The news at a glance

Dell buyout sparks bidding war; Buffett increases Goldman Sachs stake; Citi must clean up money-laundering act; Teen becomes Yahoo millionaire; Boeing 787 completes test flight

Tech: Dell buyout sparks bidding war

A bidding war is brewing over Dell, said Sharon Terlep and David Benoit in The Wall Street Journal. The PC-maker’s founder and chief executive, Michael Dell, has teamed up with private-equity firm Silver Lake to take his company private for $24.4 billion, or just under $13.65 per share. But last week, a special committee of Dell board members said it had received a “potentially superior” offer from private-equity firm Blackstone Group, which said it would pay $14.25 a share. Carl Icahn, who owns about 4.6 percent of Dell’s outstanding shares, has also submitted a rival bid to oppose the management-led buyout, and is proposing $15 per share.

The competing bids may have the company’s founder worried, said Greg Roumeliotis and Soyoung Kim in Reuters.com. As part of his deal with the Dell board, “Michael Dell has to explore the possibility of working with third parties on alternative offers.” But he is reportedly “very concerned that Blackstone’s offer would dismantle” the company and jeopardize his own future there. Blackstone has already approached at least one outsider “to run Dell if it takes over the company.” Meanwhile, the company’s shares hit 10-month highs, “indicating investors expect a deal to be done at a price higher than the Silver Lake bid.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Investors: Buffett increases Goldman Sachs stake

Warren Buffett is about to become one of Goldman Sachs’s biggest shareholders, and he won’t have to pay a dime, said Noah Buhayar and Christine Harper in Bloomberg.com. In 2008, Buffett received five-year warrants in exchange for investing $5 billion in Goldman Sachs. Under the original deal, Buffett had a right to buy 43.5 million Goldman Sachs shares for $115 apiece. But under the revised deal, announced last week, Buffett will simply receive a 2 percent stake in the company, saving him transaction costs and locking him in as one of the firm’s top stakeholders.

Banks: Citi must clean up money-laundering act

Citigroup has been ordered to tighten up its anti-money-laundering controls, said Donal Griffin in The Washington Post. In a consent order last week, the Federal Reserve ordered the bank to explain what measures it takes to stem the flow of illicit funds. Last year, the Office of the Comptroller of the Currency criticized the bank for failing to conduct due diligence on its customers and dragging its heels in issuing “suspicious activity reports.” Citi now has 60 days to submit a written plan outlining its compliance and internal controls.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Acquisitions: Teen becomes Yahoo millionaire

Yahoo just minted a teenage millionaire, said Oliver Joy in CNN.com. The Silicon Valley company has acquired Summly, a 17-year-old London teenager’s tech startup, as part of a “multimillion-dollar deal.” Nick D’Aloisio, whose past investors include Hong Kong billionaire Li Ka-shing and actors Ashton Kutcher and Stephen Fry, launched Summly when he was just 15. Its main product is a mobile app that “delivers automated snapshots of news stories” to mobile users; it won one of Apple’s Best Apps of 2012 awards. A Yahoo executive said the app provides “a simple and elegant way to find the news you want, faster than ever before.”

Airlines: Boeing 787 completes test flight

The Boeing Dreamliner’s first test flight was “utterly uneventful,” said Jason Paur in Wired—and that “was the best possible outcome” for Boeing. The company this week tested a redesigned battery system for its troubled jet after weeks of scrambling to fix an issue that has grounded all 50 Dreamliners worldwide since January. The test flight was part of a certification plan approved by the Federal Aviation Administration that Boeing hopes will soon get its fleet cleared for service.

