Mortgage giants’ contagion, Aon’s expansion

Fannie and Freddie’s cold spreads to Lehman and other financial players. Insurance broker Aon buys one of its last privately held rivals, Benfield. And Boeing plays a high-stakes game of poker with the Air Force.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

NEWS AT A GLANCE

Fannie, Freddie, and Lehman on the edge

As shares of mortgage giants Fannie Mae and Freddie Mac dive, few financial firms have been hurt as much as Lehman Brothers. Freddie Mac’s stock is now down 95 percent from a year ago, while Lehman’s has dropped 76 percent. “Lehman’s business is broader than Fannie and Freddie, but the link is that they were doing the same thing—packaging mortgages and selling them,” said Ladenburg Thalmann analyst Richard Bove, who thinks Lehman is ripe for a hostile takeover. (The New York Times) Meanwhile, investors are betting that the government will bail out Fannie and Freddie. The most likely rescue scenario is that common shareholders will lose their investment and bondholders won’t; holders of preferred shares are a toss-up. (Bloomberg)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Insurance broker Aon buys Benfield

Aon Corp., the world’s biggest insurance broker, agreed to buy British rival Benfield Group for $1.6 billion in cash. The purchase will expand Aon’s operations in Florida and the U.S. Southeast, Asia, and Latin America. Aon said it will finance the buyout without outside financing. (Bloomberg) The offer values Benfield shares 29 percent higher than their closing price yesterday. Both boards approved the merger. Benfield CEO Grahame Chilton, who will become vice chairman of Aon, said previous suitors had “champagne tastes and beer money,” but that this offer “is fair value for both parties.” (Reuters)

Gap profit rises 51 percent

Clothing retailer Gap Inc. reported a 51 percent jump in quarterly profit, to $229 million, beating estimates by about 2 cents a share. However, revenue was down 5 percent, and same-store sales dropped 10 percent in the quarter, including a 16 percent drop at Old Navy stores in North America. (Los Angeles Times) To revive Old Navy, Gap Inc. appointed retail veteran Tom Wyatt president of the unit, a position he’s held on an interim basis since February. (San Francisco Chronicle) Wyatt’s “appointment is a positive signal,” said CL King & Associates analyst Mark Montagna. Gap was able to profit from cutting costs and slashing inventory, thus limiting price-dampening clearance sales. (MarketWatch)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Boeing rolls the dice on Air Force contract

In the latest twist in the $35 billion Air Force tanker contract drama, Boeing says it may withdraw from the competition against EADS and Northrop Grumman, unless it gets six more months to put together a bid. Currently, bids are due Oct. 1. It’s a risky gamble for Boeing, which already lost the contract once to Northrop. But analysts say it could pay off, if Congress won’t accept a no-bid contract. And the Air Force already blinked once last year, when Northrop threatened to pull out. (BusinessWeek.com) Boeing could also be betting that November elections will bring a more favorable political atmosphere. “I get a feeling that they are perhaps playing delay tactics,” said aviation consultant Michel Merluzeau at G2 Solutions in Kirkland, Wash. (Bloomberg)

-

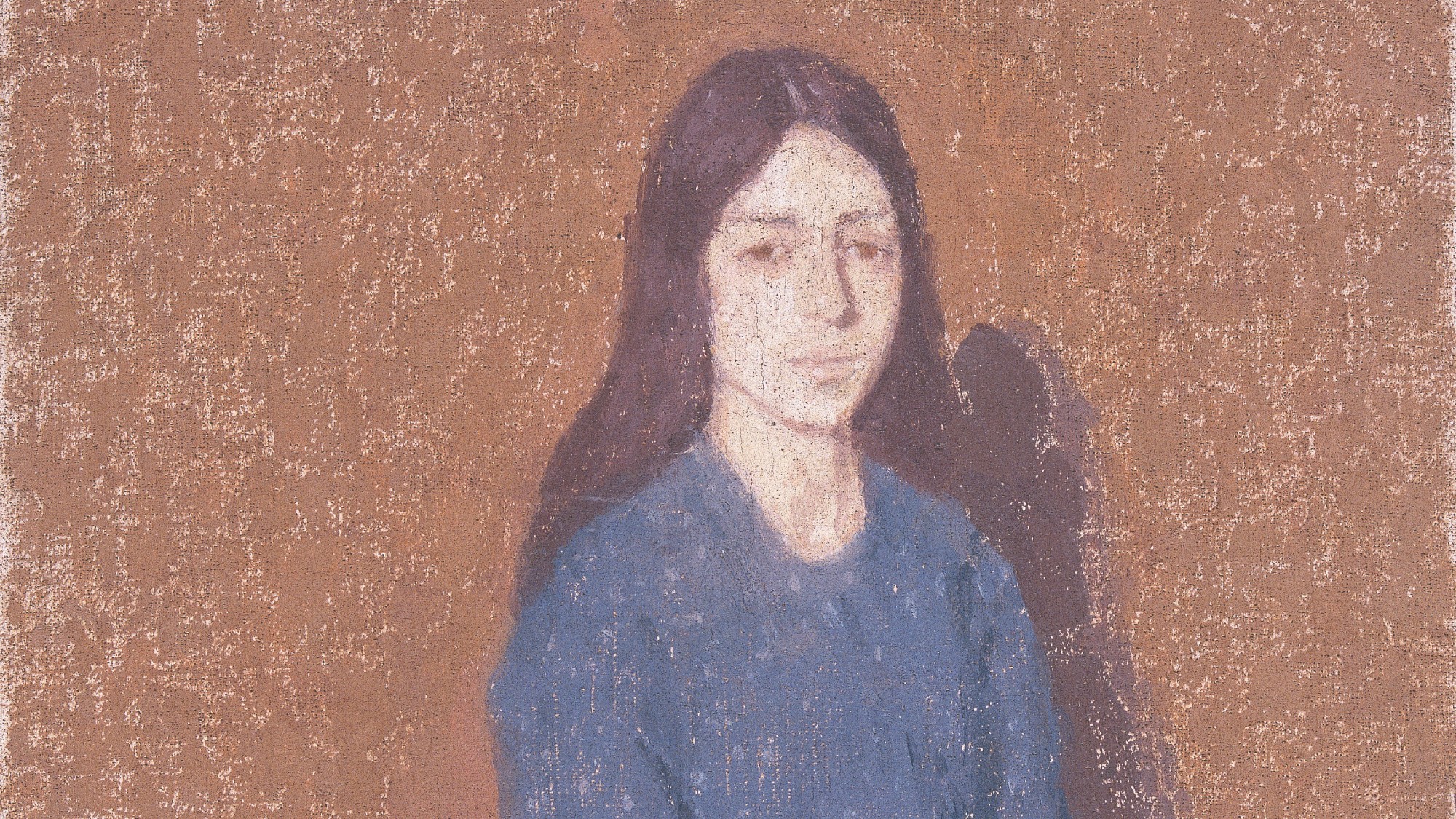

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10