Recession: The sequel?

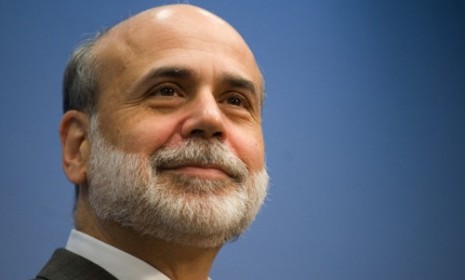

Federal Reserve chairman Ben Bernanke tells Congress the economy is still fragile and "may need more assistance." Is there still danger of a second recession?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Amid calls from Tea Partiers and other conservatives to reduce the federal deficit, Federal Reserve Chairman Ben Bernanke on Wednesday warned Congress not to radically reduce spending or raise taxes. Not yet, anyway. The budget is on an "unsustainable path," he said, and the government needs a plan for dramatically reducing it — but doing so now might derail the nation's "fragile" economic recovery. The Fed chairman also raised the option of using additional short-term stimulus spending to keep the economy on track. Is Bernanke overplaying the dangers, or are we really in jeopardy of slipping back into recession? (Watch a Reuters report about Bernanke's testimony)

"We're falling into a double-dip recession": The stimulus is one of the only reasons we're not already in a double-dip recession, says former Labor secretary Robert Reich on his website. We desperately need more to keep the recovery alive, "but the deficit crazies in the Senate, who can’t seem to differentiate between short-term stimulus (necessary) and long-term debt (bad)" are determined to shoot down any new stimulus spending. That will send us into a double-dip recession.

"We're falling into a double-dip recession"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Bernanke is being alarmist: The argument that we're sinking back into recession is pretty "flimsy," says Alan Reynolds in The Wall Street Journal. The truth is that "double-dippers" are playing accounting tricks to "make mediocre job gains appear much worse than they are." Why? Robert Reich and other "big government Democrats" are trying to scare the rest of us so we'll let them continue their reckless deficit spending.

"Don't believe the double-dippers"

Any chance of a new recession is scary: The economic picture isn't "rosy," says Annalyn Censky in CNN Money. Companies still aren't hiring, the Gulf of Mexico is awash with oil, Europe is sinking in a debt crisis. But major companies are reporting solid growth, and consumers are starting to spend again. Some economists say the chances of a double-dip recession are around 20 percent — down from 25 percent at the start of the year — although "any chance of a double dip is nothing to shrug off."

"Double dip recession: What are the odds?"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com