Obama's diagnosis of America's economic problem is right. His cure is all wrong.

The Obama plan might make the rich less rich only by dimming possibilities for everyone else

President Obama finally found a tax cut Republicans don't like.

In his State of the Union speech last night, Obama formally, if obliquely outlined his proposal for nearly $200 billion (over ten years) in middle-class tax relief. It includes an expansion of the existing child-care and earned income tax credits, as well as a new $500 "second earner" tax credit for married couples.

Now, it would hardly break Uncle Sam's bank if Obama had chosen not to pay for these tax reductions. They would add just 2 percent to the projected level of debt accumulation over the next decade. That's a rounding error. But Obama did decide to pay for them, by raising taxes on wealthier Americans. He wants to increase the long-term capital gains and dividend tax rates, eliminating a tax break for the "superrich" that allows inherited assets to escape investment taxes, and a tax on megabank borrowing. As Obama put it, "For far too long, lobbyists have rigged the tax code with loopholes that let some corporations pay nothing while others pay full freight. They've riddled it with giveaways the superrich don't need, denying a break to middle class families who do."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The GOP's response has been one of talking-point uniformity, perhaps best encapsulated by a tweet from a spokesman for House Republican budget guru Paul Ryan:

That analysis is only half right. As political matter, the Obama blueprint is pretty distant from the sort of tax reform most center-right policymakers have been floating. It would add complexity and progressivity, and raise taxes overall. But the basic tradeoff of the Obama plan is perfectly reasonable. One way to raise middle-class incomes is to let folks keep more of their incomes away from the taxman. (An improvement, though, would be to expand the child tax credit to give more families higher take-home pay and more flexibility over their spending. Obama's plan doesn't help households with a stay-at-home parent.) And if you are going to pay the bill for lowering the middle-class tax burden, raising the burden for the rich seems logical during a time when the vast bulk of income gains appear to be going to the top.

But how Obama has chosen to mostly pay for his tax cuts is perfectly dreadful. Raising capital gains tax rates increases the tax code's penalty on savings. Savings, when put to work as investment, boosts productivity and long-term economic growth. And you can't substantially raise middle-class living standards in a slow-growth economy. Redistribution will only get you so far.

There is a strong correlation between venture capital investment and a nation's per capita number of billionaire entrepreneurs. It may be unclear how Paris Hilton's wealth is helping America, but we really do want people starting high-impact startups that may turn into the next Apple or Google or Airbnb — making these entrepreneurs rich in the process. That kind of inequality is good for all us. And if want more venture capital and startups, you probably want to tax investment as lightly as possible. Since 2012, however, we have nearly doubled the capital gains tax rate. Indeed, economic models suggest a tax code that did not tax savings and investment would result in a larger economy. We should be moving the tax code more in a pro-investment direction. The Obama plan does just the opposite.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

It also teaches America a terrible economics lesson, something progressives call "middle-out economics." According to this theory, economic growth comes from redistributing wealth from the 1 percent to the 99 percent. The result would supposedly be more consumer spending and faster economic growth. But America doesn't need more "buying power" stimulus as much as it needs a higher growth potential. Right now many economists doubt whether the U.S. economy can grow much faster than 2 percent or so for an extended period vs. the postwar average of over 3 percent. If we want to raise the economy's speed limit, we need more investment in machines, people, and ideas.

So if you still want to raise investment taxes, they should be offset by lower corporate taxes. (A good chunk of the burden of corporate taxes is borne by workers anyway.) Or perhaps raise the long-term capital gains tax rate to the same as that for labor income — then phase it out over four or five years to reward long-term investing over speculation. And there are better "pay fors," such as trimming the state and local tax deduction, a tax break where the 0.4 percent of taxpayers making $1 million-plus reap more than one-fifth of the benefit.

