The Fed's historic bid to lower the jobless rate

The central bank just made a massive commitment to rejuvenating the labor market. Congress, on the other hand, is essentially MIA

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

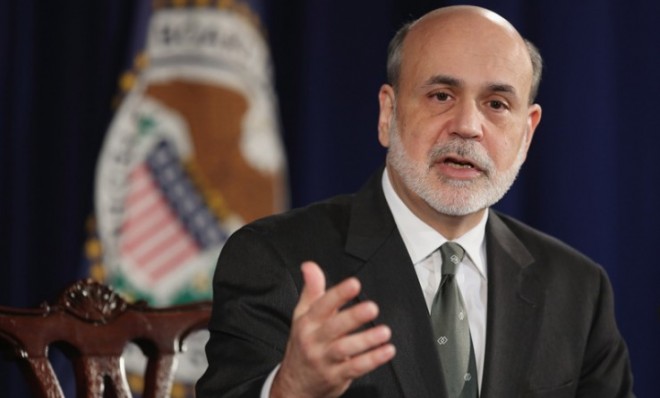

The Federal Reserve has come a long way since the days of former Chairman Alan Greenspan, who used to be an expert practitioner of Fedspeak, a dialect (only remotely related to English) that befuddles mere mortals with its utter inscrutability. His successor, Ben Bernanke, has pledged to make the Fed's intentions more transparent, and on Wednesday he made good on that promise, with the central bank announcing that it would keep its benchmark interest rate target at ultra-low levels until the unemployment rate dropped below 6.5 percent or the inflation rate topped 2.5 percent. It is the first time in history that the Fed has spelled out such a specific target, rolling back decades of conventional wisdom that said the Fed was far too influential to ever fully reveal its thinking to markets.

The Fed also said it would continue an open-ended plan to purchase $40 billion worth of mortgage-backed securities a month. In addition, the central bank will buy $45 billion worth of Treasuries a month, replacing a program in which it switched out short-term government bonds for long-term ones. Taken together, the Fed's policies are intended to ease the cost of borrowing and encourage economic activity — with the ultimate goal of lowering the stubbornly high unemployment rate, which is currently at 7.7 percent.

Bernanke's foray into openness reflects more than just a desire to guide the economy with a more explicit hand, or to assure markets of the central bank's continued support. As Binyamin Appelbaum at The New York Times notes, Bernanke is "formalizing the Fed's commitment to reduce unemployment and breaking with decades during which limiting inflation was the central bank's constant priority." The Fed has a dual mandate of maximizing employment and keeping prices stable, and it appears the central bank views pervasive joblessness as a far greater threat to the economy than the prospect of runaway prices.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There are, of course, concerns that the Fed's balance sheet is so large that the central bank will be unable to backtrack quickly enough if inflation begins to rise. But leaving aside the merits of its policy, the most striking aspect of the Fed's move is its continued focus on the problem of widespread unemployment — to use a hackneyed term, it's "laser-like." Congress, on the other hand, seems focused on anything but. There is a lot of talk about cutting deficits and reforming the tax code, but most analysts say neither will do much for the jobless in the short term. President Obama has proposed a (rather piddling) $50 billion in infrastructure investment as part of negotiations to avoid the fiscal cliff, but who knows if that will survive any budget deal with the GOP. And it's not clear whether Congress will extend unemployment benefits that will run out for 2 million people shortly after Christmas.

It seems the best that can be hoped for is that Congress doesn't actively hurt the economy by falling off the fiscal cliff — an overworked, likely inapt phrase that was coined, oddly enough, by Bernanke himself. On second thought, perhaps the central bank has a little more work to do on its communication skills.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryu Spaeth is deputy editor at TheWeek.com. Follow him on Twitter.