Saving Homes, Selling Dell

U.S. officials and major banks are nearing a deal to help out subprime mortgage holders. Dell sees a healthy rise in profits but a discouraging drop in market share. And Sprint Nextel rejects a $5 billion investment offer.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

NEWS AT A GLANCE

U.S. subprime deal reported close

Treasury Secretary Henry Paulson and other officials are close to reaching a deal with major U.S. lenders to temporarily freeze interest rates on certain subprime mortgages, The Wall Street Journal reported. The details could be announced as early as next week, but the banks have reportedly agreed to extend lower introductory rates for some borrowers at risk of defaulting. (Reuters) When you get regulators and private lenders together, “you’re likely to come up with something that will work both in the marketplace and honor the sanctity of the contracts involved,” said Wayne Abernathy of the American Bankers Association. (Bloomberg)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Dell earnings up, market share down

Dell reported a 27 percent rise in profits, to $766 million, but its stock dropped about 10 percent in extended trading on a cautious forecast. (MarketWatch) In the company’s first earnings conference call in more than a year, Dell executives said near-term earnings could take a hit from continuing restructuring costs. “The bottom line is that people were disappointed,” said Endpoint Technologies analyst Roger Kay. “People expected more than they got.” (Reuters) Desktop PC sales fell 1 percent, while laptop sales rose 19 percent—but both numbers were far below rival Hewlett-Packard’s. HP now has 20 percent global market share; Dell, 15 percent. (AP in Yahoo! Finance)

Sprint rejects money-for-CEO offer

Sprint Nextel rejected a $5 billion investment offer from a group that includes former Sprint chairman Tim Donahue, South Korea’s SK Telecom, and Providence Equity Partners, according to several published reports. One of the conditions was that Donahue, who was also Nextel chief executive, would return as Sprint CEO. (MarketWatch) Embattled Sprint CEO Gary Forsee quit in October, and analysts said new leadership is Sprint’s most pressing need right now. (The New York Times, free registration required) “Sprint is suffering from a lot of problems, but I do not think they’re facing a liquidity crunch,” notes Stanford Group analyst Michael Nelson. (Reuters)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Blue-blood social networking

In their own way, social networking sites exclusively for the rich make a lot of sense. Wealth likes to hang out with wealth, and the rules that govern blue-blood social clubs are pretty easy to transfer to the Internet. The best-known site, aSmallWorld, is suffering from growing pains, though, as invitations to join are sold on eBay or given to commoners. Stephen Martiros, a managing director of the Boston-based CCC Alliance of rich families, says that when sites lose exclusivity, the wealthy leave. “If you have one guy worth $100 million sitting at a table with a guy worth $1 million,” he notes, “only one of them is going to be excited to be there.” (The Wall Street Journal)

-

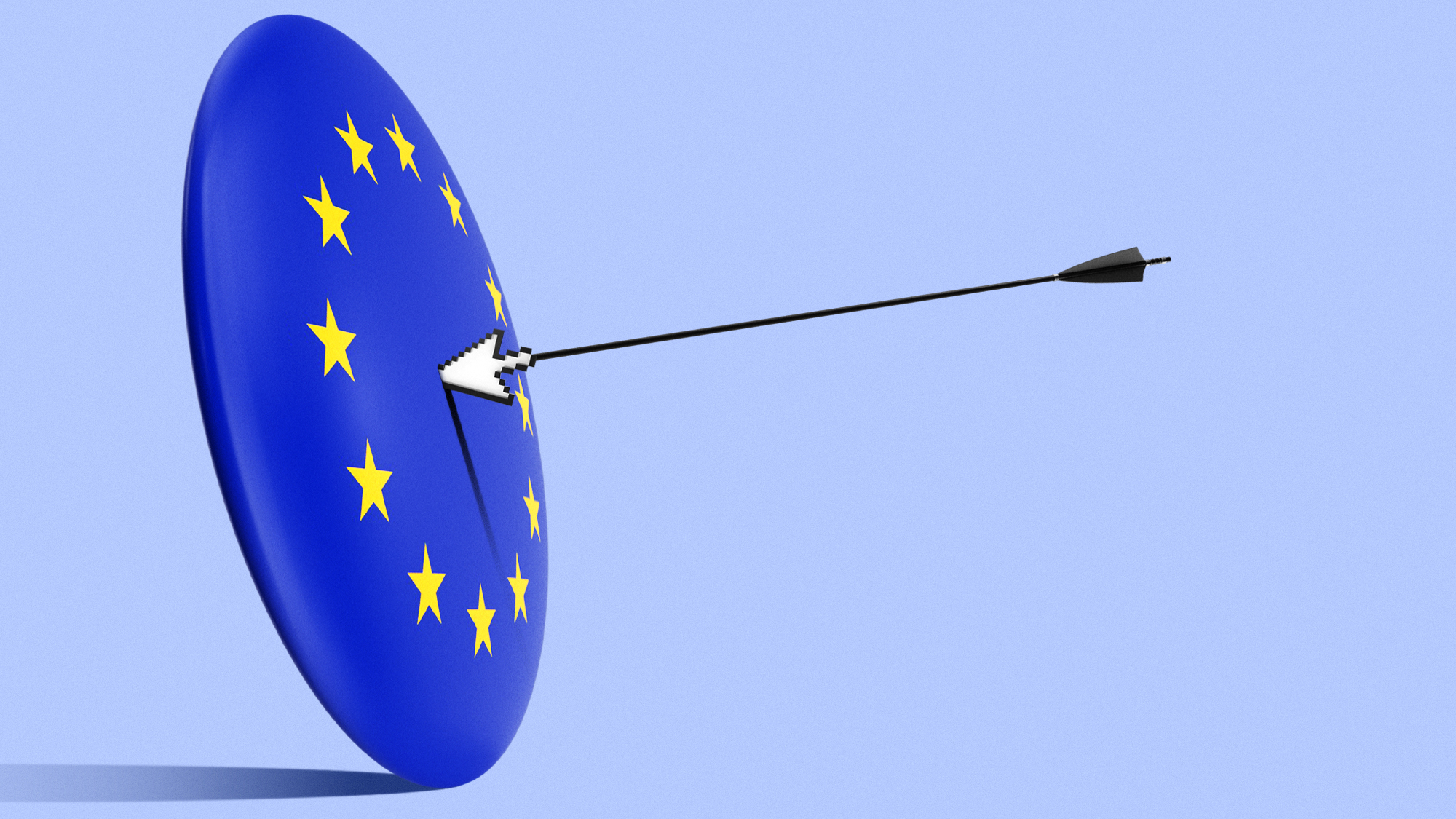

Can Europe regain its digital sovereignty?

Can Europe regain its digital sovereignty?Today’s Big Question EU is trying to reduce reliance on US Big Tech and cloud computing in face of hostile Donald Trump, but lack of comparable alternatives remains a worry

-

The Mandelson files: Labour Svengali’s parting gift to Starmer

The Mandelson files: Labour Svengali’s parting gift to StarmerThe Explainer Texts and emails about Mandelson’s appointment as US ambassador could fuel biggest political scandal ‘for a generation’

-

Magazine printables - February 13, 2026

Magazine printables - February 13, 2026Puzzle and Quizzes Magazine printables - February 13, 2026