Let's help the middle class, even if it means taxing the rich more. But the Obama plan might make the rich less rich only by dimming possibilities for everyone else.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

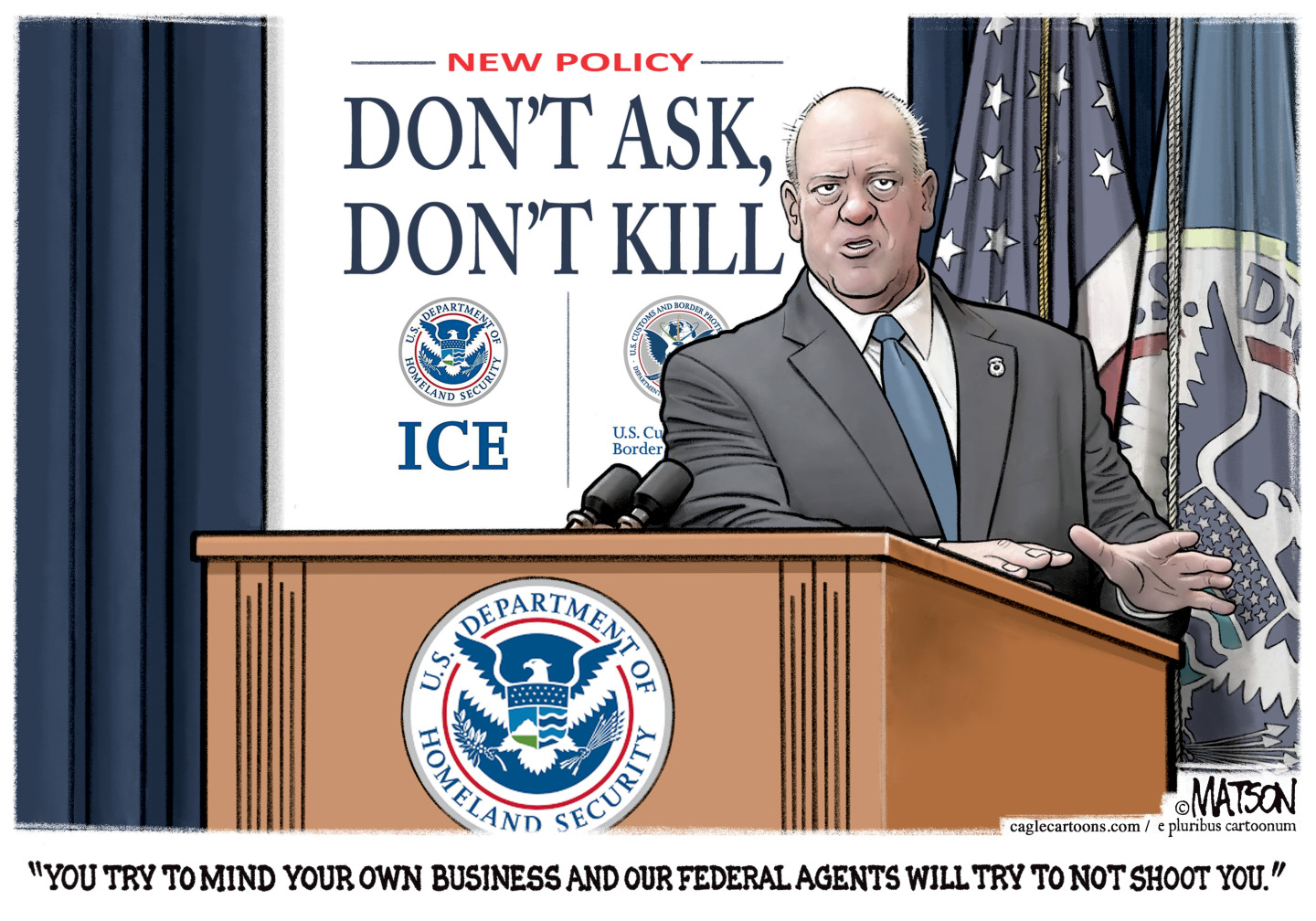

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Reforming the House of Lords

Reforming the House of LordsThe Explainer Keir Starmer’s government regards reform of the House of Lords as ‘long overdue and essential’

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred