Why are Americans still so pessimistic about the economy?

After a year of strong job creation and economic growth, economic confidence is still down in the dumps

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

2013 was — according to most major economic indicators — the best year of economic growth since the 2008 crisis.

Stocks had a bumper year, with the S&P 500 rallying 30 percent, its best performance since 1997.

Unemployment fell from close to eight percent to seven percent, with the fastest fall coming toward the end of the year. Underemployment fell from 14.4 percent to 13.2. Over two million jobs were created.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

GDP growth accelerated to above four percent by the end of the year. Industrial production rose fast. And business confidence was strong for most of the year.

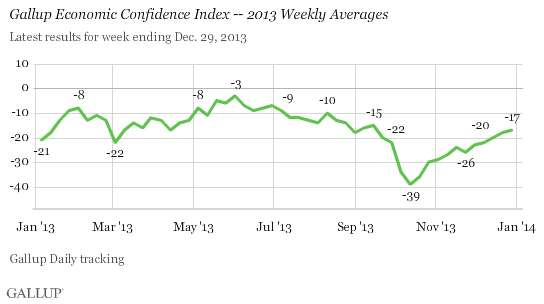

Yet consumer economic confidence according to Gallup remained quite negative all year long:

So what gives? After the best year of economic growth and job creation since 2008, why is confidence still so low? There are a few factors to consider:

1. Lots of people aren’t feeling the benefits of the recovery. While stocks have rallied to new highs, fewer Americans than ever actually own stocks. High rent costs, high food prices, and high gas prices are squeezing incomes, while wages remain stagnant. And while lots of jobs have been created, there are still lots of people out of work. So the recovery is a recovery for some — those who have benefited from boosted stock market prices, and who have managed to find employment — but less so for others whose wages are stagnant or whose food stamps are being cut.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

2. The government shutdown. The deep slump down to -39 in October coincided with the latest fiscal showdown and the first government shutdown since the 90s. Happily, the bipartisan Congressional budget deal reached in December suggests that the era of Congressional budget fights — and the uncertainty they create — may be over.

3. Economic confidence takes a long time to mend after a financial crisis — and it was absolutely shattered by the 2008 crisis. Economic confidence measured by Gallup has been negative for the entirety of the last five years. The current measurement of -17 is actually a relative high point along the road to recovery compared to 2008, when it fell as low as -65. So while confidence is negative, it has actually recovered substantially from the 2008, 2009, and 2010 lows.

Overall, this suggests that the negative economic confidence is not overly worrisome. While the recovery has been very unequal and very slow for most of the last five years, recent data shows that the recovery is finally beginning to gain some steam, and we are finally seeing stronger job creation and economic growth. As long as this growth continues, it will begin to translate into positive economic confidence numbers sooner rather than later.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

Crisis in Cuba: a ‘golden opportunity’ for Washington?

Crisis in Cuba: a ‘golden opportunity’ for Washington?Talking Point The Trump administration is applying the pressure, and with Latin America swinging to the right, Havana is becoming more ‘politically isolated’

-

5 thoroughly redacted cartoons about Pam Bondi protecting predators

5 thoroughly redacted cartoons about Pam Bondi protecting predatorsCartoons Artists take on the real victim, types of protection, and more

-

Palestine Action and the trouble with defining terrorism

Palestine Action and the trouble with defining terrorismIn the Spotlight The issues with proscribing the group ‘became apparent as soon as the police began putting it into practice’