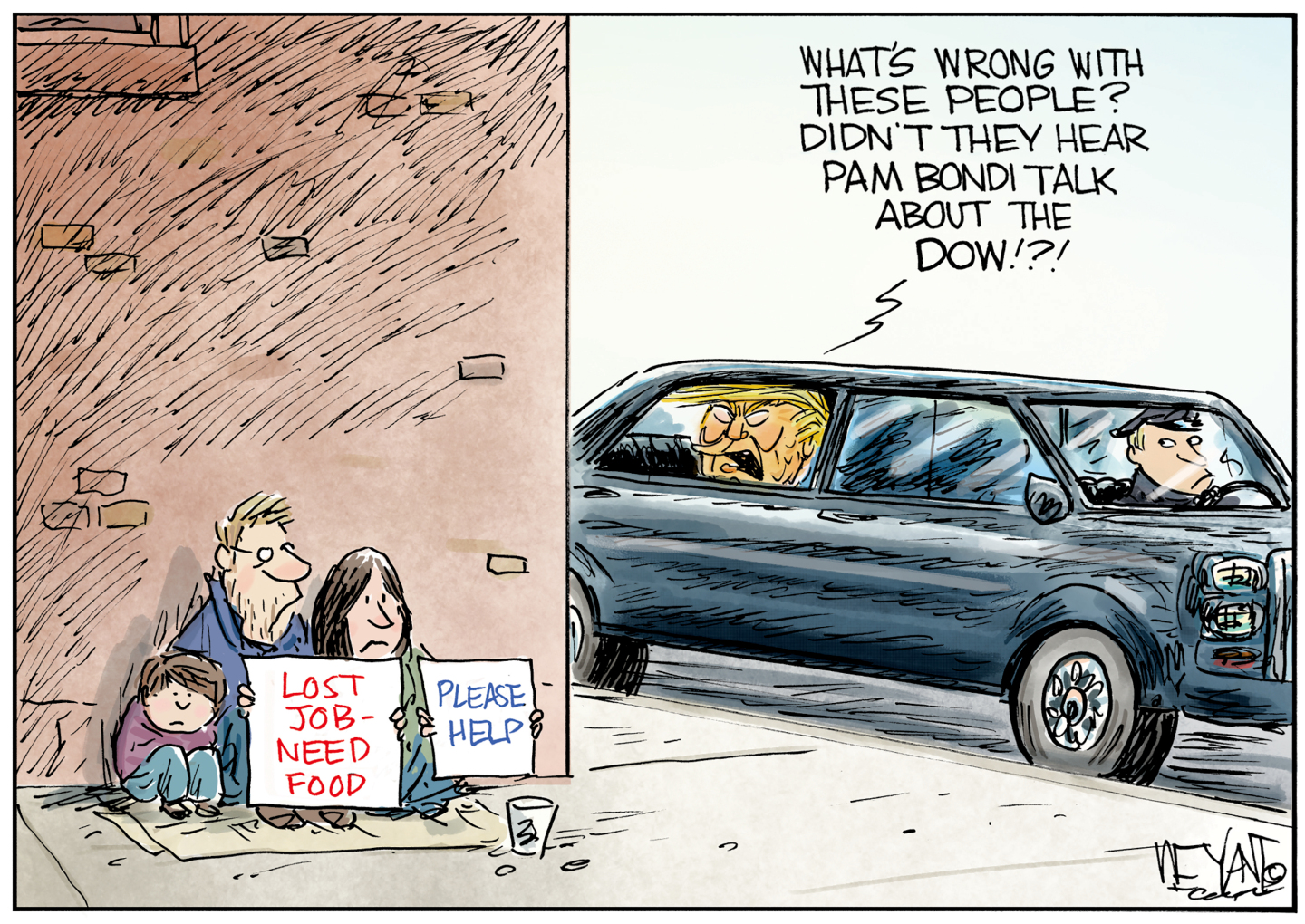

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more

-

The best music tours to book in 2026

The best music tours to book in 2026The Week Recommends Must-see live shows to catch this year from Lily Allen to Florence + The Machine

-

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ read

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ readIn the Spotlight A Hymn to Life is a ‘riveting’ account of Pelicot’s ordeal and a ‘rousing feminist manifesto’