-

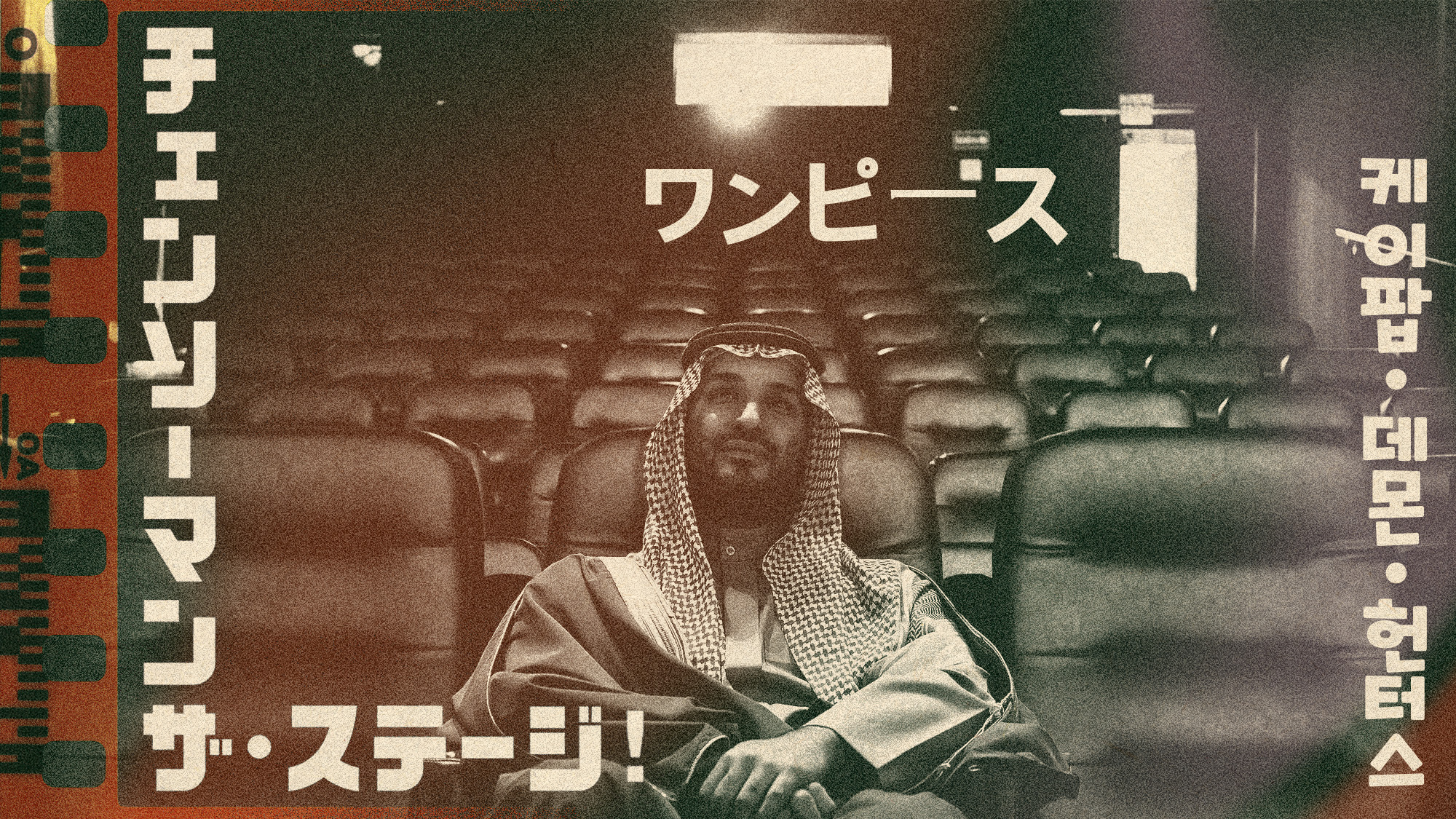

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Scoundrels, spies and squires in January TV

Scoundrels, spies and squires in January TVthe week recommends This month’s new releases include ‘The Pitt,’ ‘Industry,’ ‘Ponies’ and ‘A Knight of the Seven Kingdoms’

-

Venezuela: The ‘Donroe doctrine’ takes shape

Venezuela: The ‘Donroe doctrine’ takes shapeFeature President Trump wants to impose “American dominance”

-

The news at a glance...International

feature International

-

The bottom line

feature Youthful startup founders; High salaries for anesthesiologists; The myth of too much homework; More mothers stay a home; Audiences are down, but box office revenue rises

-

The week at a glance...Americas

feature Americas

-

The news at a glance

feature Comcast defends planned TWC merger; Toyota recalls 6.39 million vehicles; Takeda faces $6 billion in damages; American updates loyalty program; Regulators hike leverage ratio

-

The news at a glance...United States

feature United States

-

The bottom line

feature The rising cost of graduate degrees; NSA surveillance affects tech profits; A glass ceiling for female chefs?; Bonding to a brand name; Generous Wall Street bonuses

-

The news at a glance

feature GM chief faces Congress; FBI targets high-frequency trading; Yellen confirms continued low rates; BofA settles mortgage claims for $9.3B; Apple and Samsung duke it out

-

The week at a glance...International

feature International