Citibank's 'newfangled' credit card: Too many bells and whistles?

Banks are rolling out a new generation of credit cards with buttons, lights, and digital read-outs. Do we really need them?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

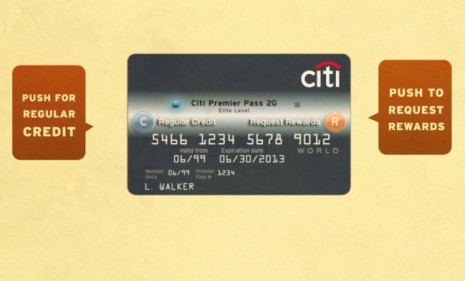

Citibank is about to roll out a flashy new version of the humble credit card equipped with a micro-engine allowing users to redeem their accumulated rewards points and potentially get their purchase for "free" anytime they swipe. Other card issuers are following suit, reports The New York Times, creating "newfangled" credit cards that feature batteries, lights, and "fraud protections baked right into the plastic." Will these 2G cards make life easier for consumers?

Everyone wins: This is "an idea whose time has come," says Dennis Moroney, a payments consultant quoted by Wallet Pop. Allowing consumers to pay with rewards points makes life easier both for them and for banks who "get the value of all those accrued points off their books." Other "high-tech" features could have "significant security benefits" — which are long overdue here in the U.S.

"New credit card technology will let you pay with reward points"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Too many bells and whistles: On a purely functional level, this "sets off my design aesthetic gag reflex," says JJ Sutherland at NPR. Shouldn't cards be made simpler, not more complicated? "Most people I know want fewer credit cards, less complexity, simpler interfaces, not more." File this one under "do we really need that?"

"Credit card makeover. Now more complicated!"

The problem isn't aesthetic — it's practical: Just have a think about "what's really happening here," says Brad Tuttle at Time. These new cards will be even "bigger enablers" of material overconsumption "than the standard credit cards of yore (and that's saying a lot)." While all that button pushing and hoping for "instant freebies" might seem fun, you'll just be left paying higher fees and attempting to keep up with the interest on unnecessary purchases.

"Citibank's credit card makeover: why I'm already not a fan of 2G plastic"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com