Can S&P scare Congress into shrinking the deficit?

The ratings agency slashes America's credit outlook, warning of major financial risks if politicians fail to reach a deal on reducing our long-term deficits

Standard & Poor's, one of the country's most influential credit-rating agencies, "fired a warning shot on Monday" about the growing U.S. debt load. S&P downgraded its credit outlook for the U.S. from "stable" to "negative," meaning it believes there is a one-in-three chance it will lower the government's sterling "AAA" rating within two years. The agency pointed to the political gridlock in Washington, and questioned whether President Obama and Republicans would agree on a plan to lower the deficit and reduce the national debt before the 2012 elections. Will S&P's downgrade get Obama and the Republicans on the same page?

This should spur Washington to act: Hopefully, this warning will act "as a catalyst" for politicians to agree on a "credible" package of reforms, says Mohammed El-Erian, CEO of bond giant PIMCO, in the Financial Times. Failure to do so would weaken the dollar and could drive up borrowing costs, "thereby undermining investment, employment and growth." The "time has come" for the U.S. "to take better control of its fiscal destiny — for the sake of American society and for the well being of the global economy."

"El-Erian: A warning for the US, and for the global economy"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

If only our political system wasn't broken: S&P basically said that it has no confidence in our political leaders "because they're pretty much all spineless cowards," says Hamilton Nolan at Gawker. And the Treasury's response — that S&P "underestimates the ability of America's leaders to come together" — is really "laughable" considering the partisan bickering that has gripped Washington for years. But, hey, "at least the problem is contained in a single sector: the economy."

"The American economy is collapsing some more today"

Who cares what S&P says? The agency "has a horrible track record for judging credit worthiness," says Dean Baker at the Center for Economic and Policy Research. It gave companies like Lehman Brothers, Bear Stearns, and Enron "top ratings" until they collapsed — and also gave good ratings to mortgage-backed securities that turned out to be junk. "Investors are aware that S&P's judgement does not mean very much."

"If a negative S&P outlook for the U.S. explains a drop in stock prices..."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

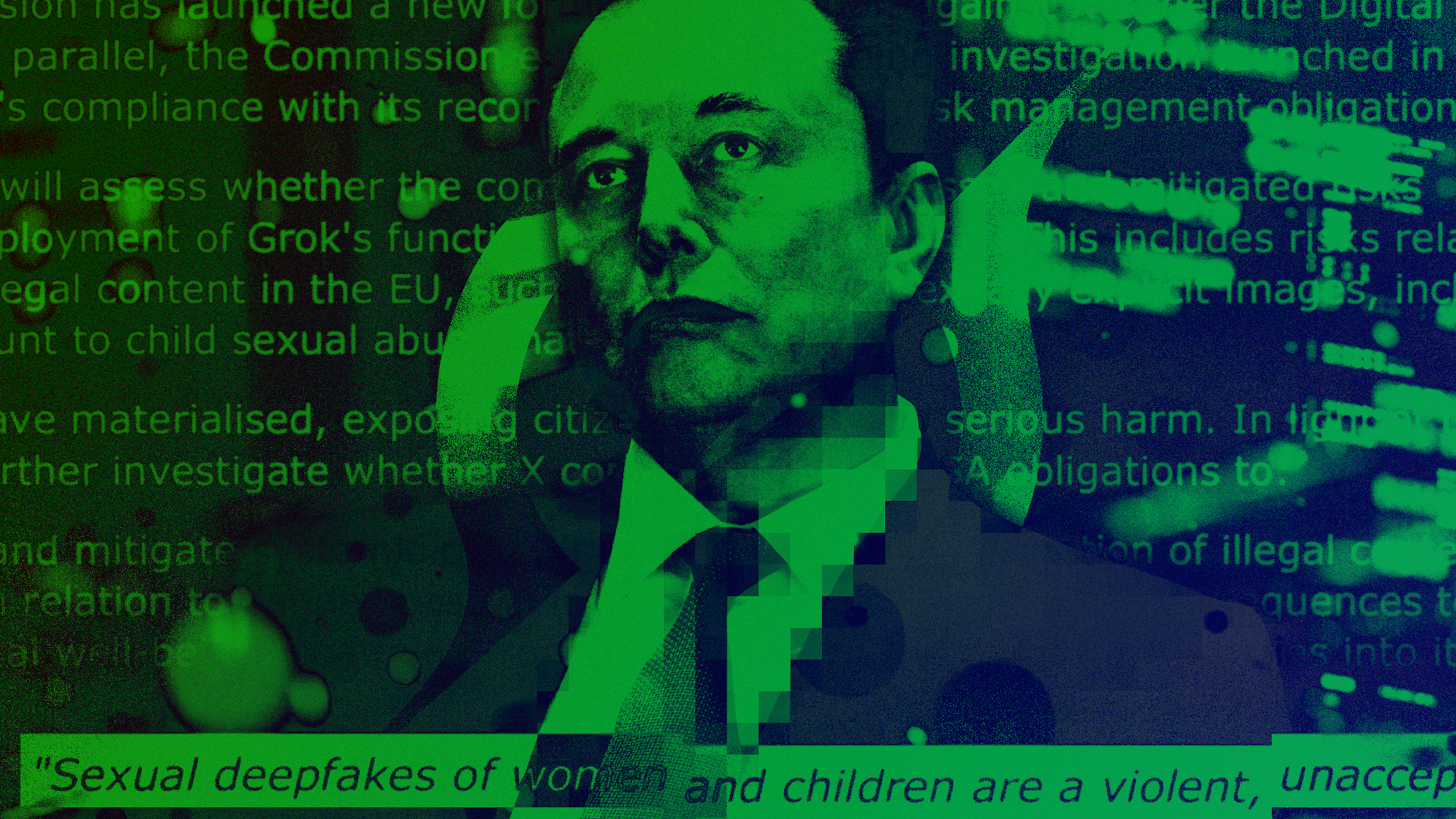

Grok in the crosshairs as EU launches deepfake porn probe

Grok in the crosshairs as EU launches deepfake porn probeIN THE SPOTLIGHT The European Union has officially begun investigating Elon Musk’s proprietary AI, as regulators zero in on Grok’s porn problem and its impact continent-wide

-

‘But being a “hot” country does not make you a good country’

‘But being a “hot” country does not make you a good country’Instant Opinion Opinion, comment and editorials of the day

-

Why have homicide rates reportedly plummeted in the last year?

Why have homicide rates reportedly plummeted in the last year?Today’s Big Question There could be more to the issue than politics

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred