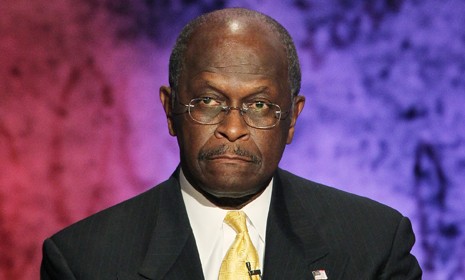

Herman Cain's 9-9-9 tax plan: 5 reasons to reject it

Cain's catchily named economic plan took center stage at Tuesday's debate — but now that it's under scrutiny, its flaws are surfacing

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The biggest star of Tuesday night's Republican presidential debate may not have been a candidate, but rather new GOP frontrunner Herman Cain's 9-9-9 tax plan. Cain wants to replace the entire tax code with a flat 9 percent personal income tax, a 9 percent corporate income tax, and a 9 percent national sales tax. The plan so saturated the debate that the number 9 was mentioned a hefty 85 times, and 9-9-9 has dominated campaign coverage ever since. But Cain's plan is "not getting sterling reviews," even from conservatives, says Aaron Blake at The Washington Post. Here, five reason people don't like 9-9-9:

1. The plan wouldn't bring in enough revenue

"Cain claims his plan is revenue neutral," says Brian Montopoli at CBS News, but a Bloomberg analysis found that if the 9-9-9 regime were in place in 2010, the federal government would have collected $2 trillion in revenue — $200 billion less than what the current system produced. In 2007, before the recession, the 9-9-9 plan would have brought in $1.3 trillion, or 9.2 percent of GDP, says Michael Linden at ThinkProgress. We actually collected 18.5 percent of GDP that year, suggesting "the 9-9-9 plan would cut federal revenue in half!"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. And it would open the door to dangerous new taxes

Cain is right that we need to fundamentally change our tax system, but introducing a new national sales tax would foolishly give Congress a new revenue stream to play with, says Matt Lewis at The Daily Caller. "And no matter what Cain says, it would only be a matter of time before taxes would be raised by others to, say, 11-11-11 — or 14-14-14." Worse, Cain's plan for a national sales tax opens the door to a value-added tax (VAT), says Dean Clancy at FreedomWorks. And a VAT is "the most insidious of all taxes, because it is built into the price of everything" so consumers never see it — and politicians love to raise it.

3. It's "shockingly regressive"

When you look past its "silly optics," Cain's 9-9-9 plan would usher in "a huge tax increase on lower-income and middle-class Americans," says New York University tax law expert Daniel Shaviro at his blog. It's "shockingly regressive." Worse, "with no tax on capital gains, the rich" — who make much of their money from investments — "would pay almost nothing" in taxes, says Bruce Bartlett at The New York Times. This "exceptionally ill conceived" plan would be "a distributional monstrosity."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

4. And probably unconstitutional

Cain wants to freeze his three taxes at 9 percent by requiring two-thirds of the Senate to approve any change to the tax rates. The biggest problem with that idea, says Brian Beutler at Talking Points Memo, is that it's "likely unconstitutional." Absent a constitutional amendment, "Senate rules could potentially be changed," says CBS's Montopoli, "but doing that would itself require a two-thirds vote — which isn't realistic in the divided chamber — and the Senate doesn't have the power to bind the House."

5. Plus, the idea is a political non-starter

Not only is the 9-9-9 idea a featherweight "slogan masquerading as a plan," but Cain has no "political strategy to pass it," says Mytheos Holt at FrumForum. It would never get enough votes in Congress, and if he hopes to use the "bully pulpit" to sell it, he's dabbling in "magical thinking" — ask President Obama how well that works. Even conservative economist Gary Robbins, "the paid campaign consultant who scored the plan for Cain, said the idea was more of a theory than a politically viable solution," says Reid J. Epstein at Politico. Ouch.