Making money: Letting go of landlines, and more

Three top pieces of financial advice — from navigating new rules on mortgages to handling debt troubles

Letting go of landlines

Is it time to ditch your landline? asked Tara Siegel Bernard at The New York Times. The government estimates that 38.2 percent of households now do without landline phones, relying solely on wireless or internet-based phones. But while cutting the cord might save you money, there "are some factors to consider." When emergencies strike, traditional landlines can be more reliable than wireless phones, since it's easier for dispatchers to pinpoint a caller's location. Landlines also use "the old copper wire system of circuits and switches, which are generally self-powered." Internet-powered phone services—such as Verizon's FiOS and AT&T's U-verse—use fiber-optic lines, which can fail when the power goes out. And contracts with the "more nimble" internet-based phone providers are not always subject to "the same regulations and consumer protections as traditional lines."

New rules on mortgages

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

If you're in the market for a mortgage, brush up on the rules, said Les Christie at CNN. New guidelines from the Consumer Financial Protection Bureau went into effect last week, aiming to "lower the risk of defaults and foreclosures." Lenders will now need to "determine that a borrower has the income and assets to afford to make payments throughout the life of the loan," which means borrowers can expect stricter underwriting scrutiny. And since "lenders will be required to document" more information about borrowers, count on "more paperwork and longer processing times." The new rules stipulate that "your debt-to-income ratio generally must be below 43 percent," though banks can still give you credit if other factors, such as substantial assets, mitigate the risk of default.

When debt troubles surface

"If you're in debt, you don't get to set the repayment terms," said Bev O'Shea at Credit.com. But that doesn't mean there's no room to negotiate. "Collectors are smart enough to know some money is better than no money, and their job is to get you to pay as much as possible as quickly as possible." If you're behind on a bill, try to work out a payment arrangement "you can stick with," and whatever you do, "get it in writing before you pay. If the debt winds up in court, you'll want documentation of your agreement." Check your credit report regularly for errors, and "work toward getting your credit back on track by addressing any derogatory items."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

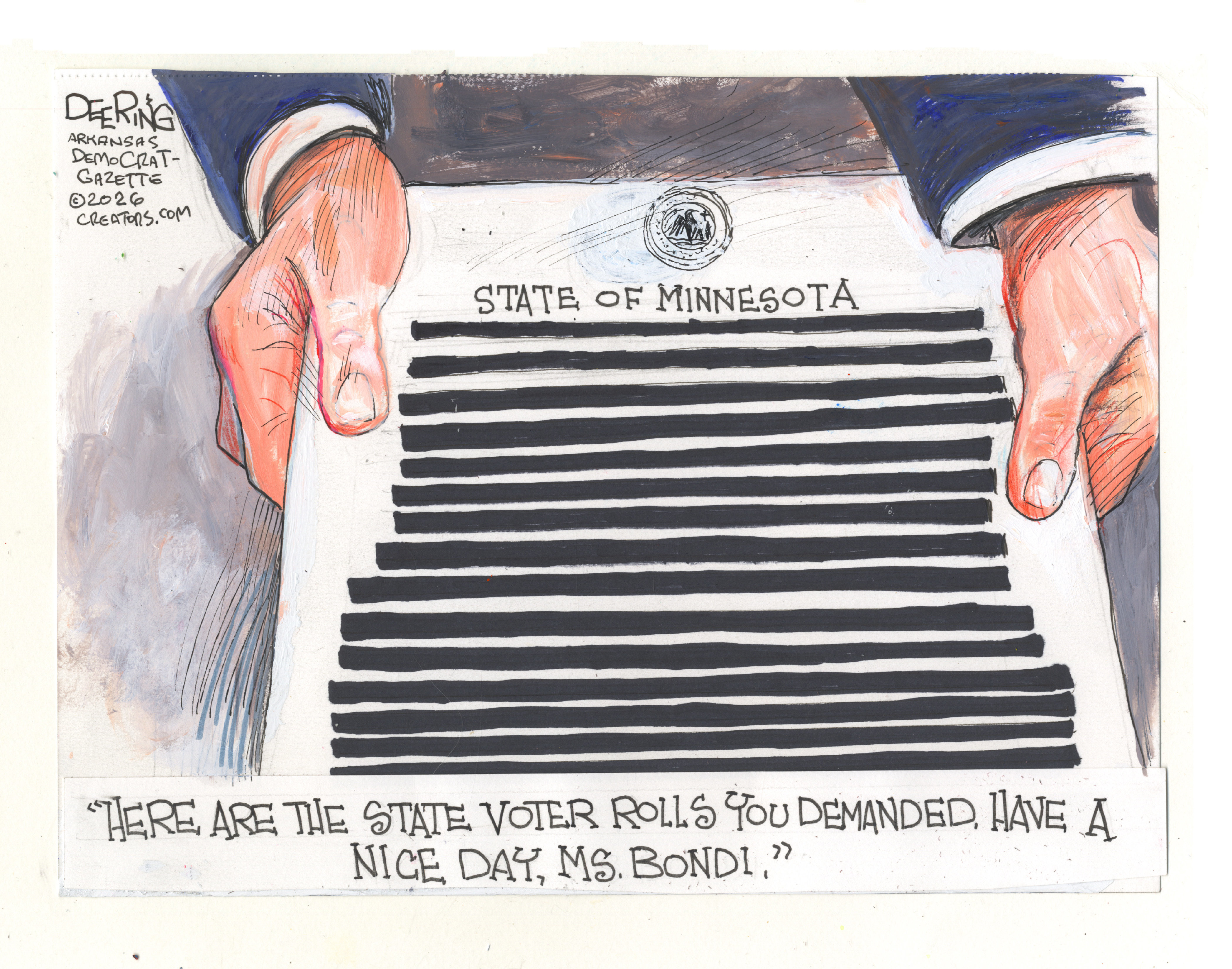

Political cartoons for January 30

Political cartoons for January 30Cartoons Friday's political cartoons include redacted rolls, a CBS snafu, and fascist fashion

-

Getting behind the wheel of the Dacia Duster in the Agafay Desert

Getting behind the wheel of the Dacia Duster in the Agafay DesertThe Week Recommends An off-road adventure in Morocco provided the perfect opportunity to test drive the newly launched hybrid SUV

-

Norway’s scandal-hit royals

Norway’s scandal-hit royalsIn the Spotlight Rape trial of Marius Borg Høiby, son of the crown princess, adds to royal family's ‘already considerable woes’