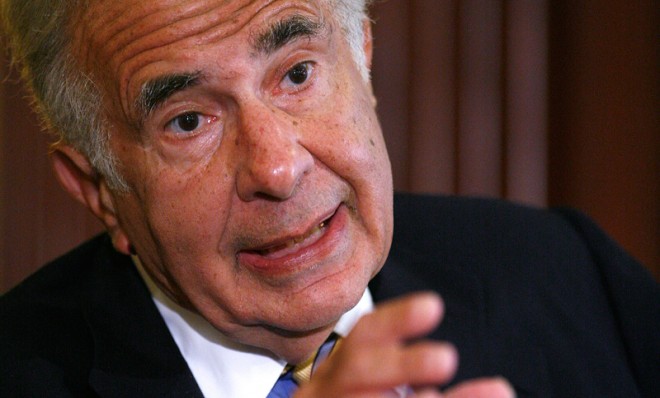

Is Carl Icahn good for Apple?

With two tweets, the activist investor bumped up Apple's market value by $9 billion

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

This afternoon, activist investor Carl Icahn moved billions of dollars of market value with a couple of Tweets:

Following Icahn's tweeting, shares of Apple jumped about 4.8 percent, a fresh direction for the stocks, which have slid some 23.4 percent over the last 12 months, due to investor worries that the tech giant's glory days are behind it.

Apple followed Icahn's tweet with the statement: "We appreciate the interest and investment of all our shareholders. Tim had a very positive conversation with Mr. Icahn today."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

After months of withering scrutiny from Wall Street, Apple may be breathing a sigh of relief for now.

But it could eventually rue the day Icahn came knocking at its door. Icahn is a known troublemaker, embroiling tech companies in bitter, drawn-out fights — just ask Dell, whose founder would like nothing more than the sight of Icahn's back.

Furthermore, while Icahn is not alone in seeing Apple as undervalued, he has plenty to gain personally from publicly supporting Apple. After all, he admittedly has a very large position in Apple, so that 5 percent bump was just fine by him.

Of more concern for Apple, he has already floated the idea that Apple use some of its enormous cash reserves to buy back more shares from investors. Apple this year already announced a very generous buyback program, which led to accusations that the company has become more concerned about pleasing investors than investing in new technologies. That raises concerns that Icahn sees Apple as a cash cow.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Of course, other investors are on board with Icahn's buyback call. "He's a vocal shareholder who can continue to put pressure on Apple to do the right thing for investors," an analyst told CNBC. "He's not going to add anything really on the product side."

All of which is likely to put more, not less, pressure on Tim Cook and company. "Icahn's predilection for forcing the issue at tech companies comes at a particularly delicate time for Apple, which is under a withering assault from the likes of Google and Samsung Electronics amid concerns Apple can still produce new hardware hits," says Jon Swartz at USA Today.

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.