Analyzing the economy's promising recovery

We've been burned by false starts before, but "right now it looks like we are headed into a very happy new year indeed"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Finally, said Annie Lowrey at New York. The economic recovery not only looks real — it looks strong. In the past few weeks, we've seen a series of promising economic milestones: The Dow Jones industrial average hit a record 18,000, the average price of gas fell below $2 a gallon, and GDP growth was revised up to an impressive 5 percent. It should be clear to everyone now that this streak of encouraging economic figures is no "one-time fluke." Unemployment continues to fall, wages are slowly beginning to creep up, and cheaper gas means more cash in consumers' pockets to "amp up" their spending. We've been burned by false starts before, but "right now it looks like we are headed into a very happy new year indeed." 2015 could be the year the economy finally fires on all cylinders.

This spate of good news should settle once and for all that "everything you've heard about President Obama's economic policies is wrong," said Paul Krugman at The New York Times. No, ObamaCare is not a "job killer," and record corporate profits clearly contradict the story line that Obama is anti-business. The economy's bounce leaves Republicans in a tricky spot, said Reihan Salam at Slate. For years, the GOP has blamed Obama for persistently high unemployment, an "eye-poppingly huge" federal deficit, and $4 per gallon gas. Now that GDP is growing, the deficit is shrinking, and gas prices are falling, that "strategy is unlikely to work so well." If conservatives want to hold on to their newfound power, they need to "explain why they can do a better job than the Democrats of steering the American economy."

No one should start celebrating just yet, said Robert J. Samuelson at The Washington Post. While the "upbeat" economic forecasts may "soothe Americans' bruised sense of self-worth and alter popular psychology for the 2016 elections," allow me to play devil's advocate. Surprises happen, and problems abroad — a renewed euro-zone crisis, Japan's flagging economy, or a slowdown in China — could easily "cause a global recession that ultimately drags down the United States." The Federal Reserve also remains a wild card. The central bank is widely expected this year to begin raising short-term rates, and though it has vowed to keep those hikes "small and slow so as not to disrupt the recovery," investors' reactions or inflation could throw a wrench into the Fed's best-laid plans.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

I wouldn't worry, said John Cassidy at The New Yorker. It's clear that U.S. central bankers know what they're doing. When the Fed started on its quantitative-easing track, "this would have been a controversial claim." But six years later and with QE in our rearview mirror, the "Bernanke-Yellen recovery" has "surely settled the issue." The euro zone's problems remain "a tragedy in the making," but I'm convinced politicians there will find the will "to safeguard [the euro's] survival." Any skepticism I have lies with the stock market, which is probably overdue for a correction. But our fundamentals appear strong enough to withstand any such hiccup: Companies are spending and hiring more, and "the long-awaited escape velocity required to emerge from recession has been achieved." Rest assured: The U.S. economy "is back."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

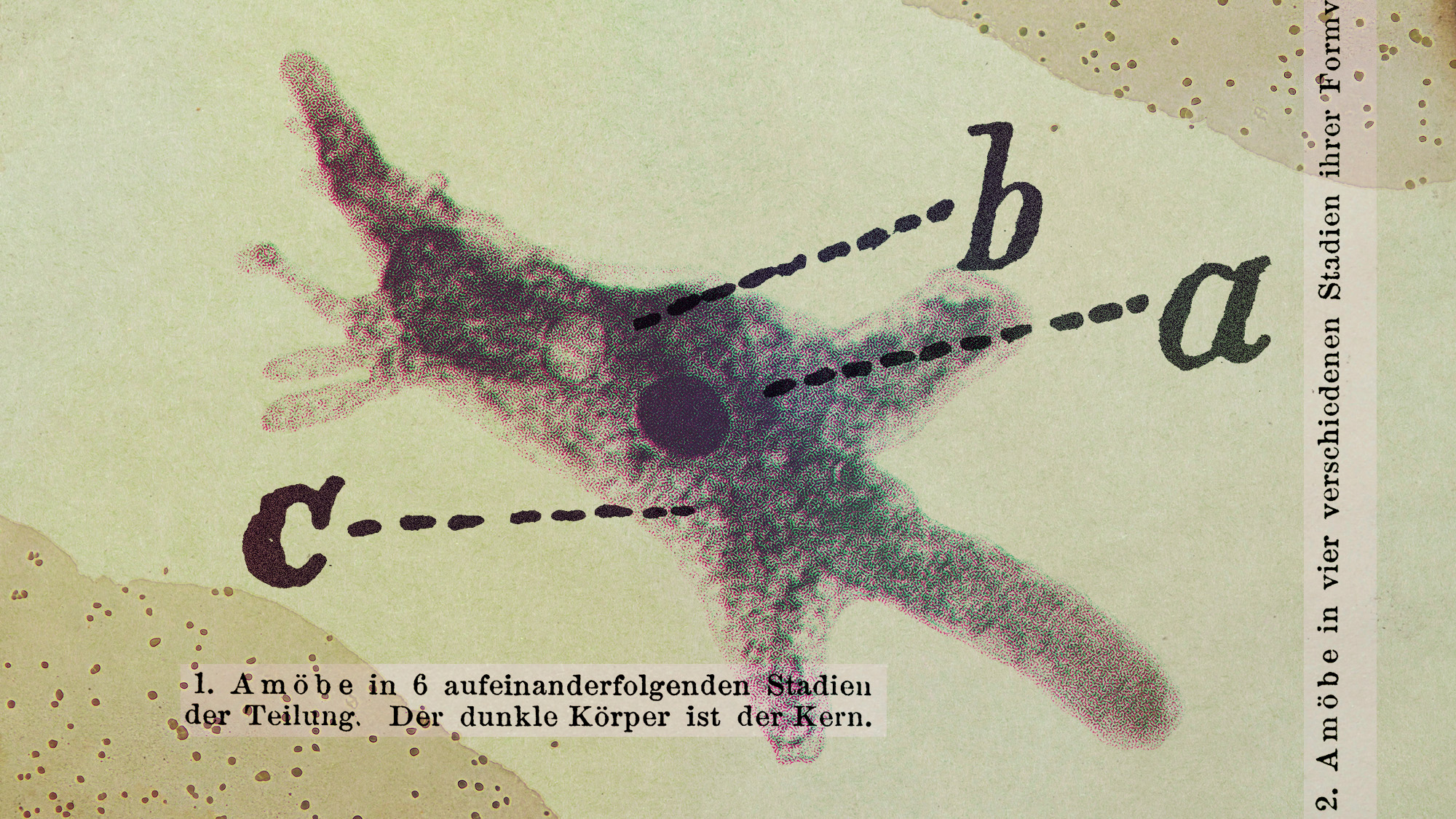

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy