What the experts say

Renters with bad credit; Training kids for wealth; Prepaid tuition

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Renters with bad credit

Having a high credit score is vital not only for buying a house, said AJ Smith in Credit.com. It’s “important for renting as well.” If you’re seeking a new place to stay but have bad credit, you may need a friend or family member to co-sign your lease. It’s not a favor to be taken lightly: “Adding someone’s name to your lease is a big benefit for you and carries significant risk for them,” since it makes them equally responsible for paying the rent. If that’s not an option, you can offer to provide a landlord with a larger-than-usual security deposit. Having several months’ rent in hand may allow him or her to “overlook your poor credit scores.” It may also help to have a few references on hand from previous landlords who can vouch for your reliability.

Training kids for wealth

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The wealthy face a tricky if enviable task in “teaching the next generation how to be rich,” said Liz Moyer in The Wall Street Journal. Parents who want to prevent their offspring from squandering a hard-earned family fortune should start talking about money early, “well before children are grown, and then building on those early conversations as the time nears when kids will receive any inheritance.” Kids should know “the rags-to-riches story” that led to their family’s privilege, and should be well coached on “the need for discretion and privacy”on social media. Oversharing online can increase the risk of theft, and “even as adults, heirs need to learn how to handle questions about their personal circumstances” if they want to maintain their privacy.

Prepaid tuition

Tax-advantaged 529 savings accounts aren’t the only way to save ahead for your child’s college, said Kim Clark in Money. Some conservative investors find prepaid tuition plans to be an attractive option. “Offering identical tax benefits, these plans allow you to buy future tuition credits at a fixed price” to certain groups of schools, thus eliminating “the uncertainty of relying on investments that fluctuate in value to pay for college.” Look for plans that are backed by the “full faith and credit” of the state or participating schools, and carefully vet the rates and policies: “Some plans charge a premium over current tuition rates,” while others let you lock in current prices. And be aware that you’ll take a hit “if your child doesn’t attend a member school or you want a refund.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

6 exquisite homes with vast acreage

6 exquisite homes with vast acreageFeature Featuring an off-the-grid contemporary home in New Mexico and lakefront farmhouse in Massachusetts

-

Film reviews: ‘Wuthering Heights,’ ‘Good Luck, Have Fun, Don’t Die,’ and ‘Sirat’

Film reviews: ‘Wuthering Heights,’ ‘Good Luck, Have Fun, Don’t Die,’ and ‘Sirat’Feature An inconvenient love torments a would-be couple, a gonzo time traveler seeks to save humanity from AI, and a father’s desperate search goes deeply sideways

-

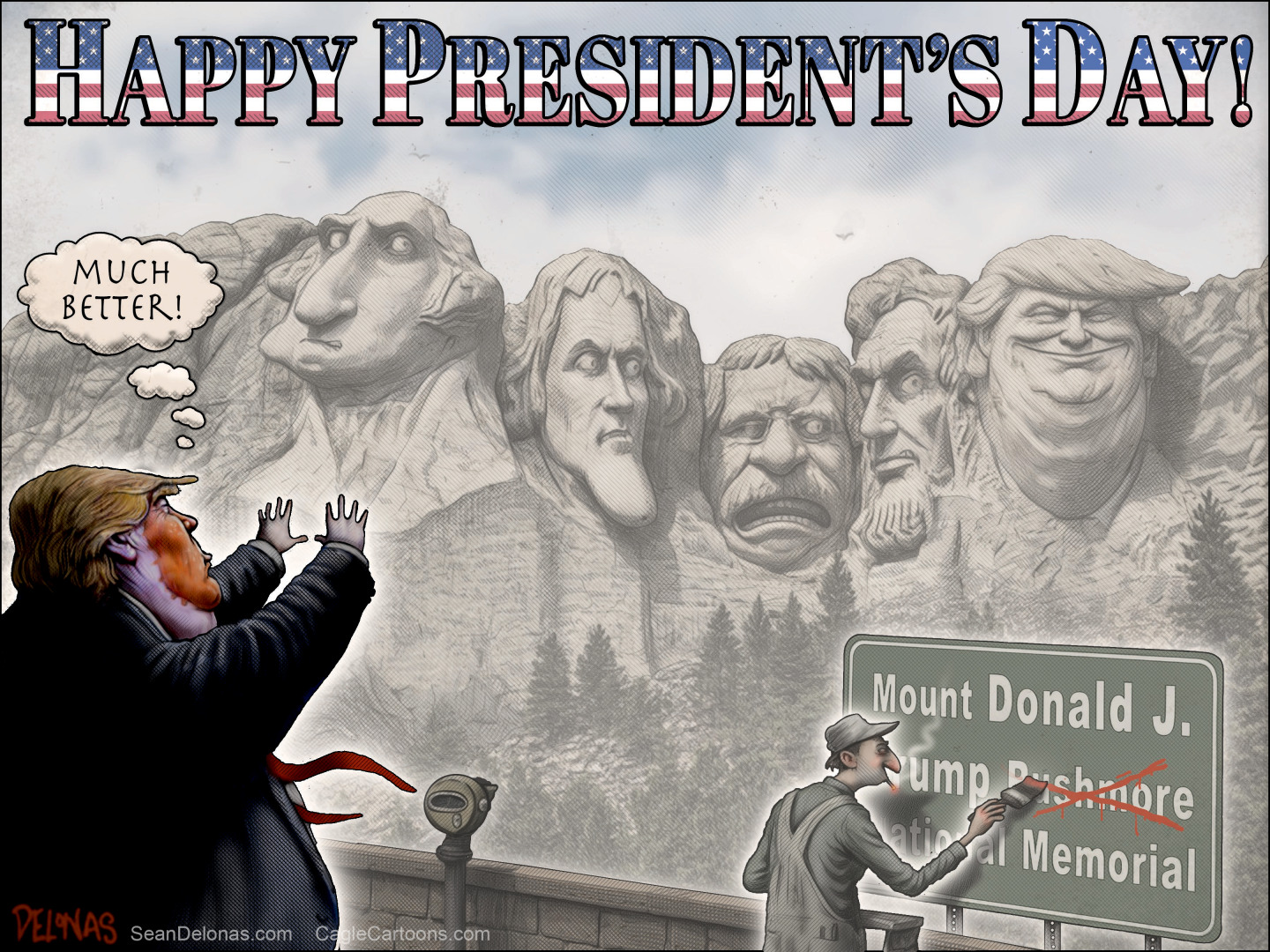

Political cartoons for February 16

Political cartoons for February 16Cartoons Monday’s political cartoons include President's Day, a valentine from the Epstein files, and more