The lessons of Iraq: The U.S. economy is still way too vulnerable to oil price shocks

This is one reason why we need a renewable energy revolution

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

With oil prices rising due to the crisis in Iraq, it's become clear that for all the progress the U.S. has made in securing energy independence, it is still far too vulnerable to geopolitical turmoil halfway around the world. And the only way to change that is for the U.S. to wean itself off oil.

Now, sometimes rising oil prices can signify growing global economic strength. Demand for oil is a bellwether of the market's appetite for energy, so if prices are climbing on booming demand, then that's a pretty happy sign.

But oil price spikes can also spell serious problems. Rising energy and transportation prices — which affect nearly every product and service —trickle down and squeeze businesses and consumers. Mortgages and other loans can suddenly become unaffordable as energy prices rise, encouraging defaults.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

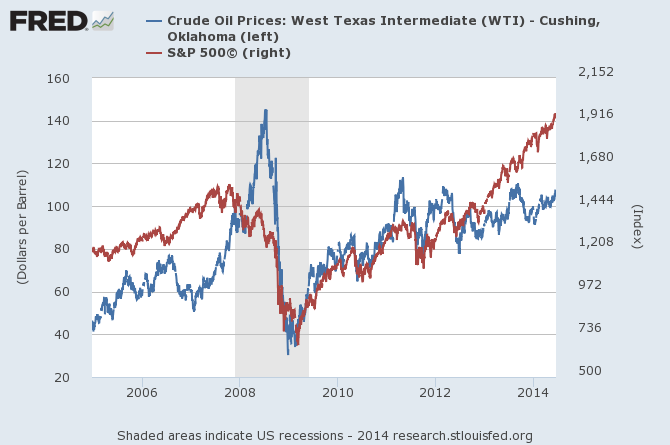

This appears to be what occurred between 2006 and 2008. While the seeds of the financial crisis — excessive consumer and financial sector debt, and risky financial practices — were sown much earlier, rising energy and transportation prices surely exacerbated the credit crunch. Indeed, rising oil prices were arguably one of the factors that triggered the crisis, the straw that broke the camel's back.

(Federal Reserve Bank of St. Louis)

With Iraq facing an incipient civil war, the issue is coming back into focus. A big enough oil spike translating into soaring energy prices could once again squeeze American consumers and businesses, leaving the economy vulnerable to a recession.

Of course, the U.S. is in a better position to weather the storm than in 2007. Interest rates remain near historic lows, giving debtors some breathing room. The total level of debt relative to the size of the economy is lower, too. And the U.S. — thanks to a shale oil and natural gas boom — is much less dependent on energy brought in from abroad.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But just because the U.S. is importing a lower proportion of its energy doesn't mean that it isn't vulnerable to energy shocks. The U.S. energy market is part of the global energy market. If oil supplies are cut off or impeded in the Middle East (or elsewhere) the U.S. will still be affected, because the rest of the global marketplace will still need to buy oil. That means that the price of oil for Americans will still rise.

All of which is to say that true energy independence isn't as simple as pumping more hydrocarbons at home. That may relieve both American and global energy pressures to a certain degree, but only in a transitional sense. It is not a real solution.

A real solution would be a renewable energy economy in which energy and transportation are fuelled by local sunlight, wind, and water. If you're capturing the bulk of your energy needs on your rooftop, driving an electric car, and storing excess power in a battery in your garage, you're far more insulated against geopolitical turmoil in oil-producing regions.

The cost of solar electricity has fallen to 1 percent of what it was 40 years ago — thanks in part to large scale solar investment in recent years — but it still needs to drop a little more to become cheaper than fossil fuels. The U.S. is also not close to a widescale adoption of electric cars, nor a to feasible energy storage solution, such as large-scale, high-capacity, fast-charging batteries. Both of these things appear to be in the pipeline, but are not quite ready for prime time yet.

Nuclear power — which unlike renewables is not dependent on the development of better storage technology — can ease this transition.

But the biggest mountain renewable energy has to climb may be government subsidies for fossil fuels. The world spends half a trillion dollars a year subsidizing fossil fuels, six times the amount it spends on subsidizing renewables.

Other nations are showing the way, though, offering greater subsidies to help put renewables on a level playing field. Solar power is now just as cheap as conventional electricity in Italy and Germany. Germany has a longer-term goal of producing 35 percent of electricity from renewable sources by 2020, and 100 percent by 2050. And it's already paying off — earlier this month, Germany for the first time ever satisfied 50 percent of its electricity demand with solar.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day