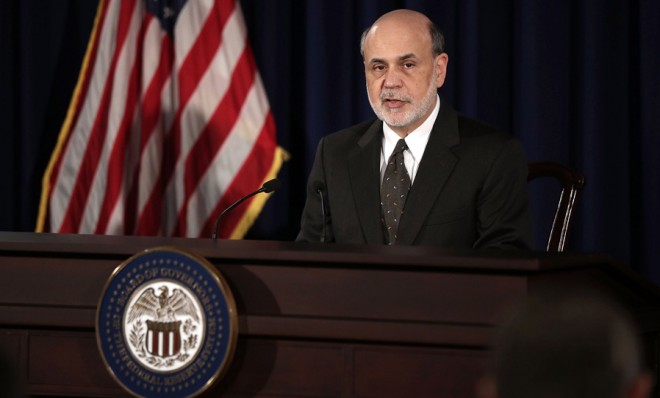

Ben Bernanke to Wall Street: It's the beginning of the end

The bearded one says the Fed could soon pull its support for the economy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

After almost a month of nervous speculation, jittery markets, and creeping interest rates, Fed Chairman Ben Bernanke met the press this afternoon following a two-day policy meeting of the Federal Open Market Committee. His chief message: The Fed is not ready to wind down its emergency stimulus programs just yet, an exit strategy that has come to be known as tapering. But if the economy continues to grow as projected, tapering will go into effect — as soon as this year.

Here, five key takeaways:

1. The Fed feels pretty positive about the next couple years of economic growth...

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In a statement, the FOMC said downside risks to the economy and the job market have "diminished since the fall," pointing to improvements in household spending, business investments, and housing.

The Fed projected the economy will grow by 2.3 percent to 2.6 percent in 2013, and to keep accelerating from there — to 3.0 to 3.5 percent in 2014, and 2.9 to 3.6 percent in 2015.

Unemployment, the committee predicts, will slide to between 5.8 percent and 6.2 percent by 2015.

How reliable the Fed's projections are is something else entirely. As Dylan Matthews pointed out on The Washington Post's Wonkblog:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In 2009 the Fed was predicting 4.2 percent growth in 2011. Awesome! But then in 2010 it revised that down to 3.85 percent growth. And in 2011 they revised it further to 2.8 percent growth. And when all was said and done, the economy only grew about 2.4 percent that year. The Fed projected growth almost twice as fast as what actually happened. [Washington Post]

2. ...And that may mean quantitative easing's days are numbered:

In what amounted to the Fed's strongest signal yet that its stimulus program has run its course, Bernanke said the FOMC "anticipates that it would be appropriate to moderate" the central bank's monthly purchase of billions of dollars worth of Treasurys and mortgage-backed securities. Bernanke suggested that "if the subsequent data remain broadly aligned with our current expectations for the economy" (a big if), then it would not be necessary for the Fed to continue propping up the economy with quantitative easing.

Bernanke said that tapering could begin later this year, and that the Fed could stop purchasing assets altogether by mid-2014.

Bernanke added that inflation, along with the unemployment rate and GDP growth, would be a factor in the Fed's decision. "We also want to avoid inflation that's too low," he said, suggesting the bank is concerned about deflationary pressures on the economy.

3. 7 may be the lucky number:

Even though the economy is growing steadily, and the U.S. is adding jobs at a moderate pace, the unemployment rate is still at 7.6 percent. "Pretty far from where we should be satisfied," Bernanke said.

Bernanke insisted that a lower unemployment rate would not automatically "trigger" an end to quantitative easing. However, the Fed does have some numbers in mind. For the Fed to end the bond-buying program, unemployment will need to be closer to 7 percent. And it will need to fall to around 6.5 percent for the central bank to start raising its benchmark interest rate, which has been at near zero for years in a bid to encourage lending.

4. Rising interest rates could be a good thing:

In recent weeks, investors anticipating a possible tapering have started selling off bonds, pushing the yield on 10-year Treasurys to 2.2230 percent on June 12, from 1.624 percent on May 2. At the press conference, Bernanke said the spike in rates, which raises the U.S.'s borrowing costs, isn't necessarily "a bad thing." While nervousness around the Fed's next move was one factor driving the rise, another was general optimism about the direction of the economy, as investors gingerly transition from the safe haven of government bonds to riskier investments like stocks. "That's a good thing," Bernanke said.

5. Wall Street is still fretting:

Despite all the positive news (the economy is getting better!) the markets slid over concerns that the Fed would begin winding down its support of the economy (no more ridiculously easy money!). The Dow Jones Industrial Average closed down by more than 200 points, or 1.3 percent.

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.