The economy is finally getting some momentum. Here's how to keep it going.

Wait until you see the whites of inflation's eyes

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The November jobs report, released last week, was unambiguously positive. With 321,000 jobs added and wages up slightly, the effects of economic growth could really start reaching down the socioeconomic ladder. It's a nice early Christmas present.

But the economy is still in a post-recession hole. It's critically important, therefore, that policy-makers build on this momentum. Above all, that means the Federal Reserve needs to hold back on worrying about inflation. There are good reasons to think that this recovery can continue for a long time yet without putting much pressure on prices.

On the flip side, there are equally good reasons to think that the central bank could reverse the recovery — and that it would be extremely difficult to make up lost ground if it did so.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

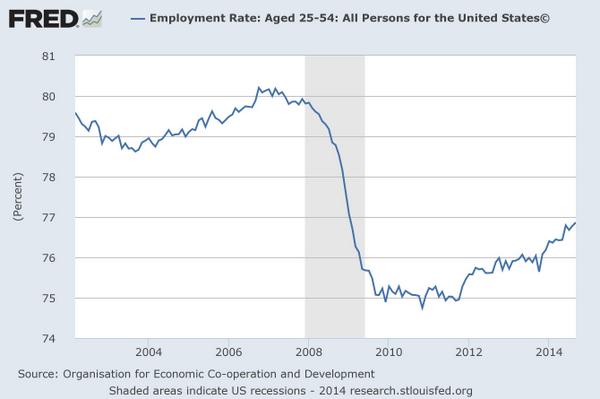

Here's some data (inspired by Nick Bunker) that puts it all in perspective. The prime working-age employment to population ratio is crawling upward, but still has a long ways to go before reaching pre-recession levels:

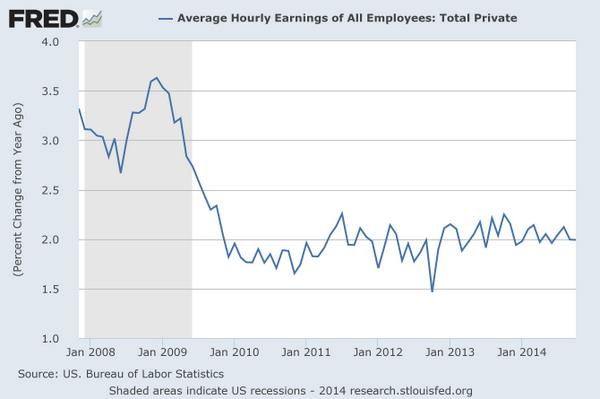

Wage growth is still barely keeping up with inflation:

And inflation is low, below the central bank's 2 percent target.

Think back to the old days of economic policy. In the post-war era, when working people would get raises, their subsequent spending would put pressure on inflation. If it looked to be getting out of hand, the Fed would raise interest rates and throw millions of people out of work, thus cutting overall spending and easing pressure on prices. Once things settled down, the central bank would unchain the economy, and it would roar back to life (thus the "V-shaped" recession).

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But around 1980, working people largely stopped getting raises. Decades later, American society has become as unequal as it was in the 1920s, and the economy is highly bifurcated between the top and bottom. Basically all economic growth is immediately captured by the rich, who spend ungodly sums on paintings and wine and whatnot, mostly shuffling money back and forth between themselves.

But there is still some job growth, gradually putting more spending power in the hands of the 99 percent, which leaks enough spending out into the rest of the economy to support more jobs, which leads to more spending, and so on. But as we've seen, this process takes a very long time. Far from being V-shaped, the 2008 recession has been more like a big shallow bowl.

However, the productive capacity of the economy has continued to increase since 2009. Technological progress hasn't stopped, and we're still making more stuff all the time. Thus, it's possible that the combination of enlarged capacity and low wages make it exceedingly easy for the economy to accommodate more jobs without increased prices. Indeed, since the mid-90s, we've gotten unemployment down to 4 percent or near it twice, with little sign of accelerating inflation. Take a look at inflation versus unemployment over the past couple decades:

On the other side of the ledger, the downside risk of getting overly anxious about inflation and raising interest rates prematurely are very large. The Fed's regular stimulus tool — lowering interest rates — has been maxed out at zero since 2008 with little effect, and its unconventional tools haven't worked that well. At the zero lower bound, it turns out to be very difficult to get the jobs-wages-more jobs spiral going. It's taken the economy six years and we're only just now getting a half-decent pace of recovery. If the Fed gets skittish about inflation, there is every danger it would knock the economy back into the zero lower bound sandpit.

So how will we know when the time is right to raise interest rates? The answer, as Paul Krugman says, is to wait until we see the "whites of inflation's eyes." When we start seeing significant and sustained price increases, then we'll know for sure that we're starting to reach the economy's job capacity. Only after that should interest rates be raised.

If we want to keep our recovery going as long as possible, then the last thing we should do is hit the brakes.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.