How falling gas prices could accelerate economic growth

Incredibly, the U.S. is now on track to become the world’s biggest oil producer in just two years

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

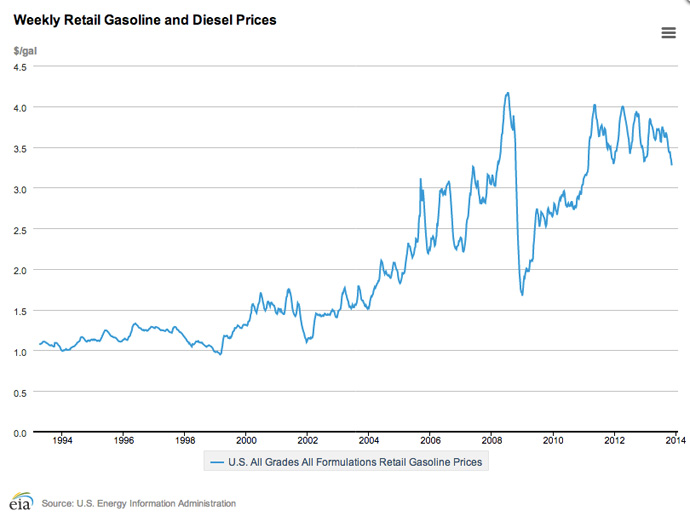

If you've recently noticed that you can fill up your tank without emptying your wallet, it's because gasoline prices have fallen back to their lowest point in over two years:

As you can see, energy prices rose strongly for several years prior to the financial crisis in 2008, fell precipitously during the crisis itself, and then started climbing again. But their current decline isn't just great news for you — it's great news for the economy too.

Rising energy prices can have powerful and deep economic effects. If energy prices — which impact most goods and services due to transport, electricity, and fuel costs — rise faster than wages, consumers have less disposable income to spend. This can decrease confidence and discourage and depress consumer spending and business hiring. An energy squeeze can also make previously affordable loan or mortgage repayments unaffordable, leading to defaults. These effects exacerbated the 2008 crisis, and the relatively elevated energy prices ever since have been a drag on the recovery.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

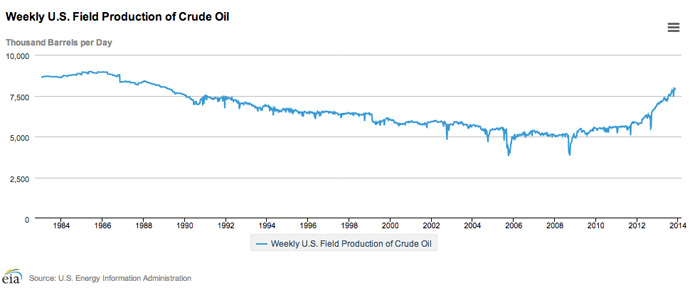

But since the pre-2008 price hikes, supply has been gradually adjusting to meet demand. With oil prices elevated, producing relatively difficult-to-extract oil, like shale, has become much more economically viable. Subsequently, U.S. oil production has rebounded strongly. In 2012, it grew more than in any year in the history of the domestic industry, which began in 1859:

Recent projections suggest that the United States will become the world’s biggest oil producer by 2015. So, although energy prices are still ultimately determined by global demand — one of the reasons for the run-up in price prior to 2008 was massively increased demand from developing economies in Asia, particularly China — supply is proving strong enough to keep prices down.

While the United States has recovered more strongly from the 2008 crisis than Europe, which is in a longer slump than the Great Depression, the recovery has still been relatively weak. Even as stock prices reach all-time highs, unemployment is still over seven percent, meaning there are over 12 million people who are looking for work who can’t find a job. Industrial production is still below its 2008 level. Goldman Sachs describes falling gas prices as a "favorable tailwind" for the U.S. economy. It’s a tailwind the economy needs, if we're ever going to get a stronger self-sustaining recovery.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.