Aramco flotation prompts dramatic U-turn in Saudi oil policy

Proposed sell-off sees Riyadh turn from dove to price hawk

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The proposed stock market flotation of Saudi Arabia’s state oil giant Aramco has prompted a major shift in the country’s energy policy.

Long seen as an advocate of restraint within Opec, seeking to convince fellow members like Venezuela, Iran and Russia that fast rising oil prices benefited alternative energy providers, the world’s biggest oil exporter has performed a remarkable volte-face since announcing its decision to sell off part of its state-owned oil company, Reuters says.

Last year, in a bid to push up oil prices to maximise the valuation of Saudi Aramco, the government tried to get fellow oil producers to agree to reduce production, even threatening to pull out of Opec altogether if they did not.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

While it remains unclear how serious this threat was, “the fact such a move was considered shows how Aramco’s initial public offering (IPO) - expected to be the biggest in history - is forcing the kingdom to rethink its Opec policies”, says Reuters.

One high-level Opec source told the news agency that “Saudi Arabia is now the main price hawk”, adding that he was “surprised how quickly the kingdom had shifted from its policy of prioritizing market share, by pumping oil at full tilt, to supporting production cuts following its decision to list Aramco”.

According to sources within the Saudi government, plans have been put in place to list around 5% of Aramco by the end of 2018. The IPO is the centrepiece of Vision 2030, a reform programme devised by Saudi Crown Prince and heir to the throne Mohammad bin Salman to diversify the Saudi economy beyond oil.

However, while expected to raise in excess of $2tn to form part of a new sovereign wealth fund, the partial sell-off of Aramco has been heavily criticised within Saudi Arabia.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

There are fears that once listed publicly and answerable to investors, Aramco will be liable to rules and anti-trust legislation which preclude price-fixing, potentially hampering an effective tool of Saudi state control and global influence.

Until now, says The Economist, the company has been “as cloistered from outside scrutiny as the kingdom itself” and “its finances remain off-limits to everyone except the government, its only shareholder”.

-

The UK expands its Hong Kong visa scheme

The UK expands its Hong Kong visa schemeThe Explainer Around 26,000 additional arrivals expected in the UK as government widens eligibility in response to crackdown on rights in former colony

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

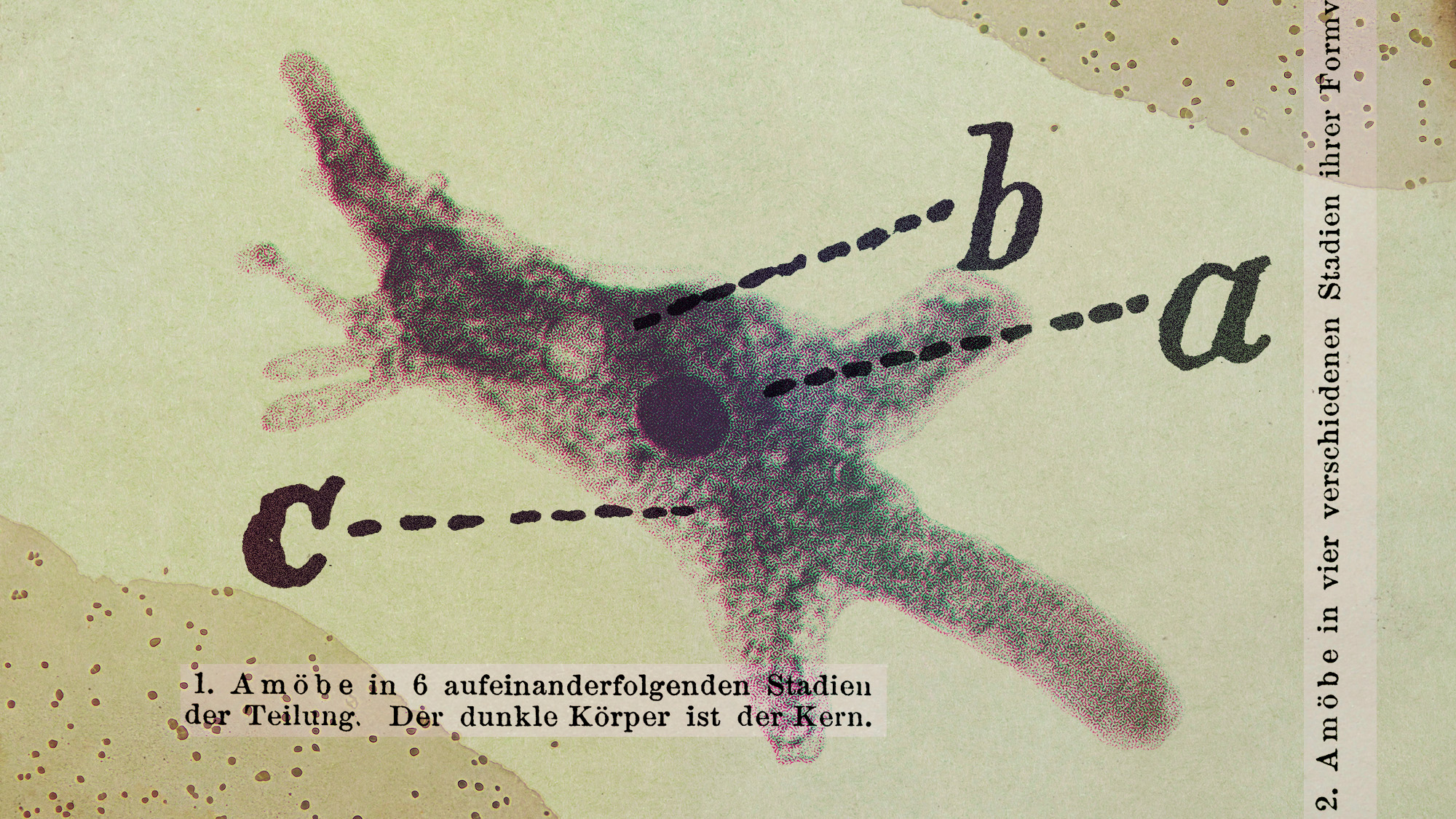

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

What Saudi Arabia wants with EA video games

What Saudi Arabia wants with EA video gamesIn the Spotlight The kingdom’s latest investment in gaming is another win for its ‘soft power’ portfolio

-

How might the Israel-Hamas war affect the global economy?

How might the Israel-Hamas war affect the global economy?Today's Big Question Regional escalation could send oil prices and inflation sky-high, sparking a worldwide recession

-

Recent mega-mergers could signal a turning point for the US oil industry

Recent mega-mergers could signal a turning point for the US oil industryTalking Point Both Chevron and Exxon have recently spent billions to acquire smaller oil companies

-

The PGA gets a Saudi makeover

The PGA gets a Saudi makeoverfeature Fans and players are reeling after the league announced a surprise merger with its Saudi-backed rival

-

Has Saudi Arabia lost control of oil prices?

Has Saudi Arabia lost control of oil prices?Today's Big Question Kingdom goes it alone to cut production, risking tension with US and reigniting cooling inflation in Europe

-

Why is Saudi Arabia going it alone on costly oil cuts?

Why is Saudi Arabia going it alone on costly oil cuts?Today's Big Question The unilateral production cuts could hurt its finances while raising gas prices for drivers and OPEC